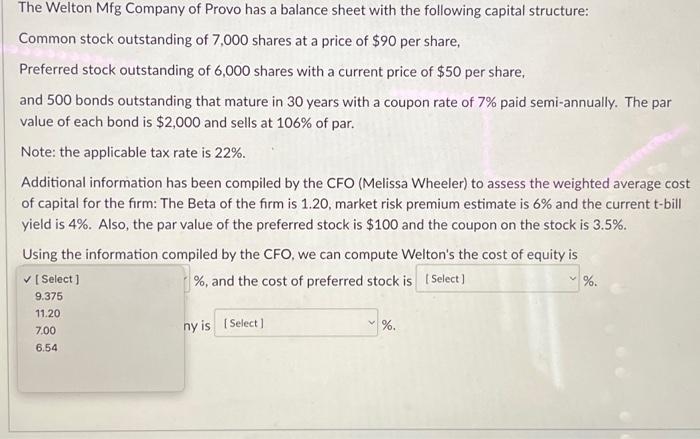

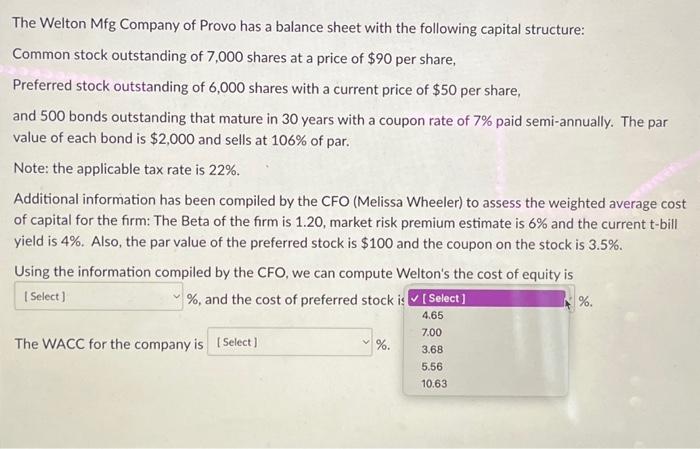

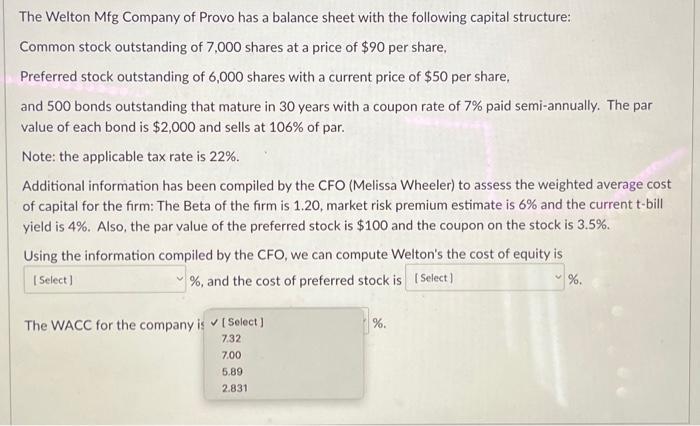

The Welton Mfg Company of Provo has a balance sheet with the following capital structure: Common stock outstanding of 7,000 shares at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. Note: the applicable tax rate is 22%. Additional information has been compiled by the CFO (Melissa Wheeler) to assess the weighted average cost of capital for the firm: The Beta of the firm is 1.20 , market risk premium estimate is 6% and the current t-bill yield is 4%. Also, the par value of the preferred stock is $100 and the coupon on the stock is 3.5%. Using the information compiled by the CFO, we can compute Welton's the cost of equity is %, and the cost of preferred stock is %. iy is % The Welton Mfg Company of Provo has a balance sheet with the following capital structure: Common stock outstanding of 7,000 shares at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. Note: the applicable tax rate is 22%. Additional information has been compiled by the CFO (Melissa Wheeler) to assess the weighted average cost of capital for the firm: The Beta of the firm is 1.20 , market risk premium estimate is 6% and the current t-bill yield is 4%. Also, the par value of the preferred stock is $100 and the coupon on the stock is 3.5%. Using the information compiled by the CFO, we can compute Welton's the cost of equity is %, and the cost of preferred stock i: %. The WACC for the company is %. The Welton Mfg Company of Provo has a balance sheet with the following capital structure: Common stock outstanding of 7,000 shares at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. Note: the applicable tax rate is 22%. Additional information has been compiled by the CFO (Melissa Wheeler) to assess the weighted average cost of capital for the firm: The Beta of the firm is 1.20 , market risk premium estimate is 6% and the current t-bill yield is 4%. Also, the par value of the preferred stock is $100 and the coupon on the stock is 3.5%. Using the information compiled by the CFO, we can compute Welton's the cost of equity is %, and the cost of preferred stock is %. The WACC for the company i %