Question: The workweek for all employees is 40 hours, except for the students 36-hour schedule. The office is open from 8:00 a.m. to 5:00 p.m. each

The workweek for all employees is 40 hours, except for the student’s 36-hour schedule. The office is open from 8:00 a.m. to 5:00 p.m. each day, except weekends. Glo-Brite allows office employees one hour for lunch, 12:00 p.m. to 1:00 p.m. The plant operates on a five-day workweek of eight hours per day, with normal working hours from 7:00 a.m. to 11:00 a.m. and 12:00 p.m. to 4:00 p.m.

All employees except for the exempt administrative employees—the president (O’Neill), the sales manager (Ferguson), sales representative (Mann), and supervisor (Sokowski)—are paid time and a half for any overtime exceeding 40 hours a week. Workers in the plant (Bonno and Ryan) are paid time and a half for any hours worked over eight each workday and for work on Saturdays and twice the regular hourly rate of pay for work on Sundays or holidays

Payday

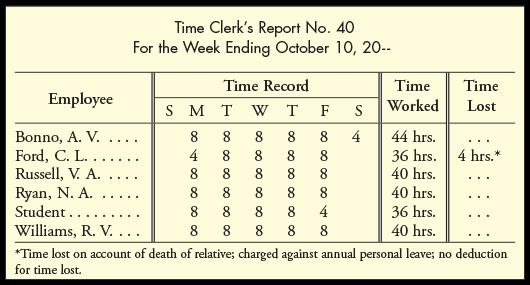

Employees are paid biweekly on Friday. The first payday in the fourth quarter is Friday, October 9. Since the weekly time clerk’s report is not finished until the Monday following the end of each week, the first pay (October 9) will be for the two weeks September 20–26 and September 27–October 3. The company, in effect, holds back one week’s pay. This policy applies to all employees. The next payday (October 23) will cover the days worked in the weeks ending October 10 and October 17.

| Payroll Taxes Levied upon Glo-Brite Paint Company and Its Employees | ||

|---|---|---|

| Federal Income Taxes (FIT) | Withheld from each employee’s gross earnings in accordance with information given on Form W-4 and employee’s earnings record. Wage-bracket method is used to determine FIT withholding. | |

| Pennsylvania State Income Taxes (SIT) | 3.07 percent withheld from each employee’s gross earnings during the fourth quarter. | |

| Philadelphia City Income Taxes (CIT) | 3.8809 percent withheld from gross earnings of each resident employee. | |

| Pennsylvania State Unemployment Taxes (SUTA) | Employee: | 0.06 percent (0.0006) on total gross earnings (no limit for the employee’s portion). |

| Employer: | 3.6890 percent on first $10,000 gross earnings paid each employee during the calendar year (PA rate for new employers). | |

| Federal Unemployment Taxes (FUTA) | Employer: | Net tax rate of 0.6 percent on first $7,000 gross earnings paid each worker in the calendar year. |

| Federal Insurance Contributions Act (FICA) | OASDI—Employee and Employer: | 6.2 percent on first $132,900 of gross earnings paid each worker in the calendar year (maximum OASDI tax of $8,239.80). |

| HI—Employee: | 1.45 percent on total gross earnings paid each worker in the calendar year, plus an additional 0.9 percent on wages over $200,000. | |

| HI—Employer: | 1.45 percent on total gross earnings paid each worker in the calendar year. | |

Deposit Rules

| Deposit Rules for Glo-Brite Paint Company | |

|---|---|

| Federal | The FICA taxes and FIT taxes must be deposited on or before the 15th of the month following the month in which the taxes were withheld. Since Glo-Brite is a new employer and has no tax liabilities during the lookback period, the company is subject to the monthly deposit rule. |

| Pennsylvania | Since the state income taxes withheld total $1,000 or more each quarter, the company must remit the withheld taxes semimonthly. The taxes must be remitted within three banking days after the semimonthly periods ending on the 15th and the last day of the month. |

| Philadelphia | Since the city income taxes withheld are more than $350 but less than $16,000 each month, the company is subject to the monthly rule. The city income taxes withheld during the month must be remitted by the 15th day of the following month. |

Group Insurance

Pay Points

Deduct insurance premiums only on the last payday of each month.

