Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are 3 companies with different credit ratings and different offers for fixed and variable rates. Company A has the offers of 4% for

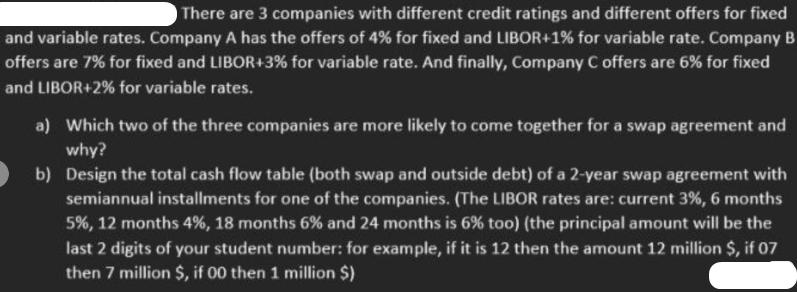

There are 3 companies with different credit ratings and different offers for fixed and variable rates. Company A has the offers of 4% for fixed and LIBOR+1% for variable rate. Company B offers are 7% for fixed and LIBOR +3% for variable rate. And finally, Company C offers are 6% for fixed and LIBOR+2% for variable rates. a) Which two of the three companies are more likely to come together for a swap agreement and why? b) Design the total cash flow table (both swap and outside debt) of a 2-year swap agreement with semiannual installments for one of the companies. (The LIBOR rates are: current 3%, 6 months 5%, 12 months 4%, 18 months 6% and 24 months is 6% too) (the principal amount will be the last 2 digits of your student number: for example, if it is 12 then the amount 12 million $, if 07 then 7 million $, if 00 then 1 million $)

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Companies are more likely to enter into a swap agreement when their comparative advantage in borro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started