Answered step by step

Verified Expert Solution

Question

1 Approved Answer

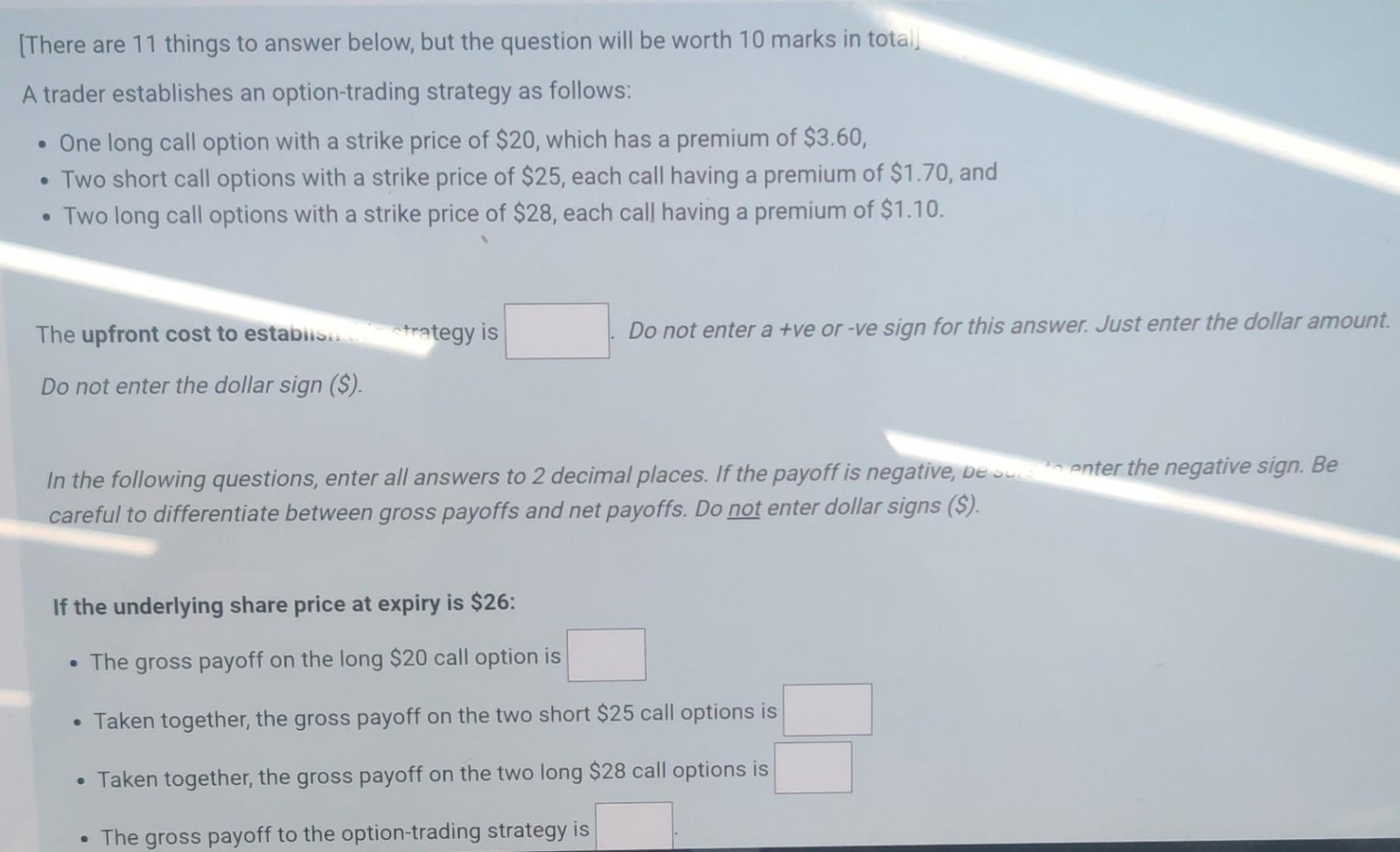

(There are 11 things to answer below, but the question will be worth 10 marks in totall A trader establishes an option-trading strategy as follows:

(There are 11 things to answer below, but the question will be worth 10 marks in totall A trader establishes an option-trading strategy as follows: One long call option with a strike price of $20, which has a premium of $3.60, Two short call options with a strike price of $25, each call having a premium of $1.70, and Two long call options with a strike price of $28, each call having a premium of $1.10. The upfront cost to establisu strategy is Do not enter a +ve or -ve sign for this answer. Just enter the dollar amount. Do not enter the dollar sign ($). In the following questions, enter all answers to 2 decimal places. If the payoff is negative, be sure to enter the negative sign. Be careful to differentiate between gross payoffs and net payoffs. Do not enter dollar signs ($). If the underlying share price at expiry is $26: The gross payoff on the long $20 call option is Taken together, the gross payoff on the two short $25 call options is Taken together, the gross payoff on the two long $28 call options is The gross payoff to the option-trading strategy is (There are 11 things to answer below, but the question will be worth 10 marks in totall A trader establishes an option-trading strategy as follows: One long call option with a strike price of $20, which has a premium of $3.60, Two short call options with a strike price of $25, each call having a premium of $1.70, and Two long call options with a strike price of $28, each call having a premium of $1.10. The upfront cost to establisu strategy is Do not enter a +ve or -ve sign for this answer. Just enter the dollar amount. Do not enter the dollar sign ($). In the following questions, enter all answers to 2 decimal places. If the payoff is negative, be sure to enter the negative sign. Be careful to differentiate between gross payoffs and net payoffs. Do not enter dollar signs ($). If the underlying share price at expiry is $26: The gross payoff on the long $20 call option is Taken together, the gross payoff on the two short $25 call options is Taken together, the gross payoff on the two long $28 call options is The gross payoff to the option-trading strategy is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started