Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are 19 problems. Please answer all 19. The answer is already given in the brackets of each question. Please give step-by-step solution to each

There are 19 problems. Please answer all 19. The answer is already given in the brackets of each question. Please give step-by-step solution to each one. Thank you!

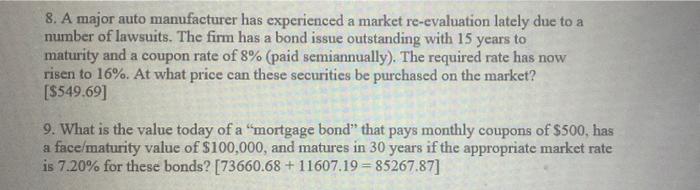

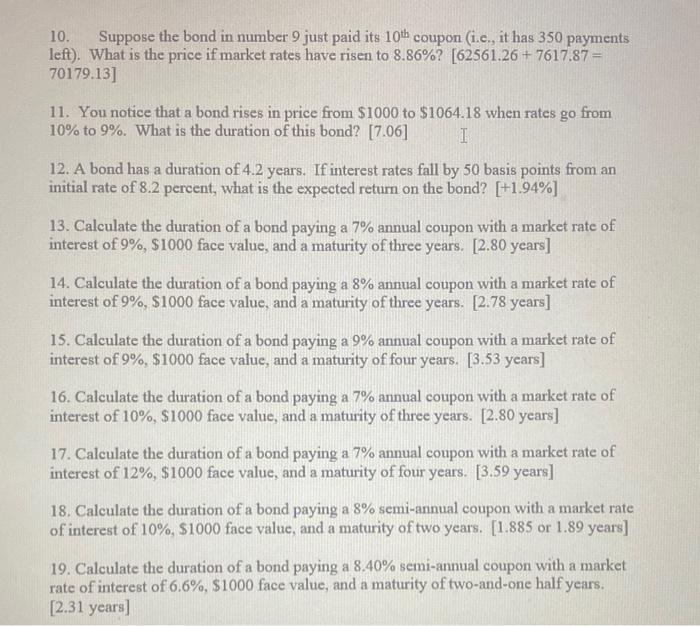

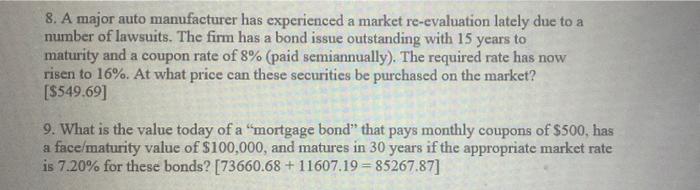

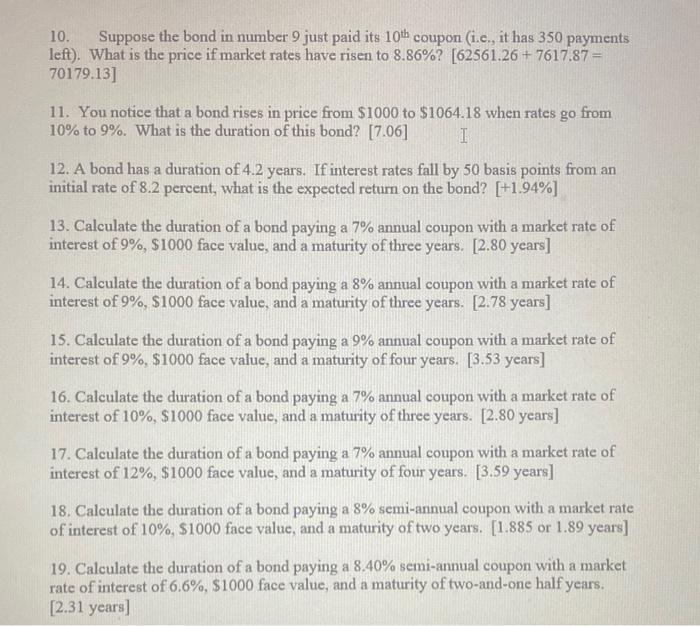

1. UM bonds pay an annual coupon rate of 10%. They have 8 years before maturity. The maturity value is $1,000. The yield to maturity (market interest rate) on this class of bonds is 10%. Determine the price of these bonds. [ $1,000] 2. What is the value of a government bond that pays semiannual payments of $50 (coupon rate of 10% ) and has a maturity value of $1,000 if the annual market interest rate is 12% and the bond has 20 years until maturity? [ $849.53 ] 3 The Banzai Auto Company has experienced a market re-evaluation lately due to a number of lawsuits. The firm has a bond issue outstanding with 15 years to maturity and a coupon rate of 8% (paid semiannually). The required rate has now risen to 12.25%. At what price can these securities be purchased on the market? [\$ 711.37] 4. Liddy Corporation has bonds that pay an annual coupon rate of 8% and a maturity value of $1,000. The yield on comparable new bonds is 9.5%. The bonds have 7 years before they mature. Determine the value of one of Liddy's bonds. [\$925.76] 5. Hamblin Inc. has bonds that pay a coupon rate of 11% and a maturity value of $1,000. The yield in the market for this risk class of bonds is 10.5%. The bonds have 18 years before maturity. How much would one Hamblin bond be worth in the market? [$1,039.73] 6. Adeline Corporation just issued a zero coupon bond with a life of 15 years. The face value of these bonds is $100,000 and the market rate is 9.6%. What would be the price of these bonds? {25,283.76] 7. You are the owner of 100 bonds issued by Georgia Corporation. These bonds have 8 years remaining to maturity, an annual coupon payment of $80, and a par value of S1,000. Unfortunately, Georgia Corp. is on the brink of bankruptcy, and the creditors, including yourself, have agreed to a postponement of the next 4 interest payments. The remaining interest payments will be made as scheduled. The postponed payments will accrue interest at an annual