Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The XYZ Company is planning to request a line of credit from its bank. The following sale forecasts have been made for 2024 and

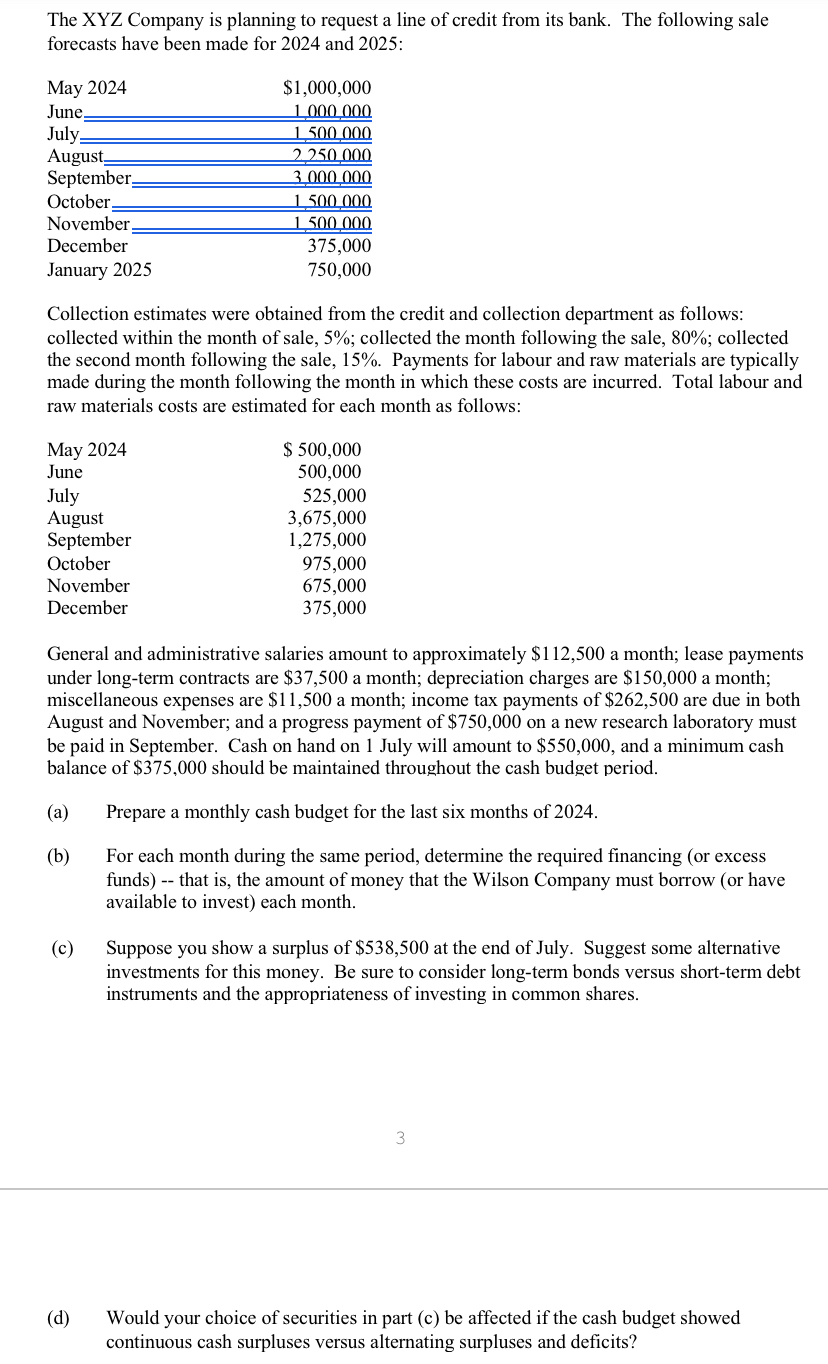

The XYZ Company is planning to request a line of credit from its bank. The following sale forecasts have been made for 2024 and 2025: May 2024 June July August September October. November $1,000,000 1,000,000 1,500,000 2250,000 3,000,000 1,500,000 1.500.000 December January 2025 375,000 750,000 Collection estimates were obtained from the credit and collection department as follows: collected within the month of sale, 5%; collected the month following the sale, 80%; collected the second month following the sale, 15%. Payments for labour and raw materials are typically made during the month following the month in which these costs are incurred. Total labour and raw materials costs are estimated for each month as follows: May 2024 June July August September October November $ 500,000 500,000 525,000 3,675,000 1,275,000 975,000 675,000 December 375,000 General and administrative salaries amount to approximately $112,500 a month; lease payments under long-term contracts are $37,500 a month; depreciation charges are $150,000 a month; miscellaneous expenses are $11,500 a month; income tax payments of $262,500 are due in both August and November; and a progress payment of $750,000 on a new research laboratory must be paid in September. Cash on hand on 1 July will amount to $550,000, and a minimum cash balance of $375,000 should be maintained throughout the cash budget period. (a) (b) (c) Prepare a monthly cash budget for the last six months of 2024. For each month during the same period, determine the required financing (or excess funds) -- that is, the amount of money that the Wilson Company must borrow (or have available to invest) each month. Suppose you show a surplus of $538,500 at the end of July. Suggest some alternative investments for this money. Be sure to consider long-term bonds versus short-term debt instruments and the appropriateness of investing in common shares. (d) 3 Would your choice of securities in part (c) be affected if the cash budget showed continuous cash surpluses versus alternating surpluses and deficits?

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

XYZ Company Cash Budget for July December 2024 July Item Amount Cash receipts from sales May sales 50000 June sales 1200000 Total cash receipts 125000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started