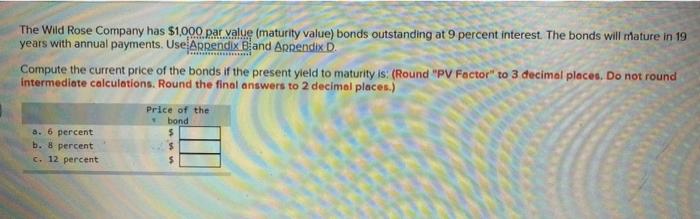

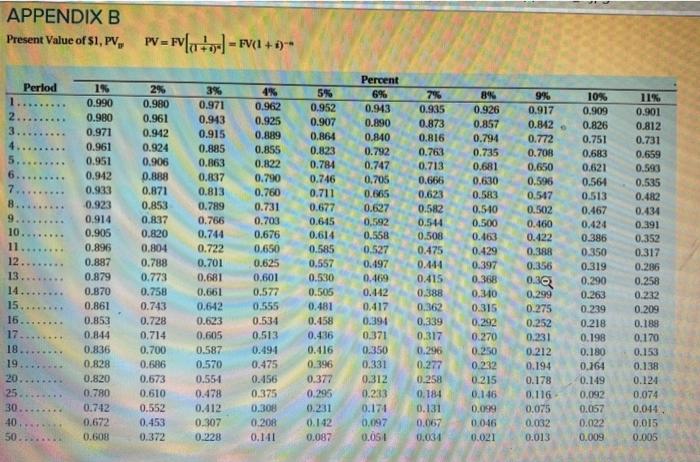

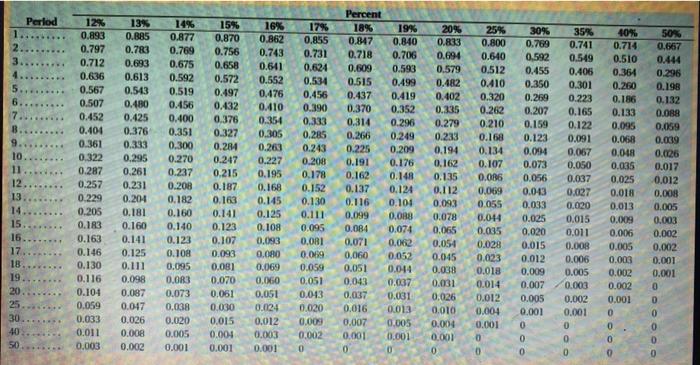

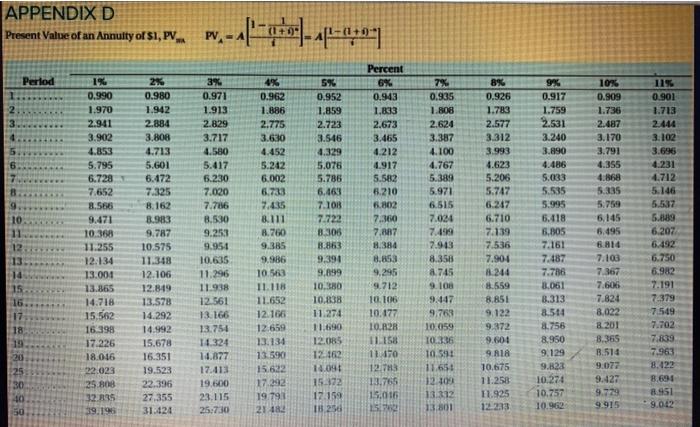

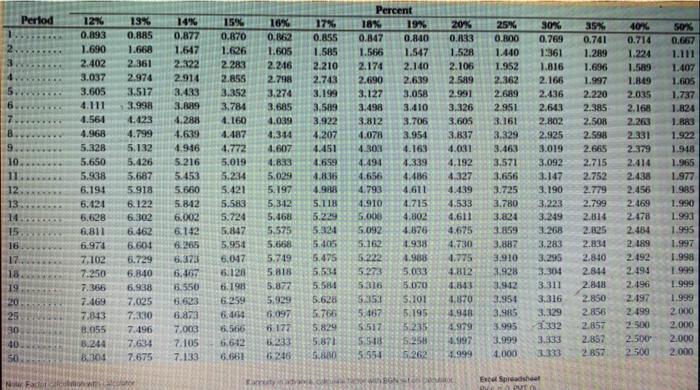

The Wild Rose Company has $1,000 par value (maturity value) bonds outstanding at 9 percent interest. The bonds will mature in 19 years with annual payments. Use Arpendix Band ArRendix D. Compute the current price of the bonds if the present yield to maturity is: (Round "PV Foctor" to 3 decimal places. Do not round intermediate calculations. Round the final answers to 2 decimal places.) Price of the bond a. 6 percent b. 8 percent c. 12 percent $ 5 APPENDIX B Present Value of $1, PV, PV=Fvla + -] = F(1+1)* Period 3. 6. 7 8...... 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.798 0.773 0.758 0.743 0.728 0,714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 9 10 11 12. 13. 3% 0.971 0.943 0.915 0.885 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.55-1 0.478 0.412 0.307 0.228 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.615 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 Percent 6% 0.943 0.890 0.840 0.792 0.747 0,705 0.605 0.627 0.592 0.558 0.527 0.497 0.469 0.142 0.417 0.391 0.371 0.350 0.331 0.312 0.233 0.174 0.097 0.051 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0,362 0.339 0.317 0.296 0.277 0.258 0.184 0.131 0.067 0.031 8N 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.510 0.500 0.463 0.429 0.397 0.368 0.310 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 10% 0.909 0.826 0.751 0,683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0,092 0.057 0.022 0.009 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.30 14. 15 15. 17 18. 19 0.170 + 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 20. 25 30. 40 50 0.153 0.138 0.124 0.074 0.044 0.015 0.005 Percent Period 18% 3.. 4. 5......... 7........ B. 9. 10. 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.101 0.059 0.033 0.011 0.003 11 12 13 14 15 16. 17. 