Answered step by step

Verified Expert Solution

Question

1 Approved Answer

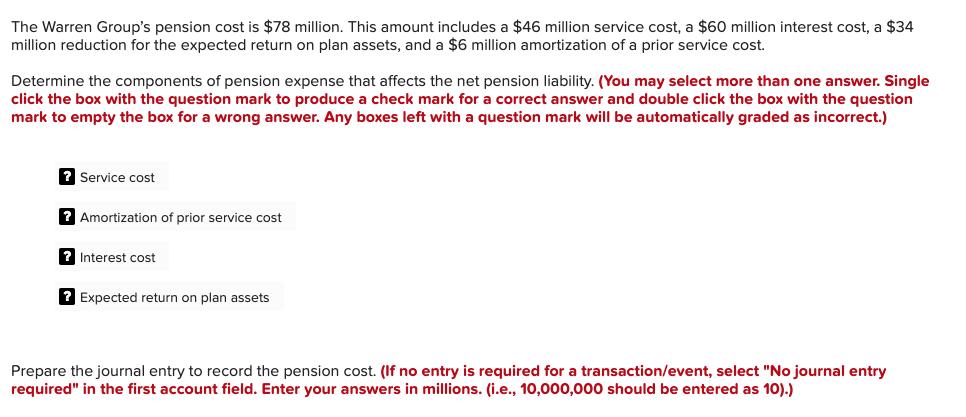

The Warren Group's pension cost is $78 million. This amount includes a $46 million service cost, a $60 million interest cost, a $34 million

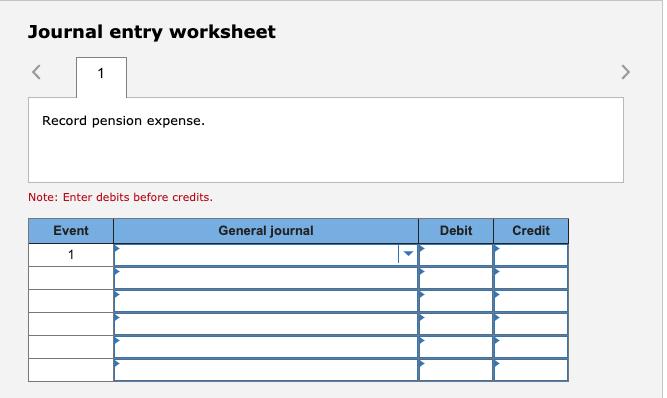

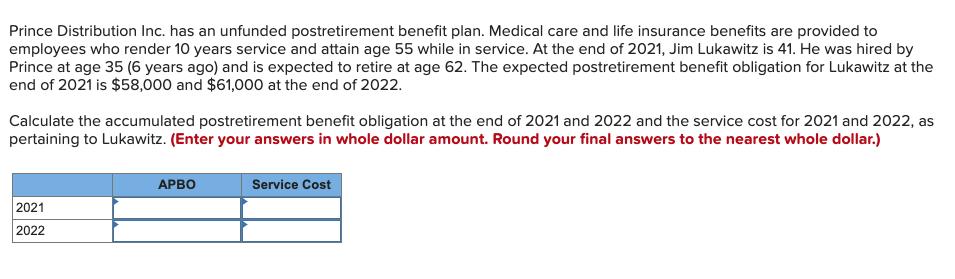

The Warren Group's pension cost is $78 million. This amount includes a $46 million service cost, a $60 million interest cost, a $34 million reduction for the expected return on plan assets, and a $6 million amortization of a prior service cost. Determine the components of pension expense that affects the net pension liability. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) ? Service cost ? Amortization of prior service cost Interest cost ? Expected return on plan assets Prepare the journal entry to record the pension cost. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions. (i.e., 10,000,000 should be entered as 10).) Journal entry worksheet 1 Record pension expense. Note: Enter debits before credits. Event General journal Debit Credit 1 Prince Distribution Inc. has an unfunded postretirement benefit plan. Medical care and life insurance benefits are provided to employees who render 10 years service and attain age 55 while in service. At the end of 2021, Jim Lukawitz is 41. He was hired by Prince at age 35 (6 years ago) and is expected to retire at age 62. The expected postretirement benefit obligation for Lukawitz at the end of 2021 is $58,000 and $61,000 at the end of 2022. Calculate the accumulated postretirement benefit obligation at the end of 2021 and 2022 and the service cost for 2021 and 2022, as pertaining to Lukawitz. (Enter your answers in whole dollar amount. Round your final answers to the nearest whole dollar.) Service Cost 2021 2022

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The Warren Groups Pension Cost is 78 million 46 million service cost 60 million interest cost 34 million reduction for the expected return on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started