Answered step by step

Verified Expert Solution

Question

1 Approved Answer

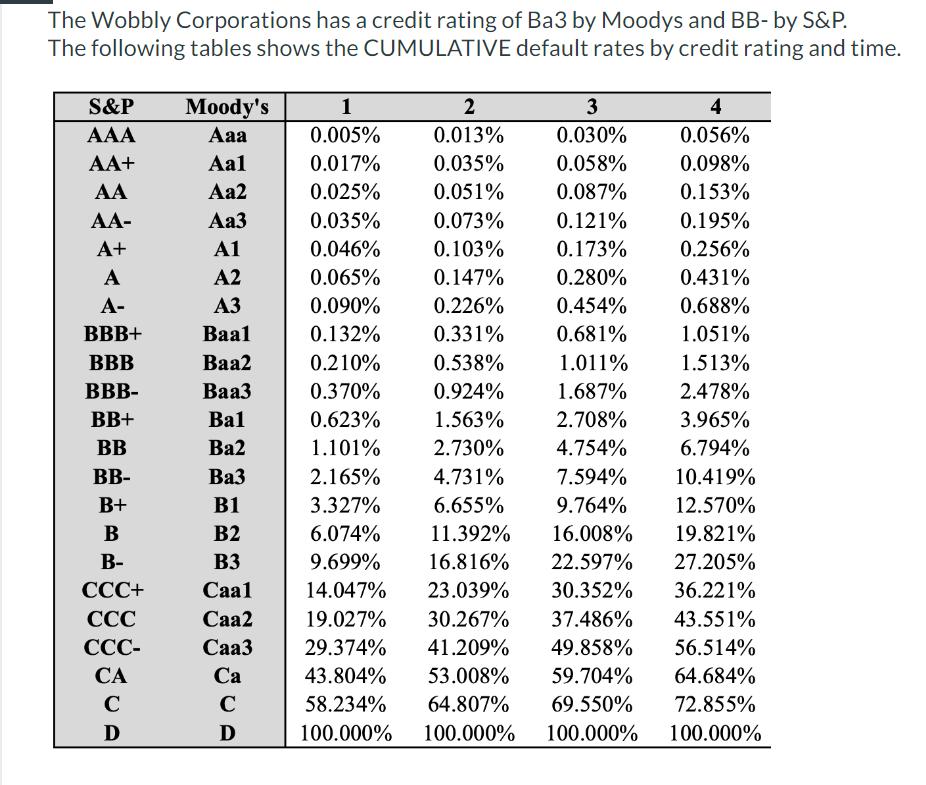

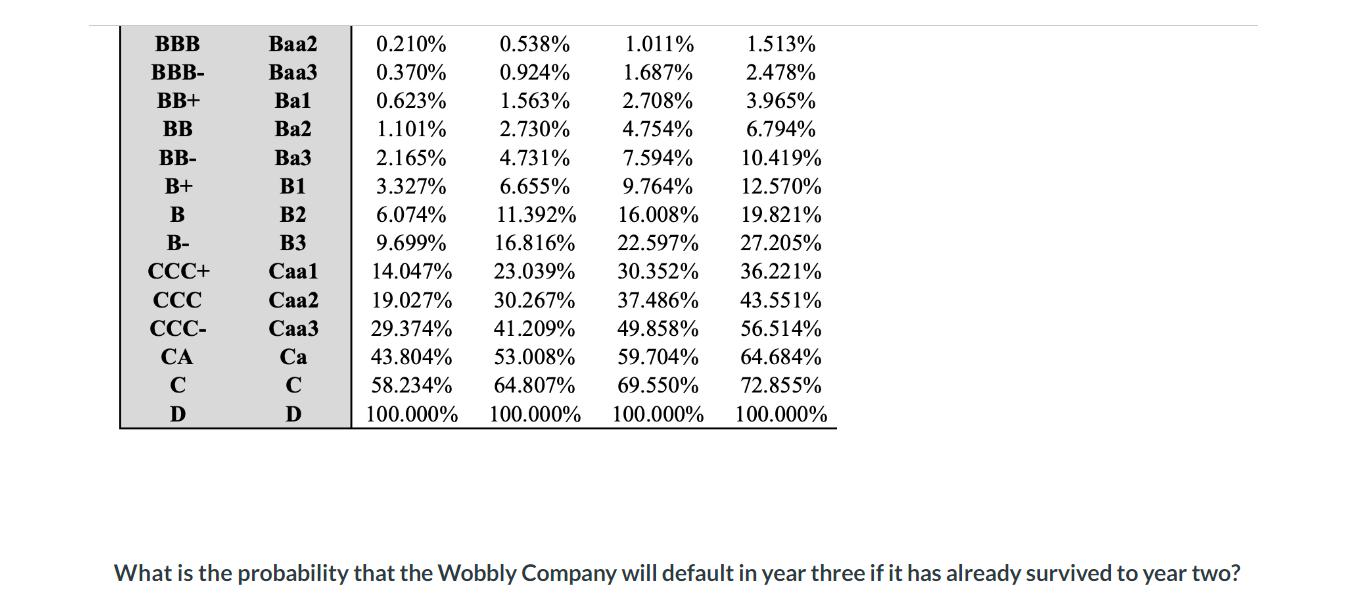

The Wobbly Corporations has a credit rating of Ba3 by Moodys and BB- by S&P. The following tables shows the CUMULATIVE default rates by

The Wobbly Corporations has a credit rating of Ba3 by Moodys and BB- by S&P. The following tables shows the CUMULATIVE default rates by credit rating and time. S&P AAA AA+ AA AA- A+ A A- BBB+ BBB BBB- BB+ BB BB- B+ B B- CCC+ CCC CCC- CA D Moody's Aaa Aal Aa2 Aa3 A1 A2 A3 Baal Baa2 Baa3 Bal Ba2 Ba3 B1 B2 B3 Caal Caa2 Caa3 Ca C D 1 0.005% 0.017% 0.025% 0.035% 0.046% 0.065% 0.090% 0.132% 0.210% 0.370% 0.623% 1.101% 2.165% 3.327% 6.074% 9.699% 14.047% 2 3 0.013% 0.030% 0.035% 0.058% 0.051% 0.087% 0.073% 0.121% 0.103% 0.173% 0.147% 0.280% 0.226% 0.454% 0.331% 0.681% 0.538% 1.011% 0.924% 1.687% 1.563% 2.708% 2.730% 4.754% 4.731% 7.594% 6.655% 9.764% 11.392% 16.008% 16.816% 22.597% 23.039% 30.352% 