Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the x=4 & AnnotationOfUserid=0&IsReadOnly=True&LearningObjectid=2180428998LearningObjectInstanceld=3141303 110% 3. Assume the Germany based Theis company has a balance sheet as follows. Cash AR Inventories Current assets Fixed assets

the x=4

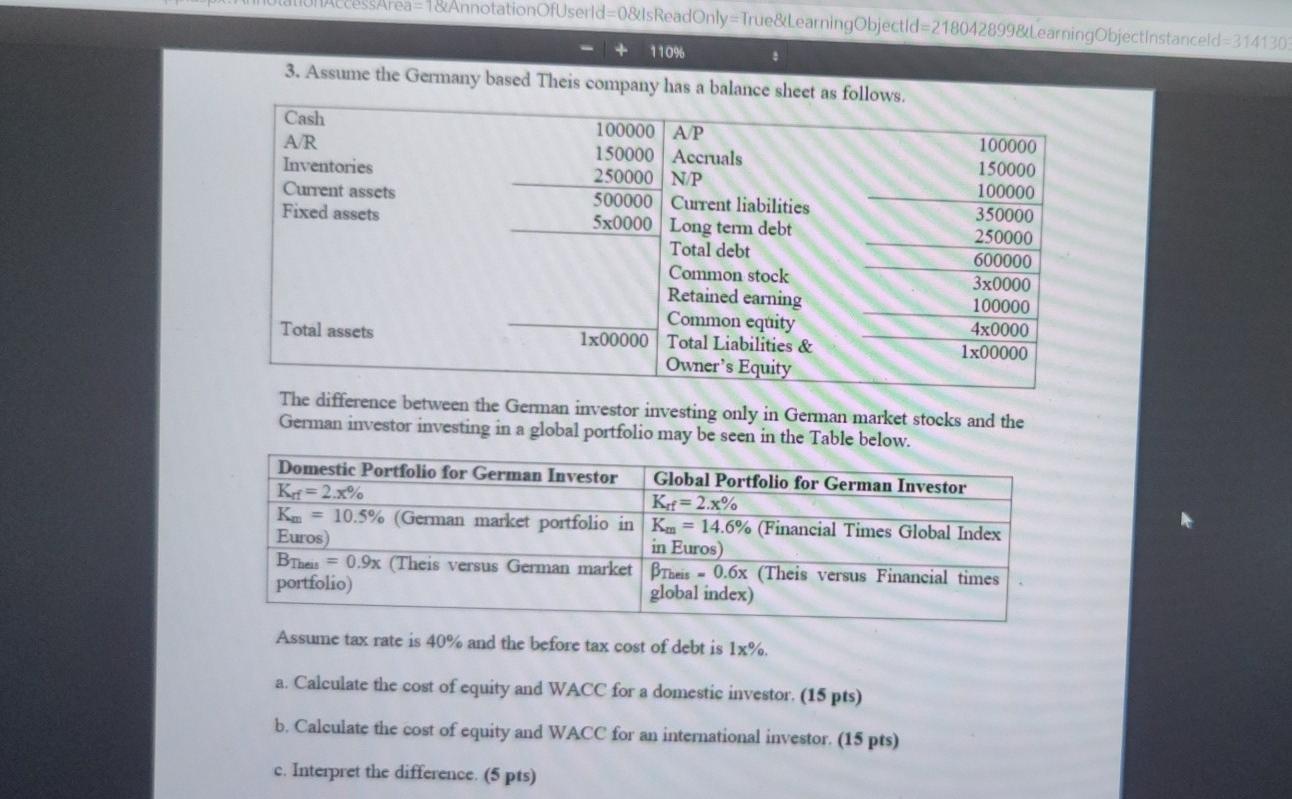

& AnnotationOfUserid=0&IsReadOnly=True&LearningObjectid=2180428998LearningObjectInstanceld=3141303 110% 3. Assume the Germany based Theis company has a balance sheet as follows. Cash AR Inventories Current assets Fixed assets 100000 AP 150000 Accruals 250000 N/P 500000 Current liabilities 5x0000 Long term debt Total debt Common stock Retained earning Common equity 1x00000 Total Liabilities & Owner's Equity 100000 150000 100000 350000 250000 600000 3x0000 100000 4x0000 1x00000 Total assets The difference between the German investor investing only in German market stocks and the German investor investing in a global portfolio may be seen in the Table below. Domestic Portfolio for German Investor Global Portfolio for German Investor Kr=2.x% Kf=2.x% K = 10.5% (German market portfolio in kn = 14.6% (Financial Times Global Index Euros in Euros) BThens = 0.9x (Theis versus German market Bromis - 0.6x (Theis versus Financial times portfolio) global index) Assume tax rate is 40% and the before tax cost of debt is 1x% a. Calculate the cost of equity and WACC for a domestic investor (15 pts) b. Calculate the cost of equity and WACC for an international investor (15 pts) c. Interpret the difference. (5 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started