Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Yellow Bird Company currently has good earnings and a capital structure that is 20% debt. Its EPS is in the upper quarter of firms

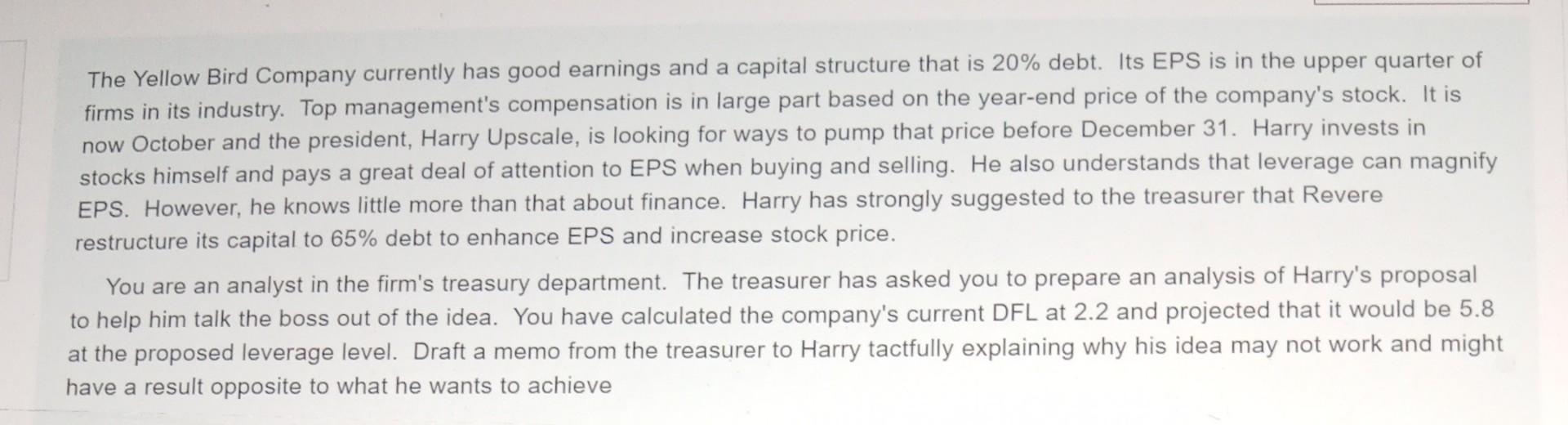

The Yellow Bird Company currently has good earnings and a capital structure that is 20% debt. Its EPS is in the upper quarter of firms in its industry. Top management's compensation is in large part based on the year-end price of the company's stock. It is now October and the president, Harry Upscale, is looking for ways to pump that price before December 31. Harry invests in stocks himself and pays a great deal of attention to EPS when buying and selling. He also understands that leverage can magnify EPS. However, he knows little more than that about finance. Harry has strongly suggested to the treasurer that Revere restructure its capital to 65% debt to enhance EPS and increase stock price. You are an analyst in the firm's treasury department. The treasurer has asked you to prepare an analysis of Harry's proposal to help him talk the boss out of the idea. You have calculated the company's current DFL at 2.2 and projected that it would be 5.8 at the proposed leverage level. Draft a memo from the treasurer to Harry tactfully explaining why his idea may not work and might have a result opposite to what he wants to achieve The Yellow Bird Company currently has good earnings and a capital structure that is 20% debt. Its EPS is in the upper quarter of firms in its industry. Top management's compensation is in large part based on the year-end price of the company's stock. It is now October and the president, Harry Upscale, is looking for ways to pump that price before December 31. Harry invests in stocks himself and pays a great deal of attention to EPS when buying and selling. He also understands that leverage can magnify EPS. However, he knows little more than that about finance. Harry has strongly suggested to the treasurer that Revere restructure its capital to 65% debt to enhance EPS and increase stock price. You are an analyst in the firm's treasury department. The treasurer has asked you to prepare an analysis of Harry's proposal to help him talk the boss out of the idea. You have calculated the company's current DFL at 2.2 and projected that it would be 5.8 at the proposed leverage level. Draft a memo from the treasurer to Harry tactfully explaining why his idea may not work and might have a result opposite to what he wants to achieve

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started