Answered step by step

Verified Expert Solution

Question

1 Approved Answer

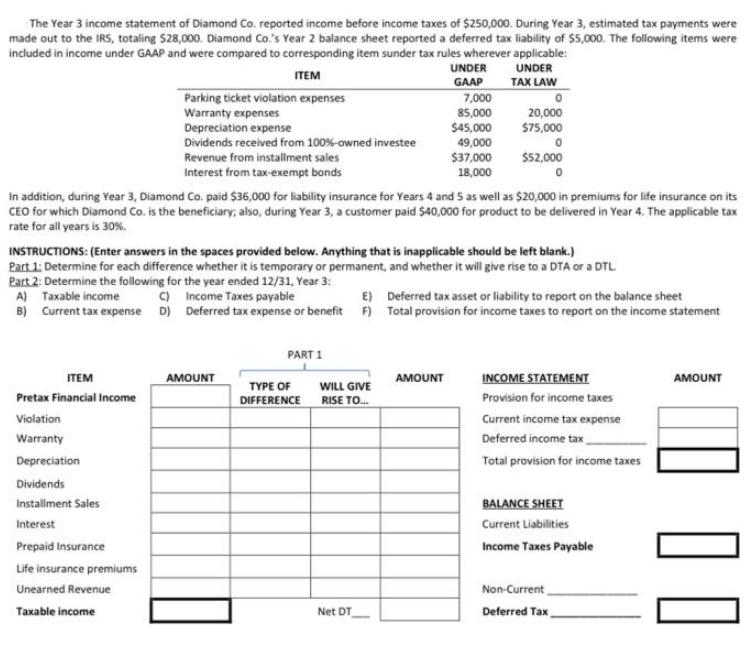

The Year 3 income statement of Diamond Co. reported income before income taxes of $250,000. During Year 3, estimated tax payments were made out

The Year 3 income statement of Diamond Co. reported income before income taxes of $250,000. During Year 3, estimated tax payments were made out to the IRS, totaling $28,000. Diamond Co.'s Year 2 balance sheet reported a deferred tax liability of $5,000. The following items were included in income under GAAP and were compared to corresponding item sunder tax rules wherever applicable: ITEM UNDER TAX LAW A) Taxable income B) Current tax expense D) Parking ticket violation expenses Warranty expenses ITEM Pretax Financial Income Violation Warranty Depreciation Dividends Installment Sales Interest Prepaid Insurance Life insurance premiums Depreciation expense Dividends received from 100%-owned investee Revenue from installment sales Interest from tax-exempt bonds Unearned Revenue Taxable income In addition, during Year 3, Diamond Co. paid $36,000 for liability insurance for Years 4 and 5 as well as $20,000 in premiums for life insurance on its CEO for which Diamond Co. is the beneficiary; also, during Year 3, a customer paid $40,000 for product to be delivered in Year 4. The applicable tax rate for all years is 30%. INSTRUCTIONS: (Enter answers in the spaces provided below. Anything that is inapplicable should be left blank.) Part 1: Determine for each difference whether it is temporary or permanent, and whether it will give rise to a DTA or a DTL Part 2: Determine the following for the year ended 12/31, Year 3: C) Income Taxes payable Deferred tax expense or benefit F) AMOUNT PART 1 TYPE OF DIFFERENCE UNDER GAAP WILL GIVE RISE TO... Net DT 7,000 85,000 $45,000 49,000 $37,000 18,000 AMOUNT 0 20,000 $75,000 $52,000 E) Deferred tax asset or liability to report on the balance sheet Total provision for income taxes to report on the income statement INCOME STATEMENT Provision for income taxes Current income tax expense Deferred income tax Total provision for income taxes BALANCE SHEET Current Liabilities Income Taxes Payable Non-Current Deferred Tax AMOUNT

Step by Step Solution

★★★★★

3.47 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started