Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are 2 small questions below about how to revise annuity to annuity due. The first one is to calculate the PV, the second one

There are 2 small questions below about how to revise annuity to annuity due. The first one is to calculate the PV, the second one is to calculate the PMT. However, what makes me confused is in the first question, we times(1+r), but in the second question, the solution says we should divide by(1+r). Why there is such a difference?

Please provide the answer as well as the detailed explanation, thank you very much

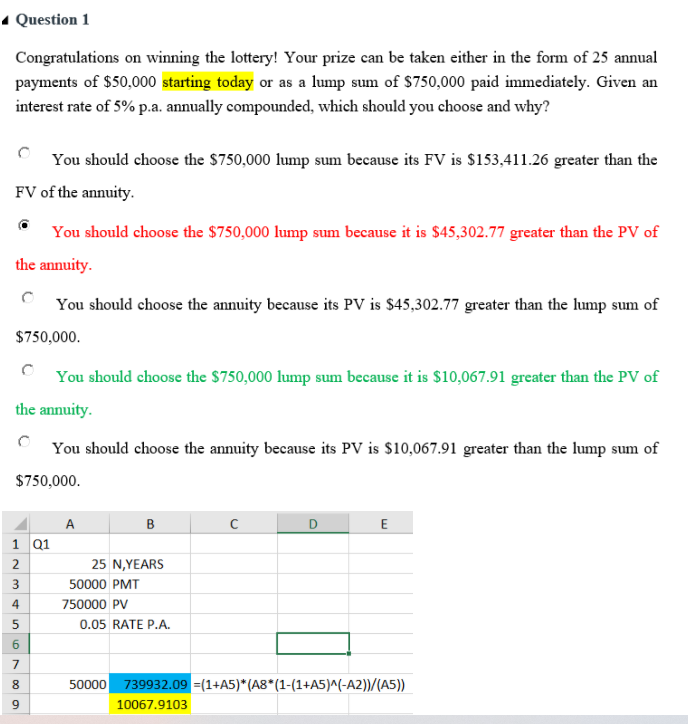

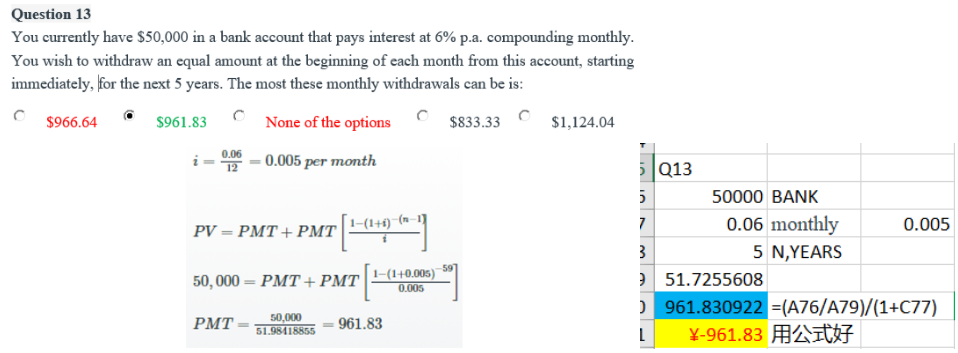

Question 1 Congratulations on winning the lottery! Your prize can be taken either in the form of 25 annual payments of $50,000 starting today or as a lump sum of $750,000 paid immediately. Given an interest rate of 5% p.a. annually compounded, which should you choose and why? You should choose the $750,000 lump sum because its FV is $153,411.26 greater than the FV of the annuity. You should choose the $750,000 lump sum because it is $45,302.77 greater than the PV of the annuity. You should choose the annuity because its PV is $45,302.77 greater than the lump sum of $750,000. You should choose the $750,000 lump sum because it is $10,067.91 greater than the PV of the annuity You should choose the annuity because its PV is $10,067.91 greater than the lump sum of $750,000. A B D E 1 01 2 3 25 N YEARS 50000 PMT 750000 PV 0.05 RATE P.A. 4 5 6 7 8 50000 739932.09 =(1+A5)* (A8*(1-(1+A5)^(-A2))/(A5)) 10067.9103 9 $966.64 0.06 12 Question 13 You currently have $50,000 in a bank account that pays interest at 6% p.a. compounding monthly. You wish to withdraw an equal amount at the beginning of each month from this account, starting immediately, for the next 5 years. The most these monthly withdrawals can be is: $961.83 None of the options $833.33 $1,124.04 i -0.005 per month 5013 5 50000 BANK PI 1-(1+1) 7 0.06 monthly 0.005 3 5 N,YEARS 50,000 = PMT +PMT 1-(1+0.005) 7 51.7255608 ) 961.830922 =(A76/A79)/(1+C77) PMT 961.83 L -961.83 2287 5 7 0.005 50,000 51.98418855Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started