The company carries group-term life insurance on all its employees in an amount equal to one and one-half times the annual salary or wages paid each employee (rounded to the nearest thousand). The group insurance program covers full-time employees. A notation has been made on each employee’s earnings record to show that each month 30¢ for each $1,000 of insurance coverage is deducted from the employee’s earnings to pay a portion of the premium cost. For example: Anthony Bonno has $55,000 of insurance coverage. Therefore, the calculation for his insurance deduction is . The amount withheld is credited to a liability account entitled Group Insurance Premiums Collected. The taxable portion of group-term life insurance in excess of $50,000 is disregarded because the employees pay for group-term life insurance

At the start of each pay period remove the Project Audit Test beginning Project Audit Test. Answer the questions as you complete each pay period.

Both workers in the plant (Bonno and Ryan) are union members. Under the check-off system, $8 is deducted each payday from the plant workers’ earnings for union dues, assessments, and initiation fees. A notation to this effect has been made on each plant worker’s earnings record. On or before the tenth of each month, the amounts withheld during the preceding month are turned over to the treasurer of the union.

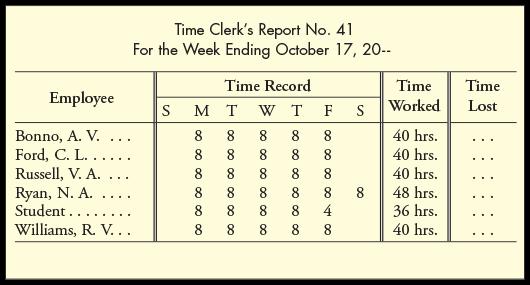

Prepare the payroll for the last pay period of October from Time Clerk’s

Report Nos. 40 and 41.

The proper procedure in recording the payroll follows:

➀ Complete the payroll register.

Project Audit Test

✓Net Paid $12,376.89

In as much as only a portion of the payroll register sheet was used in recording the October 9 payroll, the October 23 payroll should be recorded on the same sheet to save space. On the first blank ruled line after the October 9 payroll, insert “Payday October 23—For Period Ending October 17, 20--.” On the following lines, record the payroll information for the last pay date of October. When recording succeeding payrolls, continue to conserve space by recording two payrolls on each separate payroll register sheet.

Even though they are not on the time clerk’s report, remember to pay the president, sales manager, sales representatives, and supervisors.

The workers in the plant (Bonno and Ryan) are paid time and a half for any hours worked over eight each workday and for work on Saturdays and are paid twice the regular hourly rate for work on Sundays or holidays.

- With this pay period, the cumulative earnings of several employees exceed the taxable income base set up by FUTA and SUTA. This factor must be considered in preparing the payroll register and in computing the employer’s payroll taxes. Refer to each employee’s earnings record to see the amount of cumulative earnings.

➁ Make the entry transferring from Cash to Payroll Cash the net amount of the total payroll, and post. ➂ Post the required information from the payroll register to each employee’s earnings record.

➃ Record in the journal the salaries, wages, taxes withheld, group insurance premiums collected, union dues withheld, and net amount paid, and post to the proper ledger accounts.

Pay Points

The employees’ Pennsylvania State Unemployment Tax (suta) is calculated (0.0006) on the total wages of each employee. There is no taxable wage limit on the employees’ portion of the tax.

The entry required to record the October 23 payroll is the same as that to record the October 9 payroll, except it is necessary to record the liability for the amount withheld from the employees’ wages to pay their part of the group insurance premium. The amount withheld should be recorded as a credit to Group Insurance Premiums Collected.

What is the gross pay for Anthony V. Bonno?

What is the amount of OASDI withheld for Catherine L. Ford?

What is the total amount of group insurance withheld for all employees?

What is the amount of the credit to Employees FIT Payable?

What is the amount of the debit to Payroll Taxes?

What is the amount of the credit to SUTA Taxes Payable—Employer?

What is the amount of the debit to Employees SIT Payable on October 20?

What is the balance of FICA Taxes Payable—OASDI?

What is the balance of Union Dues withheld for the employees?

What is the total amount of group insurance withheld for all employees?

Employee Bonno, A. V. Ford, C. L. Russell, V. A. Ryan, N. A. Student.... Williams, R. V... ... Time Clerk's Report No. 41 For the Week Ending October 17, 20-- Time Record S M T W T F S 00 8 0 00 00 00 00 00 8 00 00 00 00 00 00 8 8 8 8 8 8 8 00 00 00 00 00 00 8 8 0 00 00 00 00 00 8 00 8 8 8 8 8 8 8 8 8 8 00 00 00 00 00 8 8 8 8 8 4 8 8 Time Worked 40 hrs. 40 hrs. 40 hrs. 48 hrs. 36 hrs. 40 hrs. Time Lost

Step by Step Solution

3.50 Rating (177 Votes )

There are 3 Steps involved in it

The total amount of grou... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

20250422_101313.xlsx

300 KBs Excel File