18 19 20 25 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.047 0.026 0.008 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.300 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0,038 0.020 0.005 0.001 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.08) 0.070 0.061 0.030 0.015 0.004 0.001 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.083 0.080 0.069 0.060 0.051 0.024 0.012 0.003 0.001 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0,081 0.069 0.059 0.051 0,043 0.020 0.000 0.002 0.847 0.718 0.609 0.515 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0,043 0.037 0.016 0.007 0.001 0 19% 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.101 0.088 0.074 0.062 0.052 0.014 0.037 0.031 0.013 0.005 0.001 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0,065 0.054 0.045 0.038 0.031 0.026 0.010 0.004 0.001 25% 0.800 0.640 0.512 0.410 0.320 0.262 0.210 0.168 0.134 0.107 0.006 0.069 0.055 0.014 0.035 0.028 0.023 0.018 0.014 0.012 0.004 0.001 0 0 30% 0.789 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0,056 0.043 0.033 0.025 0.020 0.015 0.012 0.009 0.007 0.005 0.001 35% 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0.067 0.050 0.037 0,027 0.020 0.015 0.011 0.008 0.006 0.005 0.003 0.002 0.001 0 40% 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.058 0,048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 50% 0.667 0.444 0.295 0.198 0.132 0.088 0.059 0.039 0.026 0.017 0.012 0.008 0.005 0.003 0.002 0.002 0.001 0.001 0 0 - 0 0 0 0 40 50 0 0 0 0.002 0 0 0 0 0 0 0 0 APPENDIX D Present Value of an Annulty of S1, PV.. w-alle-14-2017 Period 11 0.901 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.555 9.471 10.368 11.255 12:134 13.001 13.365 14.718 15 562 16398 17.226 18.016 22.023 25.800 32795 39.196 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.951 10.635 11.296 11.938 12 561 13.166 13.754 11.324 14.877 17.413 19.600 23.115 25,7:30 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7,435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.392 19.79 21484 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.469 7. 1018 7.722 8.306 3.863 9.390 9,899 10.30 10.838 11.274 11.690 12.085 12162 14.09 15372 17.159 IB 250 Percent 6% 0.943 1.833 2.673 3.455 4.212 4.917 5.582 6.210 6.802 7.300 7,887 8.384 8.853 9.295 9.712 10.106 10.177 10.12 11.158 to 12.TH 13.765 15.016 25 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.48 7.913 8.358 8.745 9.100 9.447 9.763 10.059 TO.336 TO : 11.65: 12:10 13.312 13.30 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.600 9.818 10.675 11.258 11.925 12233 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 5.418 6.305 