Answered step by step

Verified Expert Solution

Question

1 Approved Answer

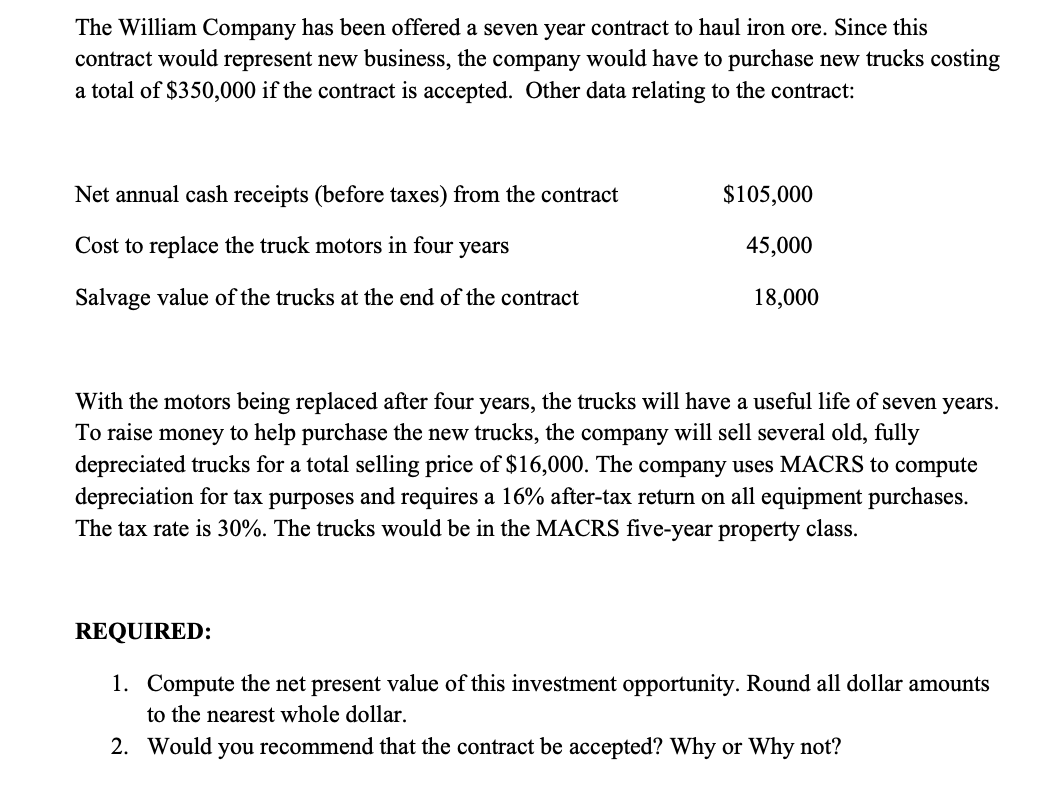

The William Company has been offered a seven year contract to haul iron ore. Since this contract would represent new business, the company would have

The William Company has been offered a seven year contract to haul iron ore. Since this

contract would represent new business, the company would have to purchase new trucks costing

a total of $ if the contract is accepted. Other data relating to the contract:

With the motors being replaced after four years, the trucks will have a useful life of seven years.

To raise money to help purchase the new trucks, the company will sell several old, fully

depreciated trucks for a total selling price of $ The company uses MACRS to compute

depreciation for tax purposes and requires a aftertax return on all equipment purchases.

The tax rate is The trucks would be in the MACRS fiveyear property class.

REQUIRED:

Compute the net present value of this investment opportunity. Round all dollar amounts

to the nearest whole dollar. explain thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started