Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are 3 excel sheets on excel file: Balance Sheet of Loblaw Income Statement of Loblaw Working Sheet for you - I have created the

There are 3 excel sheets on excel file:

- Balance Sheet of Loblaw

- Income Statement of Loblaw

- Working Sheet for you - I have created the format to show you how you should work on in and I have put an example as well.

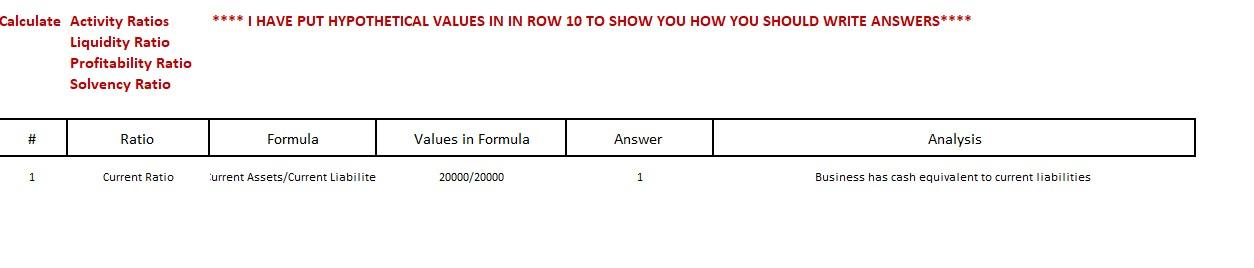

Kindly solve for all liquidity, Solvency, Profitability and Activity Ratios. write formula too

