Answered step by step

Verified Expert Solution

Question

1 Approved Answer

An electronics firm can initiate an important R&D program by making a $3 million investment at the beginning of the year. a) There is

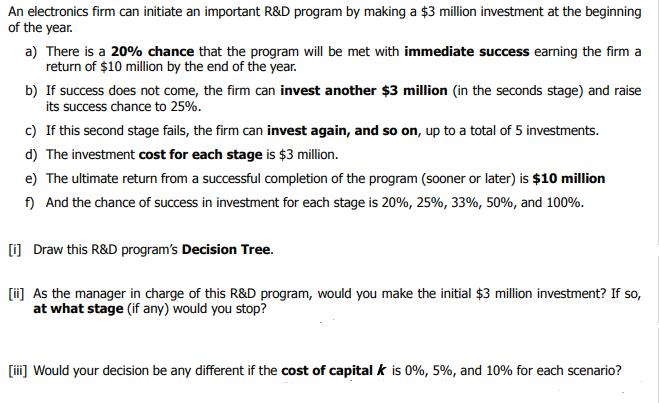

An electronics firm can initiate an important R&D program by making a $3 million investment at the beginning of the year. a) There is a 20% chance that the program will be met with immediate success earning the firm a return of $10 million by the end of the year. b) If success does not come, the firm can invest another $3 million (in the seconds stage) and raise its success chance to 25%. c) If this second stage fails, the firm can invest again, and so on, up to a total of 5 investments. d) The investment cost for each stage is $3 million. e) The ultimate return from a successful completion of the program (sooner or later) is $10 million f) And the chance of success in investment for each stage is 20%, 25%, 33%, 50%, and 100%. [i] Draw this R&D program's Decision Tree. [ii] As the manager in charge of this R&D program, would you make the initial $3 million investment? If so, at what stage (if any) would you stop? [iii] Would your decision be any different if the cost of capital k is 0%, 5%, and 10% for each scenario?

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started