Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Walt Disney Company (Disney) watched as viewership to its cable channels, including its one-time powerhouse ESPN, dropped as consumers cut the cord. Many

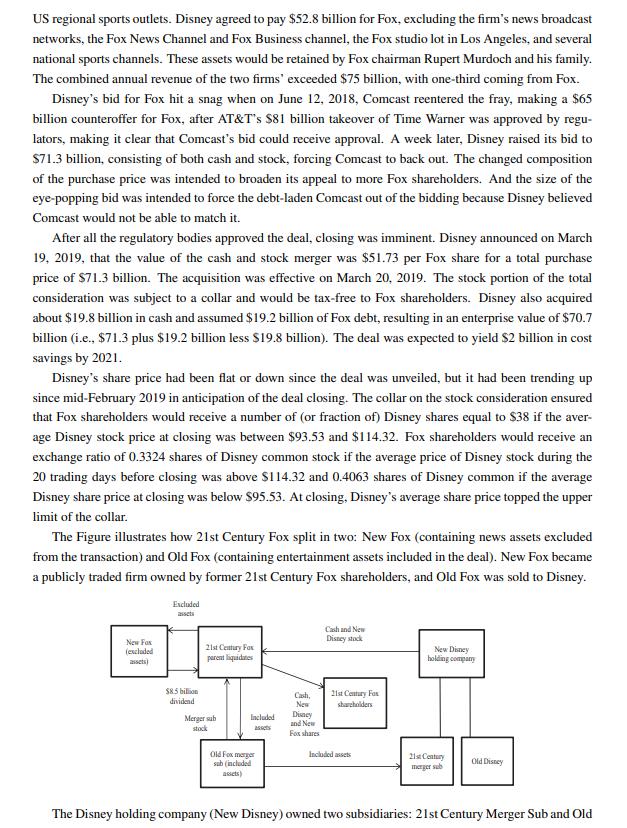

The Walt Disney Company (Disney) watched as viewership to its cable channels, including its one-time powerhouse ESPN, dropped as consumers "cut the cord." Many consumers have opted for subscriptions to Netflix or Amazon, which offered more diverse video at a fraction of the cost of cable. In a daring move, Disney announced a major media takeover in late 2017 but was unable to seal the deal until early 2019 because of a bewildering array of twists and turns. Disney's board and chairman and CEO, Bob Iger, recognized the need for bold action. They reasoned that by building up an impressive array of programming the firm could ward off efforts by these competi- tors' to penetrate the content market. With enough material, so the thinking goes, Disney could develop a streaming service that would win over customers who would have otherwise moved away from Disney products. Rupert Murdoch, chairman and CEO of 21st Century Fox (Fox). a Disney competitor, was dealing with challenges similar to those confronting Disney. After AT&T's takeover of Time Warner, the value of entertainment assets had exploded. The timing was right for Fox to sell off its entertainment assets and focus on its news businesses. Fox News and Fox Business were included as part of most basic cable bundles and were vulnerable to consumer cord-cutting. The major threats to Fox are free-access platforms such as Facebook, which have become a common source of news for many people. Murdoch hoped that by offering live news and sports and a strong broadcast network, Fox could remain competitive in the changing media landscape. American telecommunications conglomerate Comcast Corp's (Comcast) strategy involved accumulat- ing content for resale to consumers. The firm had been in discussions with Fox in early 2017 to acquire its entertainment assets. But interest in Fox would soon heat up as Comcast's negotiation with Fox attracted Disney as an alternative bidder. After several rounds of bidding. Disney announced on December 14, 2017, that it had reached an agreement to acquire the majority of the Fox's entertainment assets. As part of the deal, Disney would also acquire Fox's 30% stake in Hulu (a website offering video streaming to consumers), a group of US cable stations, several powerhouse international satellite channels (Star India and Sky Italia), and a host of US regional sports outlets. Disney agreed to pay $52.8 billion for Fox, excluding the firm's news broadcast networks, the Fox News Channel and Fox Business channel, the Fox studio lot in Los Angeles, and several national sports channels. These assets would be retained by Fox chairman Rupert Murdoch and his family. The combined annual revenue of the two firms' exceeded $75 billion, with one-third coming from Fox. Disney's bid for Fox hit a snag when on June 12, 2018, Comcast reentered the fray, making a $65 billion counteroffer for Fox, after AT&T's $81 billion takeover of Time Warner was approved by regu- lators, making it clear that Comcast's bid could receive approval. A week later, Disney raised its bid to $71.3 billion, consisting of both cash and stock, forcing Comcast to back out. The changed composition of the purchase price was intended to broaden its appeal to more Fox shareholders. And the size of the eye-popping bid was intended to force the debt-laden Comcast out of the bidding because Disney believed Comcast would not be able to match it. After all the regulatory bodies approved the deal, closing was imminent. Disney announced on March 19, 2019, that the value of the cash and stock merger was $51.73 per Fox share for a total purchase price of $71.3 billion. The acquisition was effective on March 20, 2019. The stock portion of the total consideration was subject to a collar and would be tax-free to Fox shareholders. Disney also acquired about $19.8 billion in cash and assumed $19.2 billion of Fox debt, resulting in an enterprise value of $70.7 billion (i.e., $71.3 plus $19.2 billion less $19.8 billion). The deal was expected to yield $2 billion in cost savings by 2021. Disney's share price had been flat or down since the deal was unveiled, but it had been trending up since mid-February 2019 in anticipation of the deal closing. The collar on the stock consideration ensured that Fox shareholders would receive a number of (or fraction of) Disney shares equal to $38 if the aver- age Disney stock price at closing was between $93.53 and $114.32. Fox shareholders would receive an exchange ratio of 0.3324 shares of Disney common stock if the average price of Disney stock during the 