Answered step by step

Verified Expert Solution

Question

1 Approved Answer

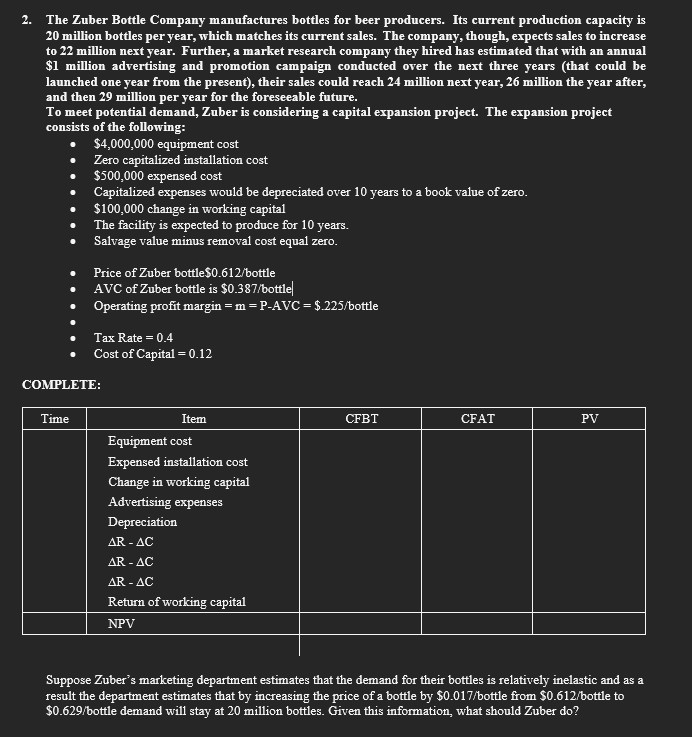

The Zuber Bottle Company manufactures bottles for beer producers. Its current production capacity is 2 0 million bottles per year, which matches its current sales.

The Zuber Bottle Company manufactures bottles for beer producers. Its current production capacity is

million bottles per year, which matches its current sales. The company, though, expects sales to increase

to million next year. Further, a market research company they hired has estimated that with an annual

$ million advertising and promotion campaign conducted over the next three years that could be

launched one year from the present their sales could reach million next year, million the year after,

and then million per year for the foreseeable future.

To meet potential demand, Zuber is considering a capital expansion project. The expansion project

consists of the following:

$ equipment cost

Zero capitalized installation cost

$ expensed cost

Capitalized expenses would be depreciated over years to a book value of zero.

$ change in working capital

The facility is expected to produce for years.

Salvage value minus removal cost equal zero.

Price of Zuber bottle $bottle

AVC of Zuber bottle is $ bottle

Operating profit margin AVC$ bottle

Tax Rate

Cost of Capital

COMPLETE:

Suppose Zuber's marketing department estimates that the demand for their bottles is relatively inelastic and as a

result the department estimates that by increasing the price of a bottle by $ bottle from $ bottle to

$ bottle demand will stay at million bottles. Given this information, what should Zuber do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started