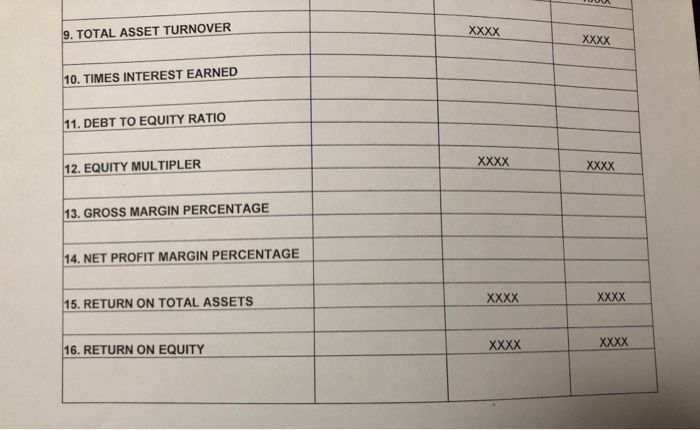

The XXXX means do not compute. Please show all work

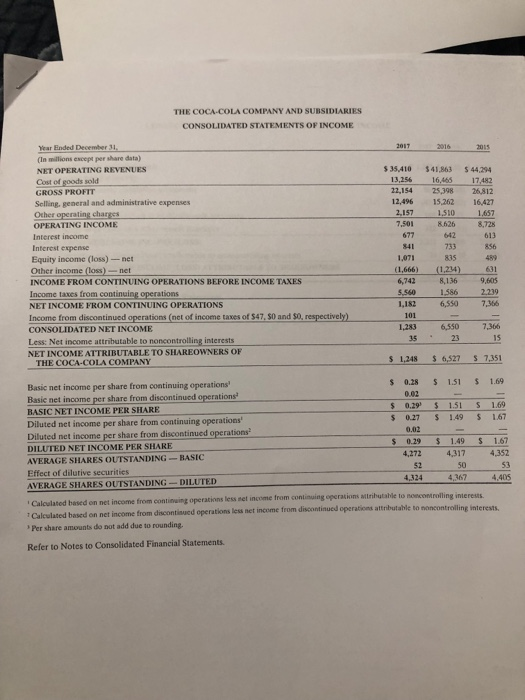

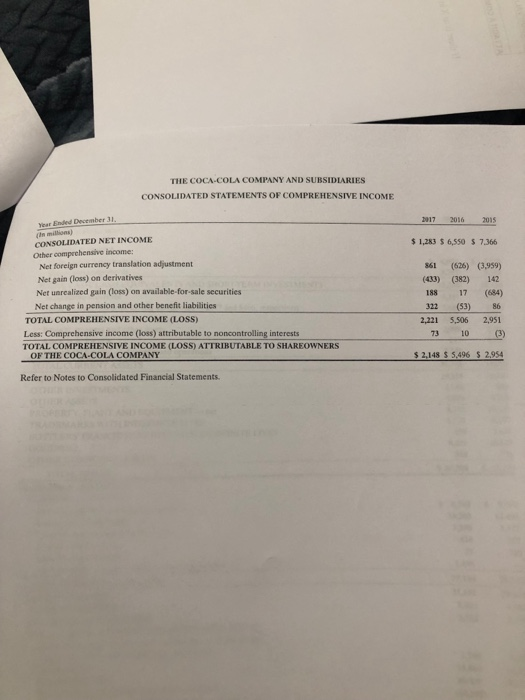

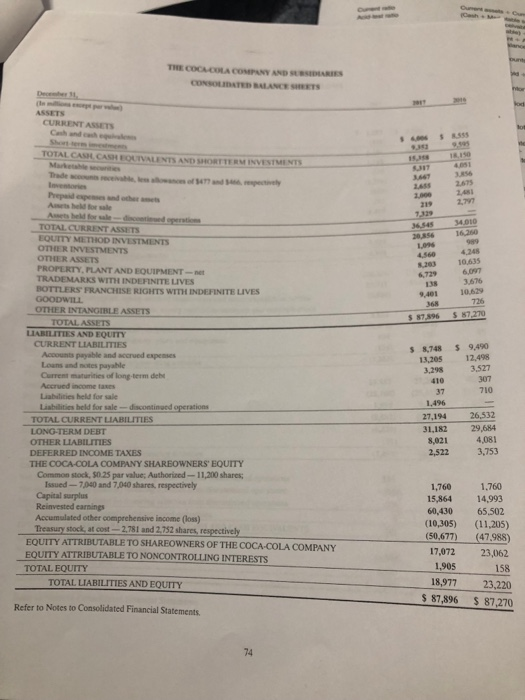

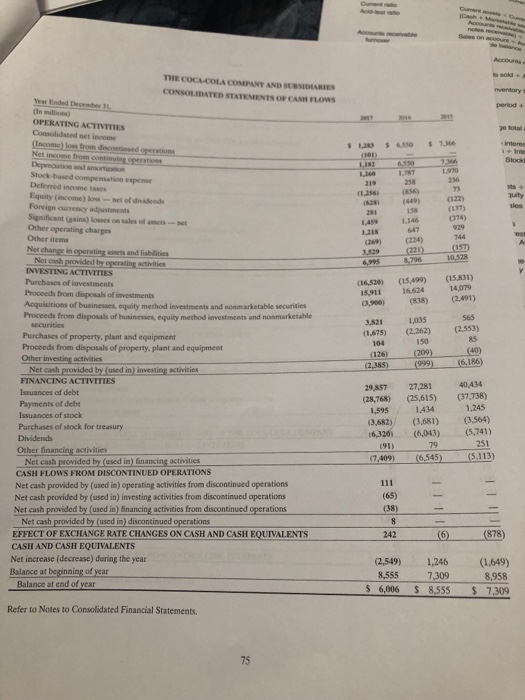

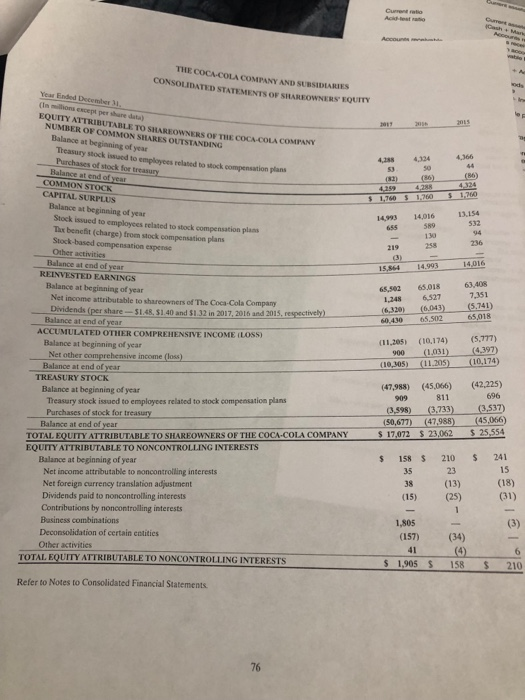

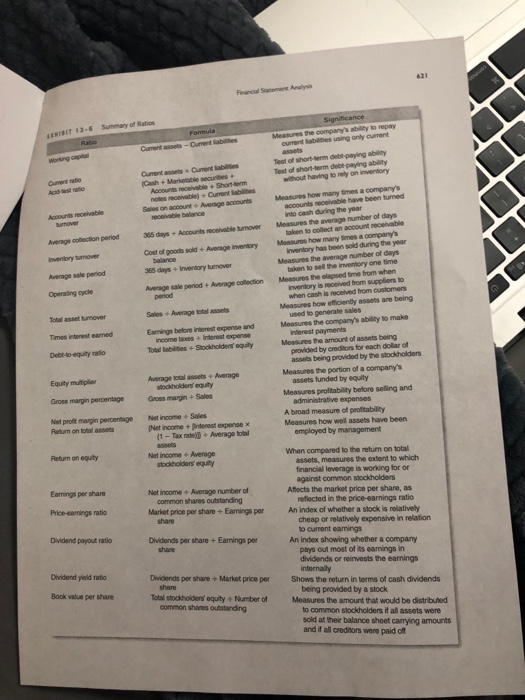

9. TOTAL ASSET TURNOVER 10. TIMES INTEREST EARNED 11. DEBT TO EQUITY RATIO 2. EQUITY MULTIPLER XXxx 13. GROSS MARGIN PERCENTAGE 14. NET PROFIT MARGIN PERCENTAGE 15. RETURN ON TOTAL ASSETS XXxX 16. RETURN ON EQUITY XXxx THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Year Ended December 3 (In millions except per share data) 35,410 41,863 44,294 13256 1646 17,482 22,154 25,398 26,812 12,496 15.262 16,427 NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, general and administrative expenses 2.157 1.510 1.657 8626 642 8,72 613 OPERATING INCOMIE Interest income Interest expense Equity income (loss)-net Other income (loss)-net INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS 7,501 733 835 (1,666) 1.24) 631 8,136 1.586 1,182 6,50 7,366 856 841 1,071 6,742 9,605 586 136 Income from discontinued operations (net of incoeme taxes of $47. 50 and S0, respectively) CONSOLIDATED NET INCOME 1,2836,5507,366 15 6,527 S 7,351 1.69 1.51 1.69 35 23 Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF S 1,248 THE COCA-COLA COMPANY $ 028 s 151 Basic net income per share from continuing operations Basic net income per share from discontinued operations' BASIC NET INCOME PER SHARE Diluted net income per share from continuing operations Diluted net income per share from discontinued operations' DILUTED NET INCOME PER SHARE AVERAGE SHARES OUTSTANDING-BASIC Effect of dilurive securities AVERAGE SHARES OUTSTANDING -DILUTED 0.02 S 0.29 s 0.27 1.49 167 0.02 0.29 1.49 $ 167 4,272 4,3174,352 50 53 4.367 4,405 Calculated based on net income from continuing operations less set income t Calculated based on net income from discontisued operations less net income from discontinued Per share amounts do not add due to rounding. om continuing operations atributahle to noecomrolling interests Refer to Notes to Consolidated Financial Statements THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Year Endled December 31. (in millons) CONSOLIDATED NET INCOME 217 2016 2015 $1,283 $ 6,550 $ 7.366 Other comprehensive income: Net foreign currency translation adjustment Net gain (loss) on derivatives Net unrealized gain (loss) on available-for-sale securities Net change in pension and other benefit liabilities 361 (626) (3,959) (433) (382) 142 188 17 (684) 322 (53)86 2,221 5,506 2,951 TOTAL COMPREHENSIVE INCOME (LOSS) Less: Comprehensive income (loss) attributable to noncontrolling interests TOTAL COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO SHAREOWNERS 73 10 3) OF THE COCA-COLA COMPANY $ 2,148 $ 5,496 S 2,954 Refer to Notes to Consolidated Financial Statements. THE COCAOLA COMPANY AND SURSIDIARIES ASSETS CURRENT ASSETS Cash and cash equial TOTAL CAS CASH EOUIVALENTS AND SHORTTERM INVESTMENTS 317 24552.675 Prepaid expenses and other amets Ausets held for sale Assets held for sale TOTAL CURRENT ASSETs EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS PROPERTY, PLANT AND EQUIPMENT- TRADEMARKS WITH INDEFINITE LIVES BOTTLERS FRANCHISE RIGHTS wrTH INDEFINITE uvES 36545 34010 4,5604,248 8,203 10635 67296,09 138 3,676 9,401 10629 OTHER INTANGIBLE ASSETS 87.,396 $87,270 LABITES AND EQUm CURRENT LIABILITIES 8,748 9,490 3,205 12,498 3,298 3,527 Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term dehe Accrued income taxes 710 Liabulities held for sale Lisbilities beld for sale-discontinged operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAXES THE COCA-COLA COMPANY SHAREOWNERS EQUITY 1,496 27,194 31,182 8,021 2,522 29,684 4,081 3,753 Common stock, $0.25 par value, Authorized-11,200 shares Issued 7040 and 7,040 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock at cost-2,781 and 2,752 shares, respectively 1,760 1,760 15,864 14,993 60,430 65.502 (10,305) (11.205) (50,677) (47.988) 17,072 23,062 EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY Refer to Notes to Consolidated Financial Statements THE COCA-COLA COMPANY AND SURSIDEARIES CONSOLIDATED STATEMENTS OF CASH FLOws Year Ended December 31 (n millions) OPERATING ACTIVTTTES 1.970 73 (628 (449)(122) ,787 Stock -based compensation expense Deferred income taxes Equity (income) oss-net of dividends 1.256(856) (137) (374) Significant (gains) losses on sales of assets-net Other operating charges Other item Net change in operating asets and liablities LAS 1,146 1218 Net cash provided by INVESTING ACTIVITIES Purchases of investments Proceeds from disposals of investments Acquisitions of businesses, equity method investments and nonmarketable securities Proceeds from disposals of businesses, equity method investments and nonmarketable (16,520) (15,499) (15,831) 16S24 14,079 15.911 3,909)(838) (2491) 565 3,821 1,035 (1.675) (2.262) 553) Purchases of property, plant and equipment Procceds from disposals of property, plant and equipment Other investing activities 85 150 126)(209) (40) 2385) (999) (6.186) 29,857 27,281 40,434 (28,768) (25,615) (37,738) 104 Net cash provided by (used in) investing activities FINANCING ACTIVITIES Issuances of debt Payments of deb 1,245 ,5951434 Issuances of stock Purchases of stock for treasury Dividends 