Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Western Beverage Company is marketing a new roduct, Tech-Tonic Sports Drink Syrup. The product sells for $16 per gallon, and in recent months

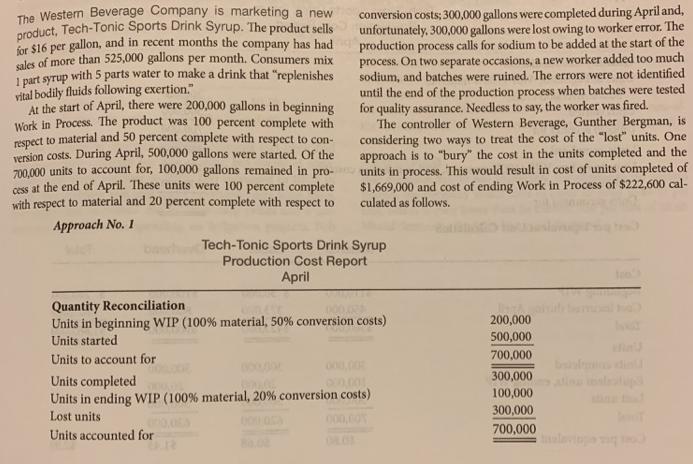

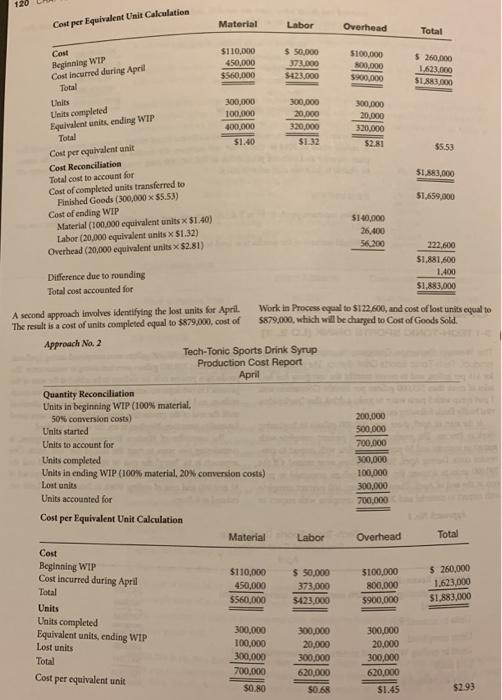

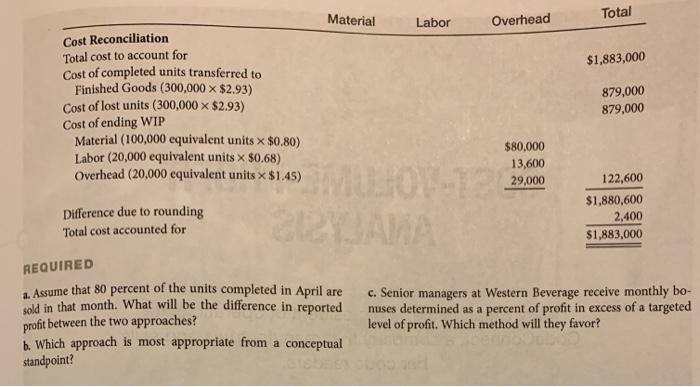

The Western Beverage Company is marketing a new roduct, Tech-Tonic Sports Drink Syrup. The product sells for $16 per gallon, and in recent months the company has had sales of more than 525,000 gallons per month. Consumers mix I part syrup with 5 parts water to make a drink that "replenishes vital bodily fluids following exertion" At the start of April, there were 200,000 gallons in beginning Work in Process. The product was 100 percent complete with eSpect to material and 50 percent complete with respect to con- version costs. During April, 500,000 gallons were started. Of the 00.000 units to account for, 100,000 gallons remained in pro- s at the end of April. These units were 100 percent complete with respect to material and 20 percent complete with respect to conversion costs; 300,000 gallons were completed during April and, unfortunately, 300,000 gallons were lost owing to worker error. The production process calls for sodium to be added at the start of the process. On two separate occasions, a new worker added too much sodium, and batches were ruined. The errors were not identified until the end of the production process when batches were tested for quality assurance. Needless to say, the worker was fired. The controller of Western Beverage, Gunther Bergman, is considering two ways to treat the cost of the "lost" units, One approach is to "bury" the cost in the units completed and the units in process. This would result in cost of units completed of $1,669,000 and cost of ending Work in Process of $222,600 cal- culated as follows. Approach No. I Tech-Tonic Sports Drink Syrup Production Cost Report April Quantity Reconciliation Units in beginning WIP (100% material, 50% conversion costs) Units started 200,000 500,000 Units to account for 700,000 300,000 ain lp Units completed Units in ending WIP (100% material, 20% conversion costs) 100,000 300,000 Lost units 000,00 Units accounted for 700,000 80.00 120 Cost per Equivalent Unit Calculation Material Labor Overhead Total Cost $110,000 $ 50,000 Beginning WIP Cost incurred during April Total $100,000 800,000 $ 260.000 1.623.000 S1.S83000 450,000 373.000 $560,000 $423.000 $900,000 Units Units completed Equivalent units, ending WIP Total 300,000 100,000 300,000 