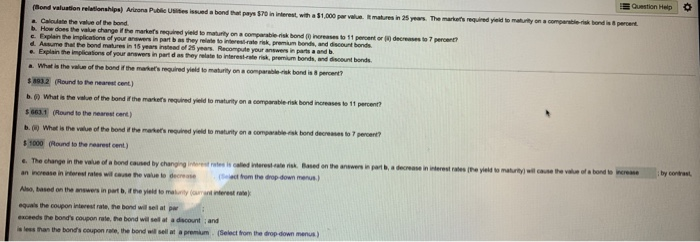

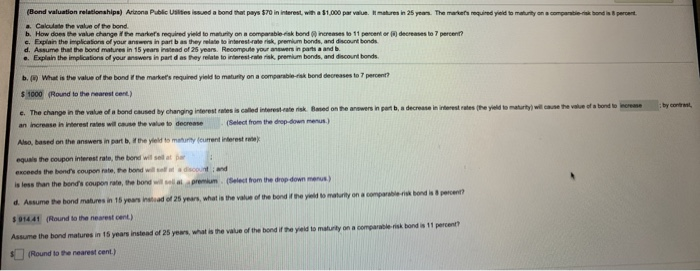

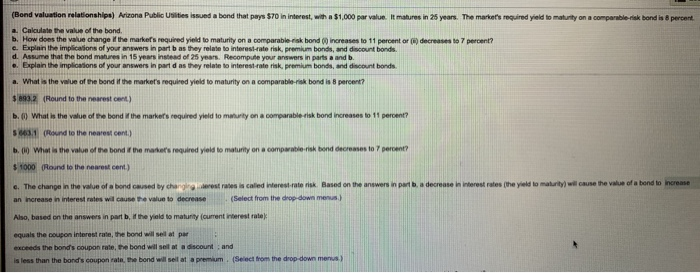

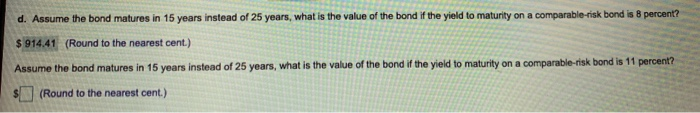

Thema 's required yield to muy on com b ond is per per hond alone on Public U d abond in with a $1,000 per matures in C e the value of the band How does the value change the marker's required yield to matarly on a comparable bondinerses to 11 p o r deres c. Explain the implications of your awes in part there to remin bond and court bonds me that the end 15 of Reco r d .. Explan the your win part d e bonds count bonds What is the w e of the band of the man's required lado matury on a comparable bond is 8 percent? $1932 Round to the nearest cent) 3 Pound to the nearest cert) b. What is the value of the bond the mate's red do meurty on a com b ond decreto pet? The change in the value of bond caused by changing an increase in forest rates will cause the value to decrease wireless based on the answer from the drop down menus) d the coupon investrate the bond wil lat po exceeds the band's upon rate the bond wil a discount and d yield to may on a comparte hond is percent (Bond valuation relationships) Arrona Public U i ssued a bond that pays $70 in interest with a $1.000 par value. hures in 25 years. The matase a. Calculate the value of the bond b. How does the value change the marker's required yield to matarly on a comparable bondinereases i 11 percent or decreases to 7 percent? c. Explain the implications of your answers in part as they relate to interest rate risk, premium bonds, and discount bonds d. Assume that the bond matures in 15 years whead of 25 years. Recompute your answers in parts and be .. Explain the implications of your answers in part d as they relate to interest premium bonds, and discount bonds to mainty on a comparable-ribond decreases to 7 percent? b. What is the value of the bond the market's required $ 1000 (Round to the nearest cent) e. The change in the value of a bond caused by changing interest rates is called interesaterik. Based on the war in portb, a decrease in rest an increase interest rates will cause the value to decrease Select from the drop-down menus) Also, based on the answers in part, the yield to maturity current interest equals the coupon interest rate, the bond wil selat : exceeds the band's coupers rate, the band will discount and is less than the band's coupon rate the bond will premium. (Select from the drop down menus d. Assume the hond matures in 15 years instead of 25 years, what is the value of the bond they maturity on a compartenbond is 8 percent? $ 1441 (Pound to the newest cent) Assume the hond matures in 15 years instead of 25 years, what is the value of the bond if the yed to matur a comparable risk bondi 11 percent $ (Round to the nearest cent.) (Bond valuation relationships) Arizona Public Ulities issued a bond that pays $70 in interest, with a $1,000 par value. It makes in 25 years. The market's required yield to maturity on a comparable-risk bond is 8 percent a. Calculate the value of the bond. b. How does the value change the marker's required yield to maturity on a comparable risk bond increases to 11 percent or (b) decreases to 7 percent? c. Explain the implications of your answers in part b as they relate to interest rate risk, premium bonds, and discount bonds d. Assume that the bond mares in 15 years instead of 25 years. Recompute your answers in parts a and b. Explain the implications of your answers in part d as they relate to interest rate risk, premium bonds, and discount bonds What is the value of the band of the market's required yield to maturity on a comparable risk bond is 8 percent? 5. What is the value of the bond the marker's required yield to maluty on a comparable-risk bond increases to 11 percent 56431 Round to the nearest cent) 6. What is the value of the bond the master's required yield to maturity on a comparisonder s to per $1000 (Round to the newest cent) crease in interest rates (the yield to maturity will cause c. The change in the value of a bond caused by chang e stres is called interest rate risk Based on the answers in an increase in interest rates will cause the value to decrease Select from the drop down menus) Also, based on the answers in part, the old to maturity current interest rate equals the coupon Interest rate, the bond will sell at par exceeds the bonds coupon rate, the bond will set at a discount and is less than the band's coupon rate the bond will sell at a premium Select from the drop down menus) d. Assume the bond matures in 15 years instead of 25 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 8 percent? $ 914.41 (Round to the nearest cent.) Assume the bond matures in 15 years instead of 25 years, what is the value of the bond if the yield to maturity on a comparable-risk bond is 11 percent? (Round to the nearest cent.)