Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the whole question is there (Computing the standard deviation for a portfollo of two risky investments) Mary Gulloti recentfy gradualed from colloge and is evaluating

the whole question is there

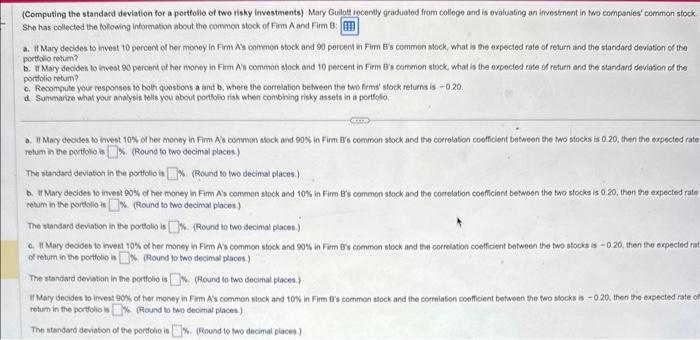

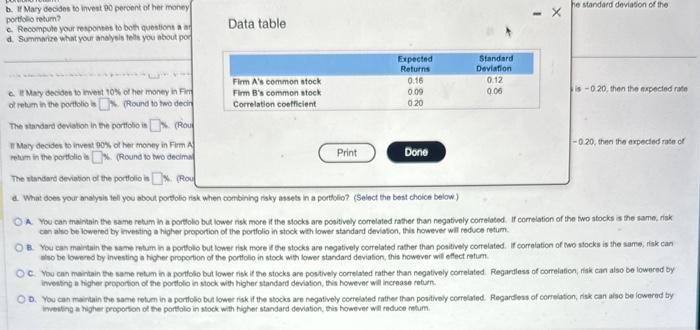

(Computing the standard deviation for a portfollo of two risky investments) Mary Gulloti recentfy gradualed from colloge and is evaluating an investment in two companies' common stock. she has collected the folowing intormation about the commen stock of Firr A and Firm : a. If Macy desides to invet 10 percent of her money in Firm As commen stock and 90 percent a Firm B's common alock, what is the expected fate of return and the standard deviation of the portolo retum? b. If Mary decides to kenest 90 percent of her money in Firm As common slock and 10 percent in Firm B's common stock, what is the expecied rate of return and the standard deviabon of the portolio rebum? c. Recompute your tesconses to both questions a and b, whece the correlation between the two firms' stock returns is -0.20. d. Summarize what your analybis telle you about porttolo risk when combining risky assets in a portfolo. a. II Macy deodes to invest 10 k of her moocy in Fim A s conmon shock and 90% in Fim B's common stock and the correbation coolficient between the two stocks is 0 .20, then the expected rate retum in the portoliso is 5. (Round to two decimal places) The standard deviaton in the portfolio is (Round so two decinal places.) b. It Mary decides 10 imest 90% of her money in Firm As common stock and 10% in Firm B's common stock and the correlation coefficient betwoen the tro stocks is 0.20 , then the expected rath retum in the portolio is k (Round to two decimal places) The standard deviabon in the portloto is 5. (Round io two decimal places.) c. If Mary decides to mest 10% of her money in Fiem As commen stock and 90% in Fim Bs commen stock and the correlation coefficient between the two stocks is - 0.20 , then the expected fi of rehurn in the portolio in is. (Round to two decimal places) The standard deviton in the portfolio is 4. (Round to two decimal places.) WMary decides to invett 90 hof ther money in Fim Ais common stock and tow in Firm E's common stock and the cotrelation coefficient between the two stocks is - 0.20 , then the expected rate o retur in the portolio is (4. (round to two decimal places,) The standard deviabon of the portolio is 4. (Round to two decimal places) b. If Mary decides to invest 90 peroent of her monoy portolob retum? c. Recompule your resoontes to both questiont a af d. Summare what your andyols tels you about pod Data table is -020 , then the erpected rate The standard deviation in the portlobo is 6. (Rour 7 Moy decides bo invest 90 s of har moncy in Fim A mhem in the portclio is 6. Round to bwo decima The rtandard deviation of the poctolio in 4. (Rou a. What does your andysis tell you about portolo risk when oombining risity assets in a portblio? (Select the best choice below.) A. You can maintain the same retum in a portiolio but lower nsk more if the slocks are positively comelated rather than negatively correlated. If correlation of the two stocks is the same, risk. cen ako be bwered by investing a higher proportion of the portolo in stock wth lower standard deviafon, this however will reduce fotum. B. You eah maintain the same mbum in a portolo but lower risk more to the stocks are negatively correlated rather than positivey correiated. if correiation of two stocks is the same, risk can wso be lowered by investing a higher propertion of the portlolo in stock with lower standard devalion, this hewever wil eflect retum. c. Vou can mentain the sane retum in a portobo but lower risk it the stocks are postively correlabed rather than negatively correiated. Regardless of correlabcn, ilik can also be lowered by. investing a higher peoportion of the portolo in stock with higher standard deviation, this however will increase return. D. You can maintain the same retum in a portolob but lower risk if the wocks are negatively cocrelased ather than positively correlaied. Regardess of correlation, risk can alse be lowerod by imewing a higher proporton of the portsolo in shock with higher standard devation, this however wil reduce retum Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started