20 trading days before closing was above $114.32 and 0.4063 shares of Disney common if the average Disney share price at closing was below $95.53. At closing, Disney's average share price topped the upper limit of the collar. The Figure illustrates how 21st Century Fox split in two: New Fox (containing news assets excluded from the transaction) and Old Fox (containing entertainment assets included in the deal). New Fox became a publicly traded firm owned by former 21st Century Fox shareholders, and Old Fox was sold to Disney. New Fox (excluded assets) Excluded $8.5 billion dividend 21st Century Fox parent liquidates Merger sub stock Included assets Old Fox marger sub (included assets) Cash, New Disney and New Fox shares Cash and New Disney stock 21st Century Fox shareholders Included assets New Disney holding company 21st Century merger sub Old Disney The Disney holding company (New Disney) owned two subsidiaries: 21st Century Merger Sub and Old Disney (a subsidiary which owned preclosing Disney assets). Immediately before closing, 21st Century Fox (the parent) initiated a "separation agreement" to transfer certain news assets to New Fox which paid the parent a dividend of $8.5 billion. The dividend reflected repayment of money transfers between the parent and its news subsidiaries in the form of intercompany loans and dividends, adjusted at closing based on the final estimate of transaction related taxes paid. The parent's liquidation involved the distribution on a pro rata basis to 21st Century Fox shareholders New Fox stock and newly issued Disney shares and cash paid to the parent to acquire Old Fox. At closing, Old Fox Merger Sub was merged into 21st Century Merger Sub, with the latter surviving. Old Disney and 21st Century Merger Sub were then merged into New Disney. Upon completion of the merger into New Disney, both Old Disney and New Fox shares were converted into New Disney shares. Discussion Questions 1. What is the form of acquisition used in this deal? What are the advantageous and disadvantageous of this deal structure? 2. What is the form of payment used to acquire the Fox entertainment assets? Speculate why the form may have been used in this instance. 3. Would you consider Disney's purchase of Fox's entertainment assets as a vertical or horizontal takeover? Explain your answer. 4. What is the purpose of a collar arrangement between Disney and Fox? The Walt Disney Company (Disney) watched as viewership to its cable channels, including its one-time powerhouse ESPN, dropped as consumers "cut the cord." Many consumers have opted for subscriptions to Netflix or Amazon, which offered more diverse video at a fraction of the cost of cable. In a daring move, Disney announced a major media takeover in late 2017 but was unable to seal the deal until early 2019 because of a bewildering array of twists and turns. Disney's board and chairman and CEO, Bob Iger, recognized the need for bold action. They reasoned that by building up an impressive array of programming the firm could ward off efforts by these competi- tors' to penetrate the content market. With enough material, so the thinking goes, Disney could develop a streaming service that would win over customers who would have otherwise moved away from Disney products. Rupert Murdoch, chairman and CEO of 21st Century Fox (Fox). a Disney competitor, was dealing with challenges similar to those confronting Disney. After AT&T's takeover of Time Warner, the value of entertainment assets had exploded. The timing was right for Fox to sell off its entertainment assets and focus on its news businesses. Fox News and Fox Business were included as part of most basic cable bundles and were vulnerable to consumer cord-cutting. The major threats to Fox are free-access platforms such as Facebook, which have become a common source of news for many people. Murdoch hoped that by offering live news and sports and a strong broadcast network, Fox could remain competitive in the changing media landscape. American telecommunications conglomerate Comcast Corp's (Comcast) strategy involved accumulat- ing content for resale to consumers. The firm had been in discussions with Fox in early 2017 to acquire its entertainment assets. But interest in Fox would soon heat up as Comcast's negotiation with Fox attracted Disney as an alternative bidder. After several rounds of bidding. Disney announced on December 14, 2017, that it had reached an agreement to acquire the majority of the Fox's entertainment assets. As part of the deal, Disney would also acquire Fox's 30% stake in Hulu (a website offering video streaming to consumers), a group of US cable stations, several powerhouse international satellite channels (Star India and Sky Italia), and a host of US regional sports outlets. Disney agreed to pay $52.8 billion