19.027% 30.267% 37.486% 29.374% 41.209% 49.858% 43.804% 53.008% 59.704% 58.234% 64.807% 69.550% 100.000% 100.000% 100.000% 4 0.056% 0.098% 0.153% 0.195% 0.256% 0.431% 0.688% 1.051% 1.513% 2.478% 3.965% 6.794% 10.419% 12.570% 19.821% 27.205% 36.221% 43.551% 56.514% 64.684% 72.855% 100.000% BBB BBB- BB+ BB BB- B+ B B- CCC+ CCC CCC- CA C D Baa2 Baa3 Bal Ba2 Ba3 B1 B2 B3 Caal Caa2 Caa3 Ca D 0.538% 0.924% 1.563% 2.730% 4.731% 6.655% 11.392% 16.816% 1.011% 1.513% 1.687% 2.478% 2.708% 3.965% 4.754% 6.794% 7.594% 10.419% 9.764% 12.570% 16.008% 19.821% 22.597% 27.205% 36.221% 19.027% 30.267% 37.486% 43.551% 29.374% 41.209% 49.858% 56.514% 43.804% 53.008% 59.704% 64.684% 58.234% 64.807% 69.550% 72.855% 100.000% 100.000% 100.000% 100.000% 0.210% 0.370% 0.623% 1.101% 2.165% 3.327% 6.074% 9.699% 14.047% 23.039% 30.352% What is the probability that the Wobbly Company will default in year three if it has already survived to year two?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started