3,682) (3,681) (3,564) (6,320) (6,043)(,741) 91) 79 Otber financing activities Net cash provided by (used in) financing activilies 17.409) (6545)(5.113) CASH FLOWS FROM DISCONTINUED OPERATIONS Net cash provided by (used in) operating activities from discontinued operations Net cash prowided by (used in) investing activities from discontinued operations Net cash provided by (used in) inancing activities from discontinued operations (65) 38) 242 Net cash provided by (used in) discontinued operations EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EOUIVALENTS CASH AND CASH EQUIVALENTS Net increase (decrease) during the year Balance at beginning of year (6 (878) (2,549)1,246 (1,649) 8.555 7.309 8,958 Refer to Notes to Consolidated Financial Statements 75 Current ratio THE IE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS EQUurry Yea, Ended Decenter except per share data) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY NUMBER OF COMMON SHARES OUTSTANDING Balance at beginning of year Theasury stock issued to employees related to stock compensation plans 4,2884,324 Purchases of stock for treasury 06) (X) (86) Balance at end of COMMON STOCK CAPITAL SURPLUS Balance at beginning of year 532 Stock issued to employees related to stock compensation plass 130 258 Tax beneft (charge) froem stock compensation plans 236 Stock-based compensation experse Other activities Balance at end of year Balance at beginning of year REINVESTED EARNINGS 7,351 6,527 Net income attributable to shareowners of The Coca-Cola Company Dividends (per share-$1.48, $1.40 and $1.32 in 2017, 2016 and 2015,respectively) 6.320) Balance at end of year ACCUMULATED OTHER COMPREHENSIVE INCOME 10ssi Balance at beginning of year Net other comprehensive income (loss) Balance at end of year 74) (47,988) (45,066) (42,225) 811 TREASURY STOCK 696 Balance at beginning of year Theasury stock issued to employees related to stock compensation plans 909 3,598) (50,677) (47 45,066) Purchases of stock for treasury Balance at end of year TOTAL EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUmY ATTRIBUTABLE TO NONCONTROLLING INTERESTS $ 158 210 241 15 (18) 23 35 3s (13 (15) (25) (31) Balance at beginning of year Net income attributable to moncontrolling interests Net foreign currency translation adjustment Dividends paid to noncontrolling interests Contributions by noncontrolling interests Basiness combinations Deconsolidation of certain cotities Other activities (157) (34) (4 TOTAL EQUrTY ATTRIBUTABLE TO NONCONTROLLING NTERESTS Refer to Notes to Consolidated Financial Statements 76 621 Financal Sacemene Analys IRIBIT 13-8 Summary of Ratios ourrent labilities using only current Test of short-erm