Question

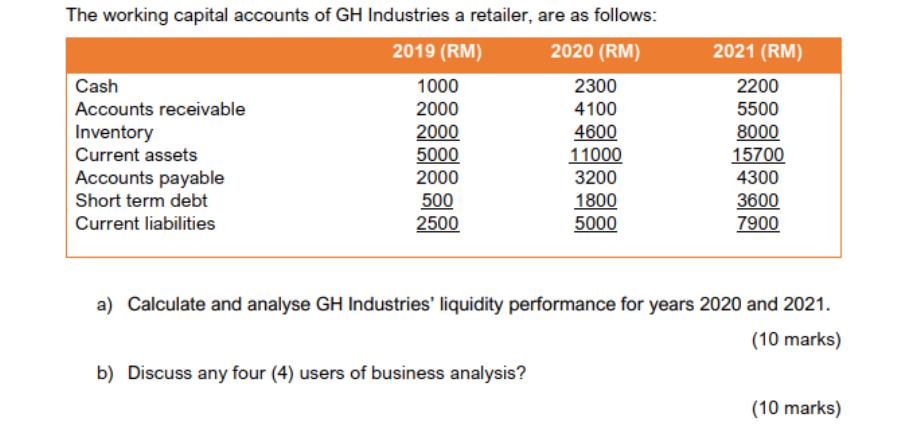

The working capital accounts of GH Industries a retailer, are as follows: 2019 (RM) 2020 (RM) Cash Accounts receivable Inventory Current assets Accounts payable

The working capital accounts of GH Industries a retailer, are as follows: 2019 (RM) 2020 (RM) Cash Accounts receivable Inventory Current assets Accounts payable Short term debt Current liabilities 1000 2000 2000 5000 2000 500 2500 2300 4100 4600 11000 3200 1800 5000 b) Discuss any four (4) users of business analysis? 2021 (RM) 2200 5500 8000 15700 4300 3600 7900 a) Calculate and analyse GH Industries' liquidity performance for years 2020 and 2021. (10 marks) (10 marks)

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To assess the liquidity performance of GH Industries for the years 2020 and 2021 we will calculate two important liquidity ratios i Current ratio Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Finance The Logic and Practice of Financial Management

Authors: Arthur J. Keown, John D. Martin, J. William Petty

8th edition

132994879, 978-0132994873

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App