7.161 7.187 7.786 3,061 8.313 8.514 2.756 8.950 9,129 9.823 10,274 10.757 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6,145 6.495 6.814 7.103 7.367 7.606 7.824 8,022 8.201 3.365 3.510 9.077 9.427 9.729 9.915 1.713 2.444 3.102 3.695 4.231 4.712 5.146 5.537 5.839 6.207 6.492 6.750 6.982 7.191 7379 7.702 7.839 7.963 3.422 8.691 8.951 9.042 50 Period 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.561 4.968 5.328 5.650 5.938 6.194 6.121 5.628 6,811 6.974 7.102 7.250 7.356 7.469 7.813 8.055 3.244 B.304 10. 11 12 13 19% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.600 6.729 6.8.40 6.938 7,025 7.330 7.196 7.634 7.675 14% 0.877 1.647 2.322 2.914 3.433 3.829 4.288 4.639 4.916 5.216 5.453 5.560 5.842 6.002 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5,019 5.234 5.421 5,583 5.724 5.847 5.954 6.047 6.128 ti.198 6.59 6.00 6.566 6.612 6.661 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 0.833 5.029 5.197 5312 5.463 5.575 5.668 5.719 5.818 5.877 5.929 6.097 172 233 06 17% 0.855 1.585 2.210 2.743 3.199 3.589 3.922 4.207 4.451 4.559 4.836 4.9 5.118 5.239 5.324 5.405 5.475 5.534 5.581 5.628 1.766 5.829 5.871 S BD Percent 18% 19% 0.847 0.840 1.566 1.547 2.174 2.140 2.690 2.639 3.127 3.058 3.498 3.410 3.812 3.706 4.078 3.954 4.303 4.163 1.491 4.339 4.486 4.793 4.611 1.910 4.715 5.000 4.802 5,092 4,876 5.162 1.938 5.222 4.983 5.273 5.033 5316 5.00 5353 S.101 5.467 5.195 5.517 5.235 5.518 5.258 5.55 5262 20% 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 4.327 4.439 4.533 4.611 4.675 4.730 0.775 4812 1.843 1.8TO 4948 4.979 4.997 4.999 25% 0.800 1.440 1.952 2.362 2.689 2.951 3.161 3.329 3.463 3.571 3.656 3.725 3.780 3.824 3.859 3.887 3.910 3.928 3.942 3.954 3.985 3.995 3.999 SOX 0.769 1:361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.283 3.295 3,304 3:311 3.316 3.329 1302 3.333 35% 0.741 1.289 1.696 1.997 2.220 2.385 2.500 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.8.10 2.844 2.8.18 2.850 2856 2.857 2.857 2857 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.189 2.492 2.194 2.196 2.197 2.199 2.500 2.500 2.500 50% 0.667 1.111 1.407 1.605 1.737 1.824 1.883 1.922 1.948 1.965 1.977 1.985 1.990 1.993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000 15 16 17 19 6.265 6.373 6.467 8.550 6.623 6.873 7.003 7.105 7.133 25 30 40 50 4.000 Fauty Boop Express