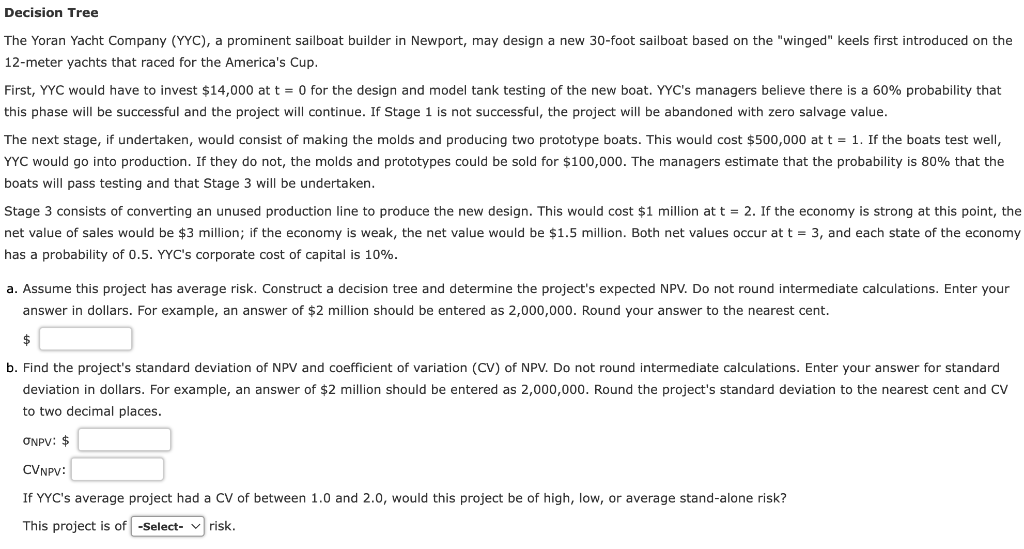

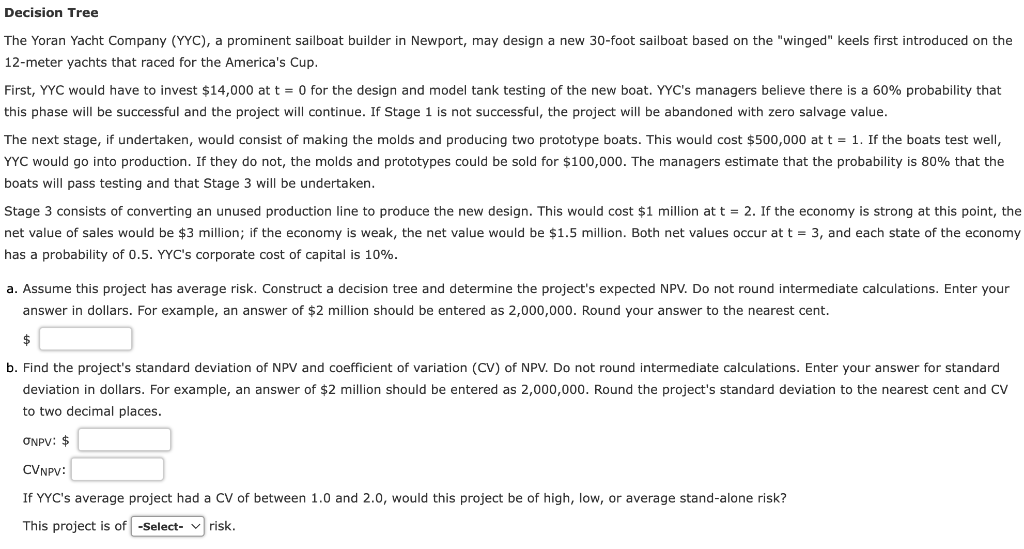

The Yoran Yacht Company (YYC), a prominent sailboat builder in Newport, may design a new 30-foot sailboat based on the "winged" keels first introduced on the 12-meter yachts that raced for the America's Cup. this phase will be successful and the project will continue. If Stage 1 is not successful, the project will be abandoned with zero salvage value The next stage, if undertaken, would consist of making the molds and producing two prototy YYC would go into production. If they do not, the molds and prototypes could be sold for $100,000. The managers estimate that the probability is 80% that the boats will pass testing and that Stage 3 will be undertaken. has a probability of 0.5. YYC's corporate cost of capital is 10%. a. Assume this project has average risk. Construct a decision tree and determine the project's expected NPV. Do not round intermedions answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest cent. $ b. Find the project's standard deviation of NPV and coefficient of variation (CV) of NPV. Do not round intermediate calch to two decimal places. CVNPV: If YYC's average project had a CV of between 1.0 and 2.0, would this project be of high, low, or average stand-alone risk? This project is of risk. The Yoran Yacht Company (YYC), a prominent sailboat builder in Newport, may design a new 30-foot sailboat based on the "winged" keels first introduced on the 12-meter yachts that raced for the America's Cup. this phase will be successful and the project will continue. If Stage 1 is not successful, the project will be abandoned with zero salvage value The next stage, if undertaken, would consist of making the molds and producing two prototy YYC would go into production. If they do not, the molds and prototypes could be sold for $100,000. The managers estimate that the probability is 80% that the boats will pass testing and that Stage 3 will be undertaken. has a probability of 0.5. YYC's corporate cost of capital is 10%. a. Assume this project has average risk. Construct a decision tree and determine the project's expected NPV. Do not round intermedions answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest cent. $ b. Find the project's standard deviation of NPV and coefficient of variation (CV) of NPV. Do not round intermediate calch to two decimal places. CVNPV: If YYC's average project had a CV of between 1.0 and 2.0, would this project be of high, low, or average stand-alone risk? This project is of risk