rate of 6% and will be paid as a lump sum at maturity 8 years hence. The required rate of return on these bonds, considering their substantial risk, is now 28%. What is the present value of each bond? [\$266.88] 8. A major auto manufacturer has experienced a market re-evaluation lately due to a number of lawsuits. The firm has a bond issue outstanding with 15 years to maturity and a coupon rate of 8% (paid semiannually). The required rate has now risen to 16%. At what price can these securities be purchased on the market? [$549.69] 9. What is the value today of a "mortgage bond" that pays monthly coupons of $500, has a face/maturity value of $100,000, and matures in 30 years if the appropriate market rate is 7.20% for these bonds? [73660.68+11607.19=85267.87] 10. Suppose the bond in number 9 just paid its 10th coupon (i.e., it has 350 payments left). What is the price if market rates have risen to 8.86% ? [62561.26+7617.87= 70179.13] 11. You notice that a bond rises in price from $1000 to $1064.18 when rates go from 10% to 9%. What is the duration of this bond? [7.06] 12. A bond has a duration of 4.2 years. If interest rates fall by 50 basis points from an initial rate of 8.2 percent, what is the expected return on the bond? [+1.94%] 13. Calculate the duration of a bond paying a 7% annual coupon with a market rate of interest of 9%,$1000 face value, and a maturity of three years. [2.80 years] 14. Calculate the duration of a bond paying a 8% annual coupon with a market rate of interest of 9%,$1000 face value, and a maturity of three years. [2.78 years] 15. Calculate the duration of a bond paying a 9% annual coupon with a market rate of interest of 9%,$1000 face value, and a maturity of four years. [3.53 years] 16. Calculate the duration of a bond paying a 7% annual coupon with a market rate of interest of 10%,$1000 face value, and a maturity of three years. [2.80 years] 17. Calculate the duration of a bond paying a 7% annual coupon with a market rate of interest of 12%,$1000 face value, and a maturity of four years. [3.59 years] 18. Calculate the duration of a bond paying a 8% semi-annual coupon with a market rate of interest of 10%,$1000 face value, and a maturity of two years. [1.885 or 1.89 years] 19. Calculate the duration of a bond paying a 8.40% semi-annual coupon with a market rate of interest of 6.6%,$1000 face value, and a maturity of two-and-one half years. [2.31 years]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started