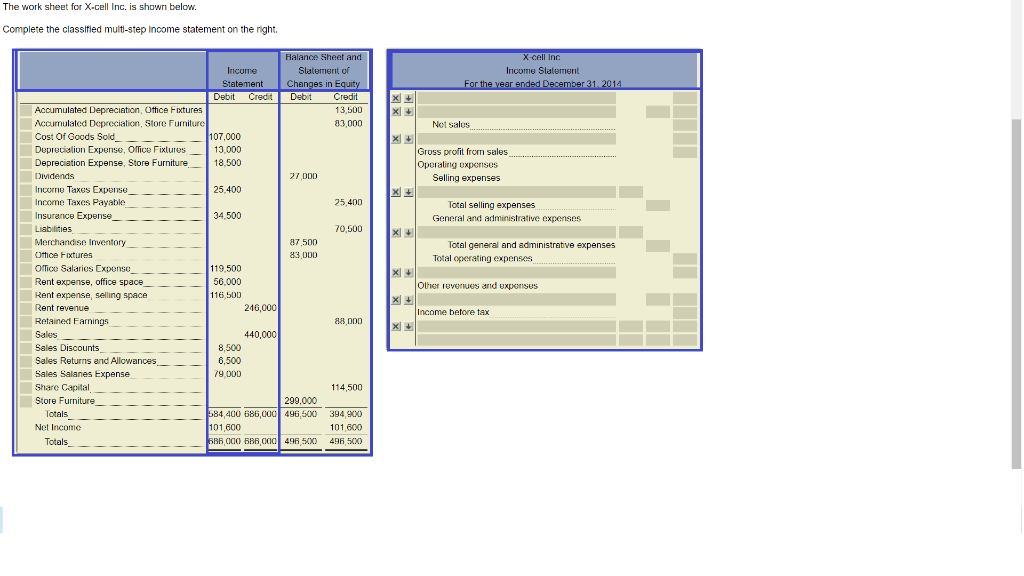

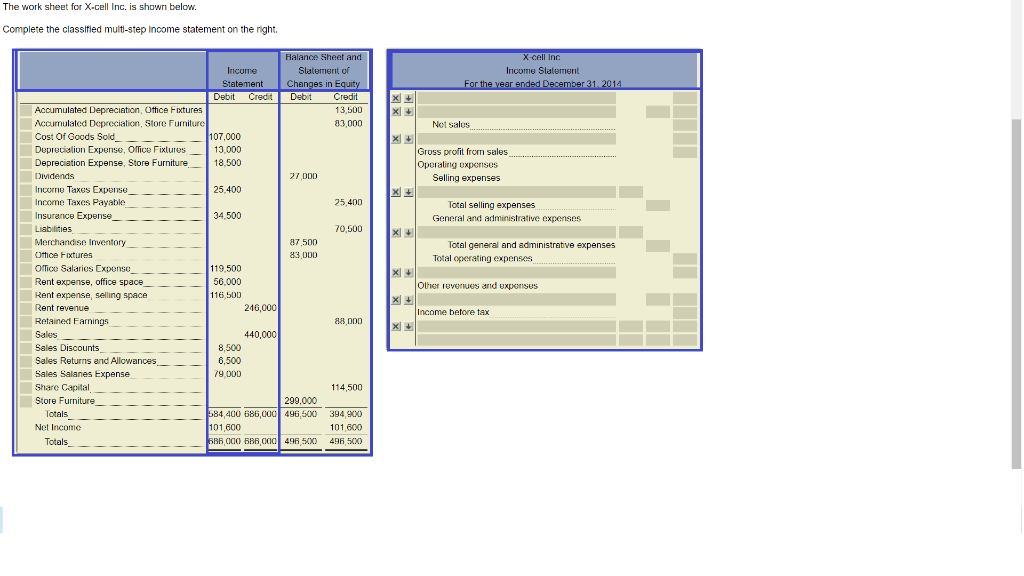

The work sheet for X-cell Inc. is shown below. Complete the classified multi-step Income statement on the right X-cell Inc Income Statement For the year ended December 31, 2014 Not sales x + Gross profit from sales Operating expenses Selling expenses Total selling expenses General and administrative expenses Balance Sheet and Income Statement of Statement Changes in Equity Debit Credit Debit Credit Accumulated Depreciation, Office Fixtures 13,500 Accumulated Depreciation, Store Furniture 83.000 Cost Of Goods Sold__ 107.000 Depreciation Expense, Ollice Fixtures 13,000 Depreciation Expense, Store Furniture 18,500 Dividends 27 000 Income Taxes Expense 25.400 Income Taxes Payable 25,400 Insurance Expense 34,500 Liabilities 70,500 Merchandise Inventory 87.500 Office Fixtures 83 DDD Office Salaries Expense 119.500 Rent expense, office space 56,000 Rent expense, selling space 116 500 Rent revenue 246,000 Retained Farnings 880DD Sales 440,000 Sales Discounts 8,500 Sales Returns and Allowances 6.500 Sales Salanes Expense 79.000 Share Capital 114.500 Store Furniture 299,000 Totals 584,400 686,000 496,500 394,900 Net Income 101,600 101,600 Totals 586.000 585.000 496 500 496 500 ) ) Total general and administrative expenses Total operating expenses Other revenues and expenses Income before tax x + The work sheet for X-cell Inc. is shown below. Complete the classified multi-step Income statement on the right X-cell Inc Income Statement For the year ended December 31, 2014 Not sales x + Gross profit from sales Operating expenses Selling expenses Total selling expenses General and administrative expenses Balance Sheet and Income Statement of Statement Changes in Equity Debit Credit Debit Credit Accumulated Depreciation, Office Fixtures 13,500 Accumulated Depreciation, Store Furniture 83.000 Cost Of Goods Sold__ 107.000 Depreciation Expense, Ollice Fixtures 13,000 Depreciation Expense, Store Furniture 18,500 Dividends 27 000 Income Taxes Expense 25.400 Income Taxes Payable 25,400 Insurance Expense 34,500 Liabilities 70,500 Merchandise Inventory 87.500 Office Fixtures 83 DDD Office Salaries Expense 119.500 Rent expense, office space 56,000 Rent expense, selling space 116 500 Rent revenue 246,000 Retained Farnings 880DD Sales 440,000 Sales Discounts 8,500 Sales Returns and Allowances 6.500 Sales Salanes Expense 79.000 Share Capital 114.500 Store Furniture 299,000 Totals 584,400 686,000 496,500 394,900 Net Income 101,600 101,600 Totals 586.000 585.000 496 500 496 500 ) ) Total general and administrative expenses Total operating expenses Other revenues and expenses Income before tax x +