Answered step by step

Verified Expert Solution

Question

1 Approved Answer

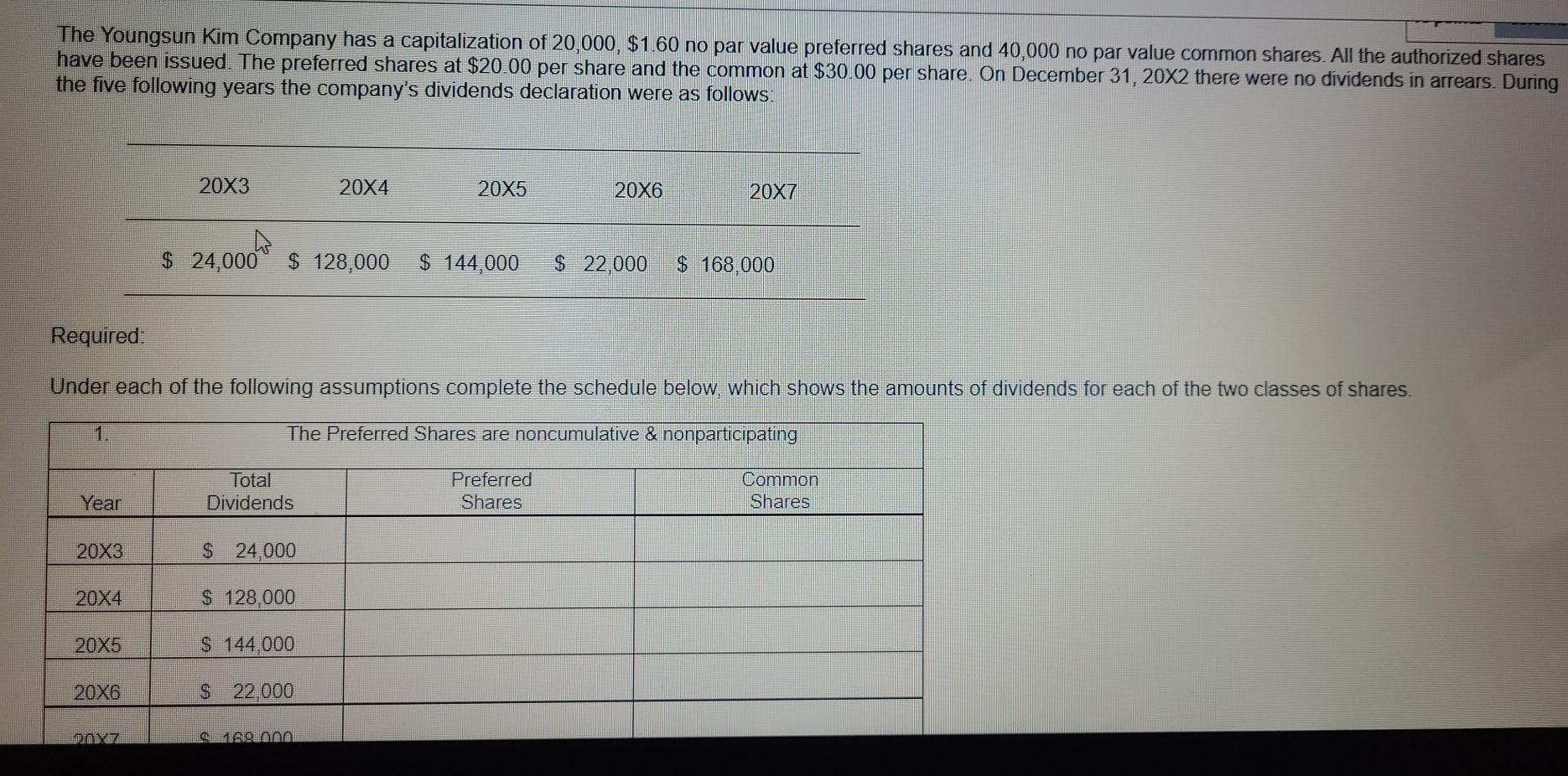

The Youngsun Kim Company has a capitalization of 20,000, $1.60 no par value preferred shares and 40,000 no par value common shares. All the

