Question

The XY Company has 1800 bonds outstanding that have a market price of $990 each and a face value of $1000. floatation cost is 0.015

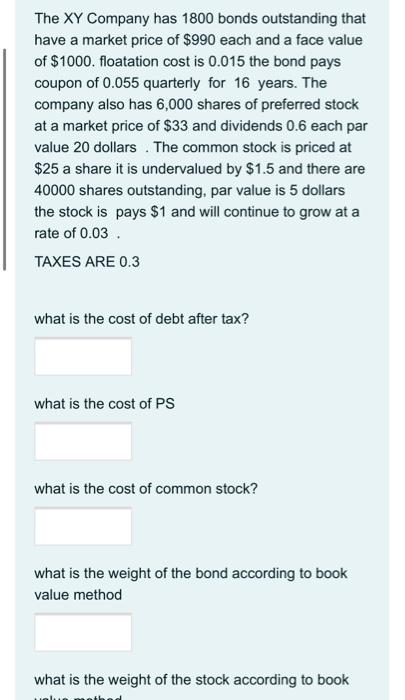

The XY Company has 1800 bonds outstanding that have a market price of $990 each and a face value of $1000. floatation cost is 0.015 the bond pays coupon of 0.055 quarterly for 16 years. The company also has 6,000 shares of preferred stock at a market price of $33 and dividends 0.6 each par value 20 dollars . The common stock is priced at $25 a share it is undervalued by $1.5 and there are 40000 shares outstanding, par value is 5 dollars the stock is pays $1 and will continue to grow at a rate of 0.03 .

TAXES ARE 0.3

what is the cost of debt after tax?

Answer for part 1what is the cost of PS

Answer for part 2what is the cost of common stock?

Answer for part 3what is the weight of the bond according to book value method

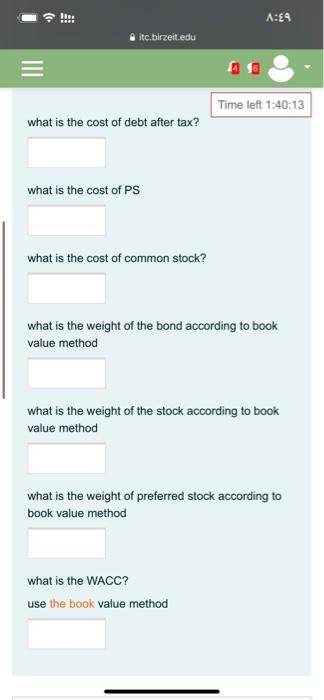

Answer for part 4what is the weight of the stock according to book value method

Answer for part 5what is the weight of preferred stock according to book value method

Answer for part 6what is the WACC?

use the book value method

Answer for part 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started