for Fox, excluding the firm's news broadcast networks, the Fox News Channel and Fox Business channel, the Fox studio lot in Los Angeles, and several national sports channels. These assets would be retained by Fox chairman Rupert Murdoch and his family. The combined annual revenue of the two firms' exceeded $75 billion, with one-third coming from Fox. Disney's bid for Fox hit a snag when on June 12, 2018, Comcast reentered the fray, making a $65 billion counteroffer for Fox, after AT&T's $81 billion takeover of Time Warner was approved by regu- lators, making it clear that Comcast's bid could receive approval. A week later, Disney raised its bid to $71.3 billion, consisting of both cash and stock, forcing Comcast to back out. The changed composition of the purchase price was intended to broaden its appeal to more Fox shareholders. And the size of the eye-popping bid was intended to force the debt-laden Comcast out of the bidding because Disney believed Comcast would not be able to match it. After all the regulatory bodies approved the deal, closing was imminent. Disney announced on March 19, 2019, that the value of the cash and stock merger was $51.73 per Fox share for a total purchase price of $71.3 billion. The acquisition was effective on March 20, 2019. The stock portion of the total consideration was subject to a collar and would be tax-free to Fox shareholders. Disney also acquired about $19.8 billion in cash and assumed $19.2 billion of Fox debt, resulting in an enterprise value of $70.7 billion (i.e., $71.3 plus $19.2 billion less $19.8 billion). The deal was expected to yield $2 billion in cost savings by 2021. Disney's share price had been flat or down since the deal was unveiled, but it had been trending up since mid-February 2019 in anticipation of the deal closing. The collar on the stock consideration ensured that Fox shareholders would receive a number of (or fraction of) Disney shares equal to $38 if the aver- age Disney stock price at closing was between $93.53 and $114.32. Fox shareholders would receive an exchange ratio of 0.3324 shares of Disney common stock if the average price of Disney stock during the 20 trading days before closing was above $114.32 and 0.4063 shares of Disney common if the average Disney share price at closing was below $95.53. At closing, Disney's average share price topped the upper limit of the collar. The Figure illustrates how 21st Century Fox split in two: New Fox (containing news assets excluded from the transaction) and Old Fox (containing entertainment assets included in the deal). New Fox became a publicly traded firm owned by former 21st Century Fox shareholders, and Old Fox was sold to Disney. New Fox (excluded assets) Excluded $8.5 billion dividend 21st century Fox parent liquidates Merger sub stock Included assets Old Fox marger sub (included assets) Cash, New Disney and New Fox shares Cash and New Disney stock 21st Century Fox shareholders Included assets New Disney holding company 21st Century merger sub Old Disney The Disney holding company (New Disney) owned two subsidiaries: 21st Century Merger Sub and Old Disney (a subsidiary which owned preclosing Disney assets). Immediately before closing, 21st Century Fox (the parent) initiated a "separation agreement" to transfer certain news assets to New Fox which paid the parent a dividend of $8.5 billion. The dividend reflected repayment of money transfers between the parent and its news subsidiaries in the form of intercompany loans and dividends, adjusted at closing based on the final estimate of transaction related taxes paid. The parent's liquidation involved the distribution on a pro rata basis to 21st Century Fox shareholders New Fox stock and newly issued Disney shares and cash paid to the parent to acquire Old Fox. At closing, Old Fox Merger Sub was merged into 21st Century Merger Sub, with the latter surviving. Old Disney and 21st Century Merger Sub were then merged into New Disney. Upon completion of the merger into New Disney, both Old Disney and New Fox shares were converted into New Disney shares. Discussion Questions 1. What is the form of acquisition used in this deal? What are the advantageous and disadvantageous of this deal structure? 2. What is the form of payment used to acquire the Fox entertainment assets? Speculate why the form may have been used in this instance. 3. Would you consider Disney's purchase of Fox's entertainment assets as a vertical or horizontal takeover? Explain your answer. 4. What is the purpose of a collar arrangement between Disney and Fox?

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 The form of acquisition used in this deal is a Cash and Stock Merger The advantages as follows Diversification of Payment Combining cash and stock a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started