300.000 20,000 20.000 400,000 320,000 320,000 $1.40 $1.32 $2.81 $5.53 Cost per equivalent unit Cost Reconciliation Total cost to account for Cost of completed units transferred to Finished Goods (300,000 x $5.53) Cost of ending WIP Material (100,000 equivalent units x $1.40) Labor (20,000 equivalent units x S1.32) Overhead (20,000 equivalent units X $2.81) S1.883,000 $1,659,000 $140,000 26,400 56,200 222,600 $1,881,600 1,400 Difference due to rounding $1,883,000 Total cost accounted for A second approach involves identifying the lost units for April. The result is a cost of units completed equal to $879,000, cost of Work in Process equal to $122.600, and cost of lost units equal to $879,000, which will be charged to Cost of Goods Sold. Approach Na. 2 Tech-Tonic Sports Drink Syrup Production Cost Report April Quantity Reconciliation Units in beginning WIP (100% material. 50% conversion costs) Units started 200,000 500,000 Units to account for 700,000 Units completed Units in ending WIP (100% material, 20% conversion costs) Lost units 300,000 100,000 300,000 Units accounted for 700,000 Cost per Equivalent Unit Calculation Material Labor Overhead Total Cost Beginning WIP Cost incurred during April $ 260,000 1,623,000 $110,000 $ 50,000 $100,000 450,000 $560,000 373,000 800,000 Total $423,000 $900,000 $1,883,000 Units Units completed Equivalent units, ending WIP Lost units 300,000 100,000 300,000 300,000 300,000 20,000 300,000 20,000 300,000 Total 700,000 620,000 620,000 Cost per equivalent unit $0.80 S0.68 S1.45 $2.93 Material Overhead Total Labor Cost Reconciliation Total cost to account for Cost of completed units transferred to Finished Goods (300,000 x $2.93) Cost of lost units (300,000 x $2.93) Cost of ending WIP Material (100,000 equivalent units x $0.80) Labor (20,000 equivalent units x $0.68) Overhead (20,000 equivalent units x $1.45) $1,883,000 879,000 879,000 $80,000 0V-126 13,600 29,000 122,600 $1,880,600 Difference due to rounding Total cost accounted for 2,400 $1,883,000 REQUIRED 1 Asume that 80 percent of the units completed in April are old in that month. What will be the difference in reported profit between the two approaches? b. Which approach is most appropriate from a conceptual standpoint? c. Senior managers at Western Beverage receive monthly bo- nuses determined as a percent of profit in excess of a targeted level of profit. Which method will they favor?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

240000416 Sales Approach no1 35440000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started