Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The WhyEyeOughta general partnership is comprised of three general partners; Mo, Larry, & Curley. The partnership agreement calls for profits of the partnership to

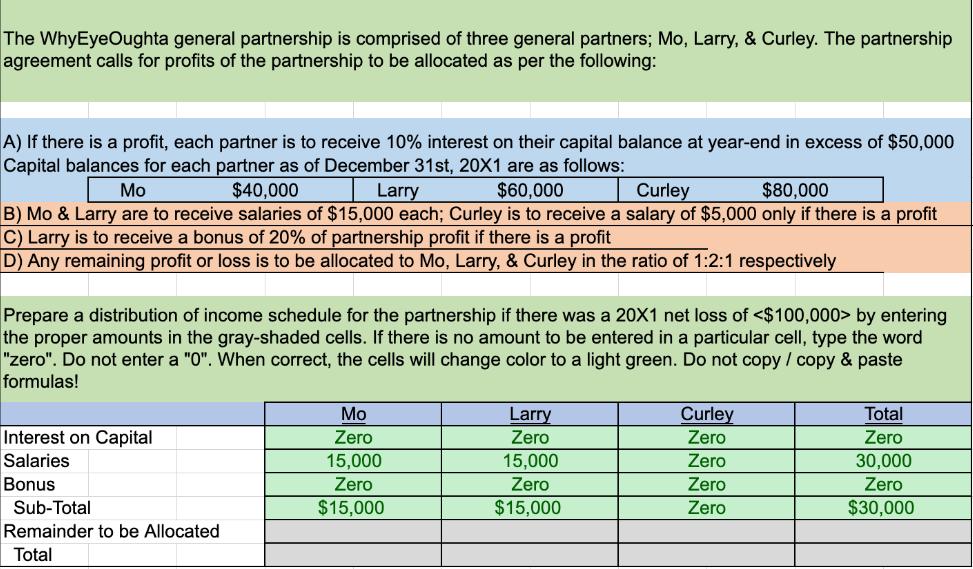

The WhyEyeOughta general partnership is comprised of three general partners; Mo, Larry, & Curley. The partnership agreement calls for profits of the partnership to be allocated as per the following: A) If there is a profit, each partner is to receive 10% interest on their capital balance at year-end in excess of $50,000 Capital balances for each partner as of December 31st, 20X1 are as follows: Mo $40,000 Larry $60,000 Curley $80,000 B) Mo & Larry are to receive salaries of $15,000 each; Curley is to receive a salary of $5,000 only if there is a profit C) Larry is to receive a bonus of 20% of partnership profit if there is a profit D) Any remaining profit or loss is to be allocated to Mo, Larry, & Curley in the ratio of 1:2:1 respectively Prepare a distribution of income schedule for the partnership if there was a 20X1 net loss of by entering the proper amounts in the gray-shaded cells. If there is no amount to be entered in a particular cell, type the word "zero". Do not enter a "0". When correct, the cells will change color to a light green. Do not copy / copy & paste formulas! Interest on Capital Salaries Bonus Sub-Total Remainder to be Allocated Total Mo Zero 15,000 Zero $15,000 Larry Zero 15,000 Zero $15,000 Curley Zero Zero Zero Zero Total Zero 30,000 Zero $30,000

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

WhyEyeOughta General Partnership Income Distribution Schedule 20X1 Net Loss 100000 Partner Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started