Answered step by step

Verified Expert Solution

Question

1 Approved Answer

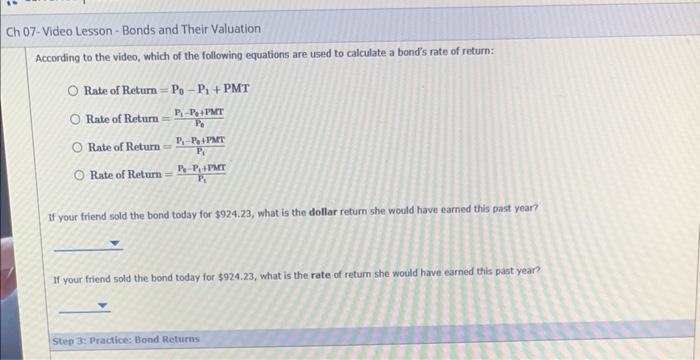

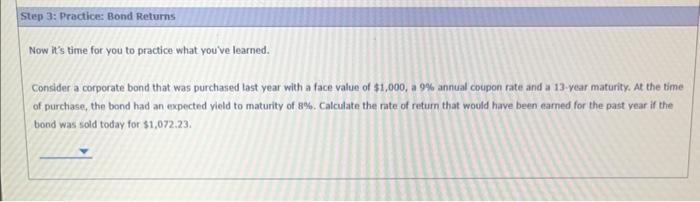

Their Valuation Step 1: Quick Take: Bond Returns When a coupon bond is issued, the coupon is generally set at a level that causes

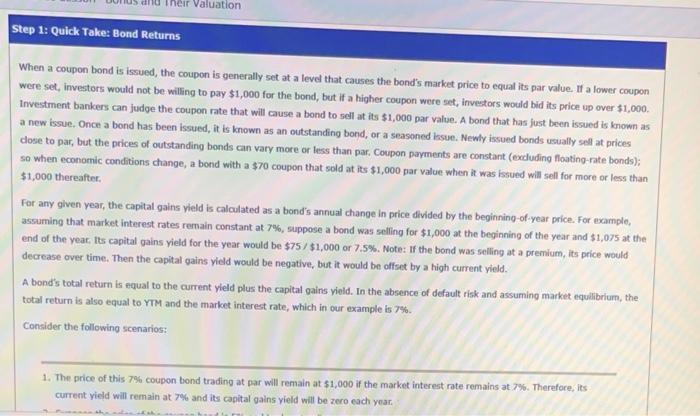

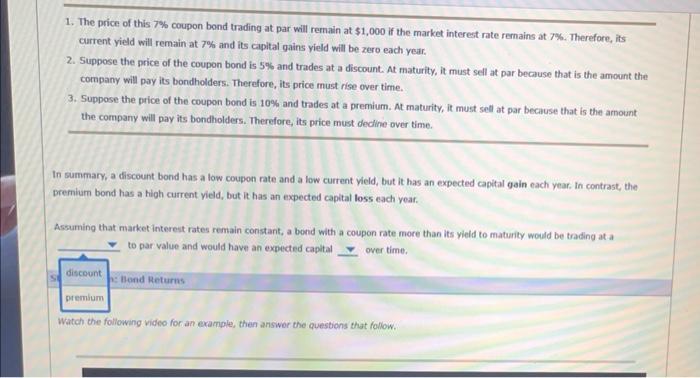

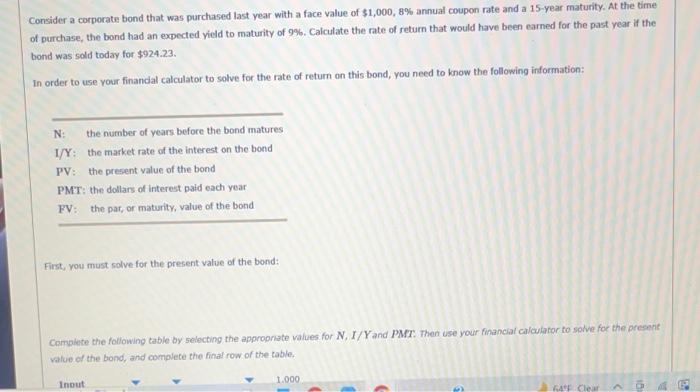

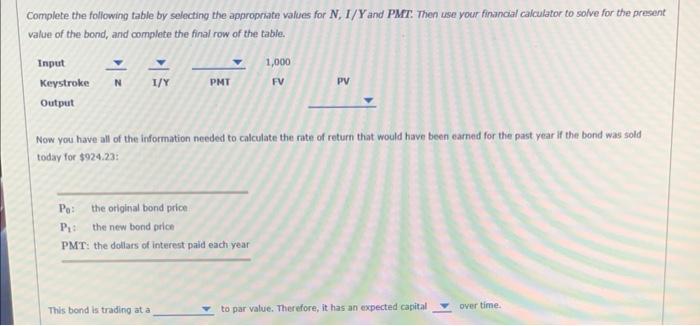

Their Valuation Step 1: Quick Take: Bond Returns When a coupon bond is issued, the coupon is generally set at a level that causes the bond's market price to equal its par value. If a lower coupon were set, investors would not be willing to pay $1,000 for the bond, but if a higher coupon were set, investors would bid its price up over $1,000. Investment bankers can judge the coupon rate that will cause a bond to sell at its $1,000 par value. A bond that has just been issued is known as a new issue. Once a bond has been issued, it is known as an outstanding bond, or a seasoned issue. Newly issued bonds usually sell at prices close to par, but the prices of outstanding bonds can vary more or less than par. Coupon payments are constant (excluding floating-rate bonds); so when economic conditions change, a bond with a $70 coupon that sold at its $1,000 par value when it was issued will sell for more or less than $1,000 thereafter. For any given year, the capital gains yield is calculated as a bond's annual change in price divided by the beginning-of-year price. For example, assuming that market interest rates remain constant at 7%, suppose a bond was selling for $1,000 at the beginning of the year and $1,075 at the end of the year. Its capital gains yield for the year would be $75/$1,000 or 7.5%. Note: If the bond was selling at a premium, its price would decrease over time. Then the capital gains yield would be negative, but it would be offset by a high current yield. A bond's total return is equal to the current yield plus the capital gains yield. In the absence of default risk and assuming market equilibrium, the total return is also equal to YTM and the market interest rate, which in our example is 7%. Consider the following scenarios: 1. The price of this 7% coupon bond trading at par will remain at $1,000 if the market interest rate remains at 7%. Therefore, its current yield will remain at 7% and its capital gains yield will be zero each year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started