Bob owns and operates a mechanics workshop. During the year ended 30 June 2021 he incurred the following expenditure: 15 July 2020 1 December

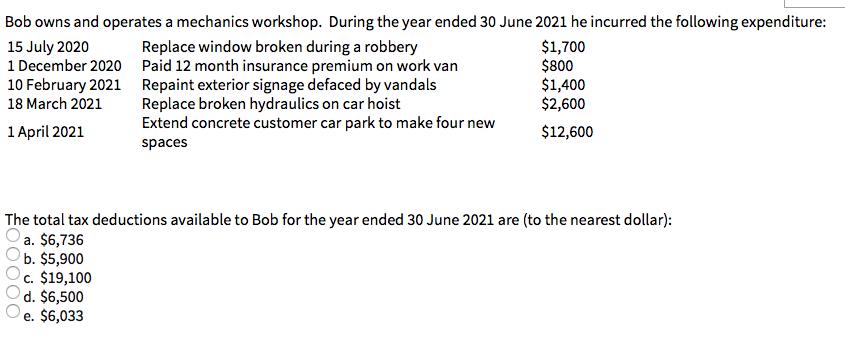

Bob owns and operates a mechanics workshop. During the year ended 30 June 2021 he incurred the following expenditure: 15 July 2020 1 December 2020 10 February 2021 18 March 2021 1 April 2021 Replace window broken during a robbery Paid 12 month insurance premium on work van Repaint exterior signage defaced by vandals Replace broken hydraulics on car hoist Extend concrete customer car park to make four new spaces c. $19,100 d. $6,500 e. $6,033 $1,700 $800 $1,400 $2,600 $12,600 The total tax deductions available to Bob for the year ended 30 June 2021 are (to the nearest dollar): a. $6,736 b. $5,900

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer d 6500 The total tax deductions available to Bob for the year end...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started