RATIO ANALYSIS FOR 2020 AND 2019

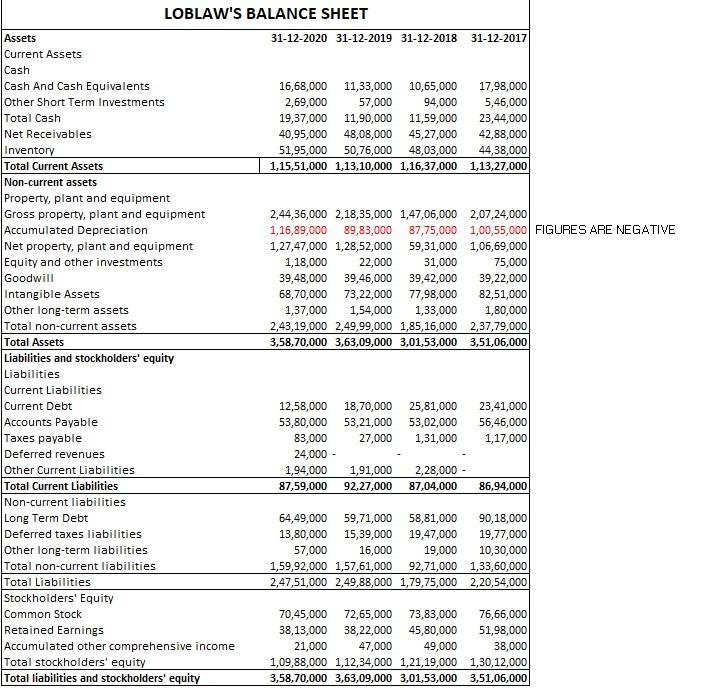

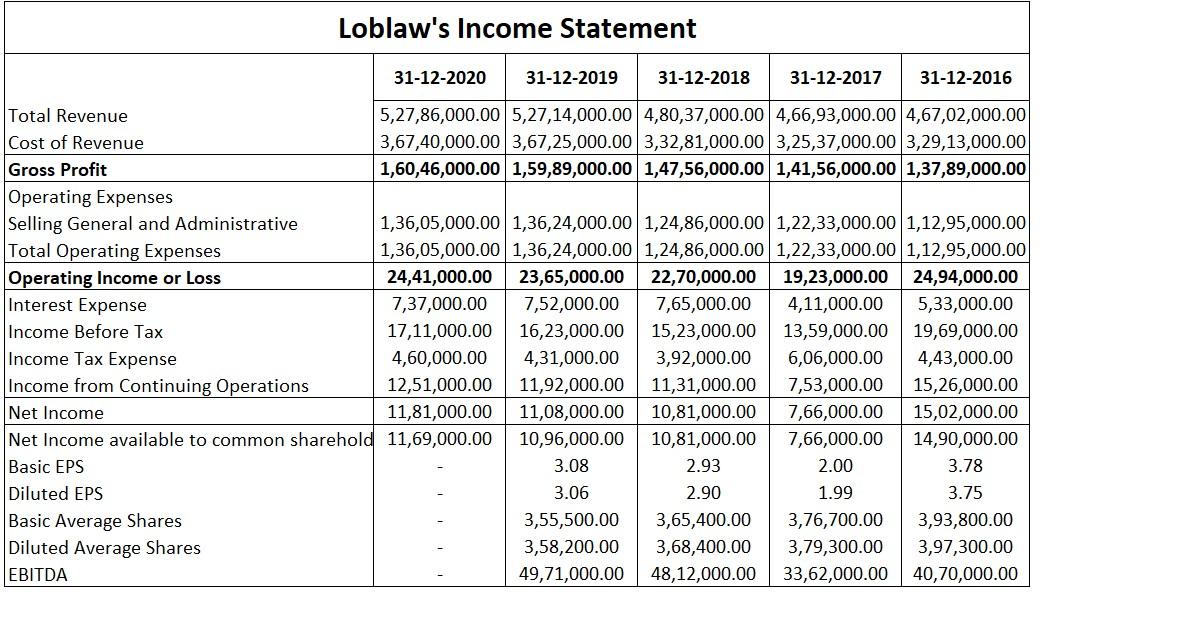

LOBLAW'S BALANCE SHEET Assets 31-12-2020 31-12-2019 31-12-2018 31-12-2017 Current Assets Cash Cash And Cash Equivalents 16,68,000 11,33,000 10,65,000 17,98,000 Other Short Term Investments 2,69,000 57,000 94,000 5,46,000 Total Cash 19,37,000 11,90,000 11,59,000 23,44,000 Net Receivables 40,95,000 48,08,000 45,27,000 42,88,000 Inventory 51,95,000 50,76,000 48,03,000 44,38,000 Total Current Assets 1,15,51,000 1,13,10,000 1,16,37,000 1,13,27,000 Non-current assets Property, plant and equipment Gross property, plant and equipment 2,44,36,000 2,18,35,000 1,47,06,000 2,07,24,000 Accumulated Depreciation 1,16,89,000 89,83,000 87,75,000 1,00,55,000 FIGURES ARE NEGATIVE Net property, plant and equipment 1,27,47,000 1,28,52,000 59,31,000 1,06,69,000 Equity and other investments 1,18,000 22,000 31,000 75,000 Goodwill 39,48,000 39,46,000 39,42,000 39,22,000 Intangible Assets 68,70,000 73,22,000 77,98,000 82,51,000 Other long-term assets 1,37,000 1,54,000 1,33,000 1,80,000 Total non-current assets 2,43,19,000 2,49,99,000 1,85,16,000 2,37,79,000 Total Assets 3,58,70,000 3,63,09,000 3,01,53,000 3,51,06,000 Liabilities and stockholders' equity Liabilities Current Liabilities Current Debt 12,58,000 18,70,000 25,81,000 23,41,000 Accounts Payable 53,80,000 53,21,000 53,02,000 56,46,000 Taxes payable 83,000 27,000 1,31,000 1,17,000 Deferred revenues 24,000 - Other Current Liabilities 1,94,000 1,91,000 2,28,000 - Total Current Liabilities 87,59,000 92,27,000 87,04,000 86,94,000 Non-current liabilities Long Term Debt 64,49,000 59,71,000 58,81,000 90,18,000 Deferred taxes liabilities 13,80,000 15,39,000 19,47,000 19,77,000 Other long-term liabilities 57,000 16,000 19,000 10,30,000 Total non-current liabilities 1,59,92,000 1,57,61,000 92,71,000 1,33,60,000 Total Liabilities 2,47,51,000 2,49,88,000 1,79,75,000 2,20,54,000 Stockholders' Equity Common Stock 70,45,000 72,65,000 73,83,000 76,66,000 Retained Earnings 38,13,000 38,22,000 45,80,000 51,98,000 Accumulated other comprehensive income 21,000 47,000 49,000 38,000 Total stockholders' equity 1,09,88,000 1,12,34,000 1,21,19,000 1,30,12,000 Total liabilities and stockholders' equity 3,58,70,000 3,63,09,000 3,01,53,000 3,51,06,000 Loblaw's Income Statement 31-12-2020 31-12-2019 31-12-2018 31-12-2017 31-12-2016 Total Revenue 5,27,86,000.00 5,27,14,000.00 4,80,37,000.00 4,66,93,000.00 4,67,02,000.00 Cost of Revenue 3,67,40,000.00 3,67,25,000.00 3,32,81,000.00 3,25,37,000.00 3,29,13,000.00 Gross Profit 1,60,46,000.00 1,59,89,000.00 1,47,56,000.00 1,41,56,000.00 1,37,89,000.00 Operating Expenses Selling General and Administrative 1,36,05,000.00 1,36,24,000.00 1,24,86,000.00 1,22,33,000.00 1,12,95,000.00 Total Operating Expenses 1,36,05,000.00 1,36,24,000.00 1,24,86,000.00 1,22,33,000.00 1,12,95,000.00 Operating Income or Loss 24,41,000.00 23,65,000.00 22,70,000.00 19,23,000.00 24,94,000.00 Interest Expense 7,37,000.00 7,52,000.00 7,65,000.00 4,11,000.00 5,33,000.00 Income Before Tax 17,11,000.00 16,23,000.00 15,23,000.00 13,59,000.00 19,69,000.00 Income Tax Expense 4,60,000.00 4,31,000.00 3,92,000.00 6,06,000.00 4,43,000.00 Income from Continuing Operations 12,51,000.00 11,92,000.00 11,31,000.00 7,53,000.00 15,26,000.00 Net Income 11,81,000.00 11,08,000.00 10,81,000.00 7,66,000.00 15,02,000.00 Net Income available to common sharehold 11,69,000.00 10,96,000.00 10,81,000.00 7,66,000.00 14,90,000.00 Basic EPS 3.08 2.93 2.00 3.78 Diluted EPS 3.06 2.90 1.99 3.75 Basic Average Shares 3,55,500.00 3,65,400.00 3,76,700.00 3,93,800.00 Diluted Average Shares 3,58,200.00 3,68,400.00 3,79,300.00 3,97,300.00 EBITDA 49,71,000.00 48,12,000.00 33,62,000.00 40,70,000.00 **** I HAVE PUT HYPOTHETICAL VALUES IN IN ROW 10 TO SHOW YOU HOW YOU SHOULD WRITE ANSWERS**** Calculate Activity Ratios Liquidity Ratio Profitability Ratio Solvency Ratio # Ratio Formula Values in Formula Answer Analysis 1 Current Ratio urrent Assets/Current Liabilite 20000/20000 1 Business has cash equivalent to current liabilitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started