debt-paying ability Test of short-term debt-paying ability ant assets amt lables without having to nely on inventory Sales on account+Avernge accounts Measures how many times a company's aocounts receivable have been turned nto cash during the year Average colection period eventory tunover Average sale period Operating cycle 305 days + Accounts recevable tumover Measures the average number of days Cost of goods sold+Average inventory Measures how many Simes a companys 365 days+ Inventory turmover Average sale period+Average collection Messures the elapsed time from when takken to collect an account receivable Inventory has been sold during the year taken to sell the inventory one time nventory is received from suppliors to when cash is received from customers used to generate sales interest payments provided by creditors for each dollar of Measures the average number of days Total asset turnover Times interest earned Debt-to-equity ratio Sales +Average total assets Earmings betore interest expense and Total labilities+ Stockholders equity Measures how efficienty assets are being Measures the company's ability to make Measures the amount of assets being assets being provided by the slockholders Measures the portion of a company's Measures profitability belore selling and A broad measure of peofitability Average total assets+Average Equity mutipler Gross margin percentageGss margin + Net proft mage percentage Net none Sales assets tunded by equity administrative expenses Return on total assets Net income +Interest expense x Measures how well assets have been (1-Tax rate). Average ttal employed by management Return on equity Net income + Average When compared to the return on total stockholdeors equty assets, measures the extent to which financial leverage is working for or against common stockholders Earnings per share Net income + Average number of Aflects the market price per share, as common shares outstanding Market price per share + Earmings per Price-eernings ratio reflected in the price-earnings ratio An index of whether a stock is relatively share cheap or relatively expensive in relation to current earnings Dividend payout ratio Dlvidonds per share+ Earmings per An index showing whether a company share pays out most of its earmings in dividends or reirvests the earnings internaly Oividend yieid ratio Dividends per share+Market price per Shows the return in terms of cash dividends share Book value per share Total stockholders' equity+Number of Measures the amount that would be distributed being peovided by a stock common shares outstanding to common stockholders it all assets were sold at their balance sheet carrying amounts and if all crednors were paid off