Answered step by step

Verified Expert Solution

Question

1 Approved Answer

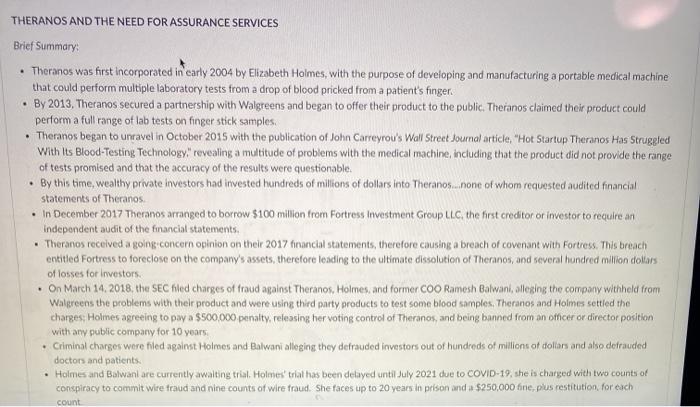

THERANOS AND THE NEED FOR ASSURANCE SERVICES Brief Summary: Theranos was first incorporated in early 2004 by Elizabeth Holmes, with the purpose of developing

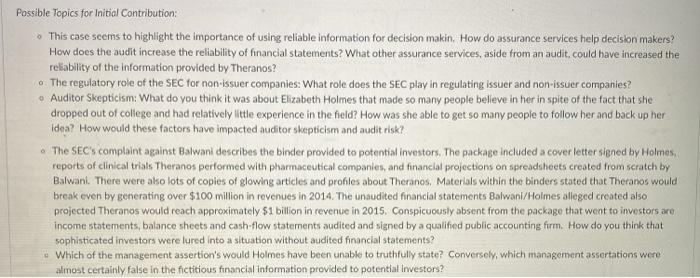

THERANOS AND THE NEED FOR ASSURANCE SERVICES Brief Summary: Theranos was first incorporated in early 2004 by Elizabeth Holmes, with the purpose of developing and manufacturing a portable medical machine that could perform multiple laboratory tests from a drop of blood pricked from a patient's finger. . By 2013, Theranos secured a partnership with Walgreens and began to offer their product to the public. Theranos claimed their product could perform a full range of lab tests on finger stick samples. Theranos began to unravel in October 2015 with the publication of John Carreyrou's Wall Street Journal article, "Hot Startup Theranos Has Struggled With Its Blood-Testing Technology," revealing a multitude of problems with the medical machine, including that the product did not provide the range of tests promised and that the accuracy of the results were questionable. . By this time, wealthy private investors had invested hundreds of millions of dollars into Theranos...none of whom requested audited financial statements of Theranos. In December 2017 Theranos arranged to borrow $100 million from Fortress Investment Group LLC, the first creditor or investor to require an independent audit of the financial statements. Theranos received a going concern opinion on their 2017 financial statements, therefore causing a breach of covenant with Fortress. This breach entitled Fortress to foreclose on the company's assets, therefore leading to the ultimate dissolution of Theranos, and several hundred million dollars of losses for investors. On March 14, 2018, the SEC filed charges of fraud against Theranos, Holmes, and former COO Ramesh Balwani, alleging the company withheld from Walgreens the problems with their product and were using third party products to test some blood samples. Theranos and Holmes settled the charges; Holmes agreeing to pay a $500,000 penalty, releasing her voting control of Theranos, and being banned from an officer or director position with any public company for 10 years. Criminal charges were filed against Holmes and Balwani alleging they defrauded investors out of hundreds of millions of dollars and also defrauded doctors and patients. Holmes and Balwani are currently awaiting trial. Holmes' trial has been delayed until July 2021 due to COVID-19, she is charged with two counts of conspiracy to commit wire fraud and nine counts of wire fraud. She faces up to 20 years in prison and a $250,000 fine, plus restitution, for each count Possible Topics for Initial Contribution: This case seems to highlight the importance of using reliable information for decision makin. How do assurance services help decision makers? How does the audit increase the reliability of financial statements? What other assurance services, aside from an audit, could have increased the reliability of the information provided by Theranos? The regulatory role of the SEC for non-issuer companies: What role does the SEC play in regulating issuer and non-issuer companies? Auditor Skepticism: What do you think it was about Elizabeth Holmes that made so many people believe in her in spite of the fact that she dropped out of college and had relatively little experience in the field? How was she able to get so many people to follow her and back up her idea? How would these factors have impacted auditor skepticism and audit risk? The SEC's complaint against Balwani describes the binder provided to potential investors. The package included a cover letter signed by Holmes, reports of clinical trials Theranos performed with pharmaceutical companies, and financial projections on spreadsheets created from scratch by Balwani. There were also lots of copies of glowing articles and profiles about Theranos. Materials within the binders stated that Theranos would break even by generating over $100 million in revenues in 2014. The unaudited financial statements Balwani/Holmes alleged created also projected Theranos would reach approximately $1 billion in revenue in 2015. Conspicuously absent from the package that went to investors are income statements, balance sheets and cash-flow statements audited and signed by a qualified public accounting firm. How do you think that sophisticated investors were lured into a situation without audited financial statements? Which of the management assertion's would Holmes have been unable to truthfully state? Conversely, which management assertations were almost certainly false in the fictitious financial information provided to potential investors?

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

REQUIREMENT 1 Assurance services help decisionmakers by providing them with reliable information that has been independently verified This information can help decisionmakers make informed decisions a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started