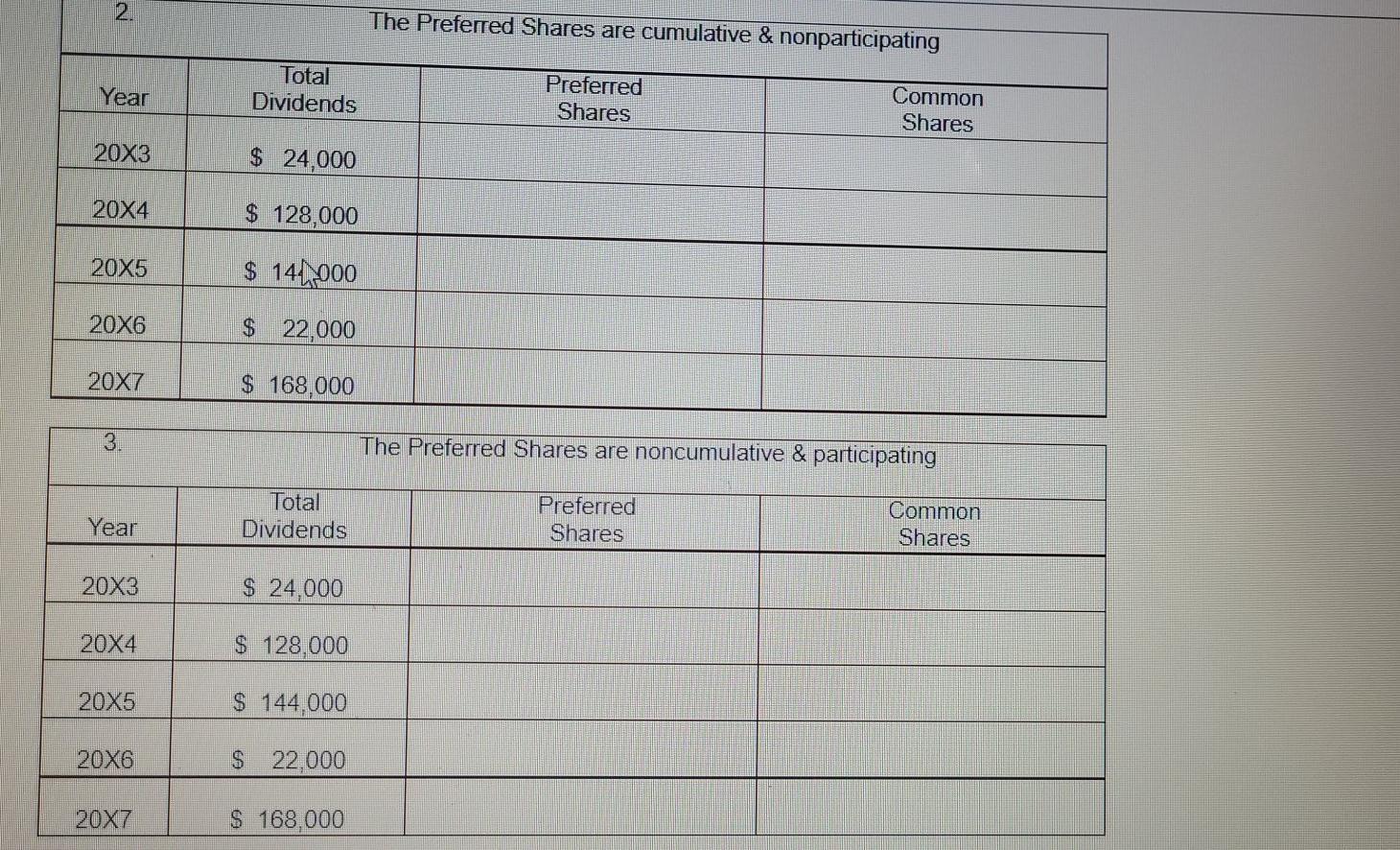

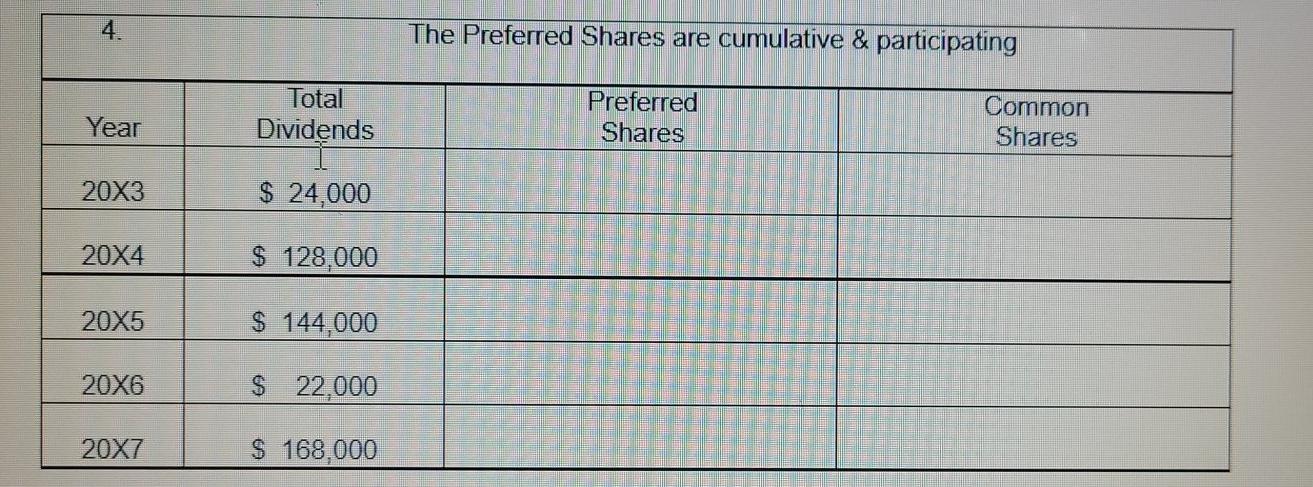

The Youngsun Kim Company has a capitalization of 20,000, $1.60 no par value preferred shares and 40,000 no par value common shares. All the authorized shares have been issued. The preferred shares at $20.00 per share and the common at $30.00 per share. On December 31, 20X2 there were no dividends in arrears. During the five following years the company's dividends declaration were as follows: 20X3 20X4 20X5 20X6 20X7 $24,000 $ 128,000 $ 144,000 $22,000 $ 168,000 Required. Under each of the following assumptions complete the schedule below, which sh the amounts of dividends for each two classes of shares. 1. The Preferred Shares are noncumulative & nonparticipating Common Shares Total Preferred Year Dividends Shares 20X3 $ 24,000 20X4 $ 128,000 20X5 S 144,000 20X6 S 22 000 9168 00O 2. The Preferred Shares are cumulative & nonparticipating Total Dividends Preferred Year Common Shares Shares 20X3 $24 ,000 20X4 $ 128,000 20X5 $ 14,000 20X6 $2,000 20X7 $ 168,000 3. The Preferred Shares are noncumulative & participating Total Dividends Preferred Shares Common Shares Year 20X3 $ 24,000 20X4 $ 128,000 20X5 $ 144,000 20X6 $ 22,000 20X7 $ 168,000 4. The Preferred Shares are cumulative & participating Total Preferred Shares Common Shares Year Dividends 20X3 $ 24,000 20X4 $ 128,000 20X5 $ 144,000 20X6 $2,000 20X7 $ 168,000

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A In case of non cumulative preferred stock company will pay only current year divided to preferred ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started