Answered step by step

Verified Expert Solution

Question

1 Approved Answer

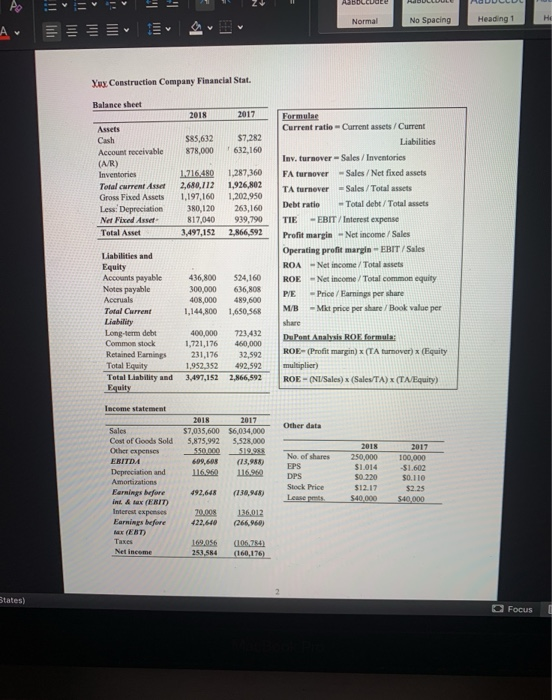

there are 5 photos Au bolcuole Normal No Spacing Heading 1 Yux Construction Company Financial Stat. Balance sheet 2018 2017 Formulae Current ratio Current assets/Current

there are 5 photos

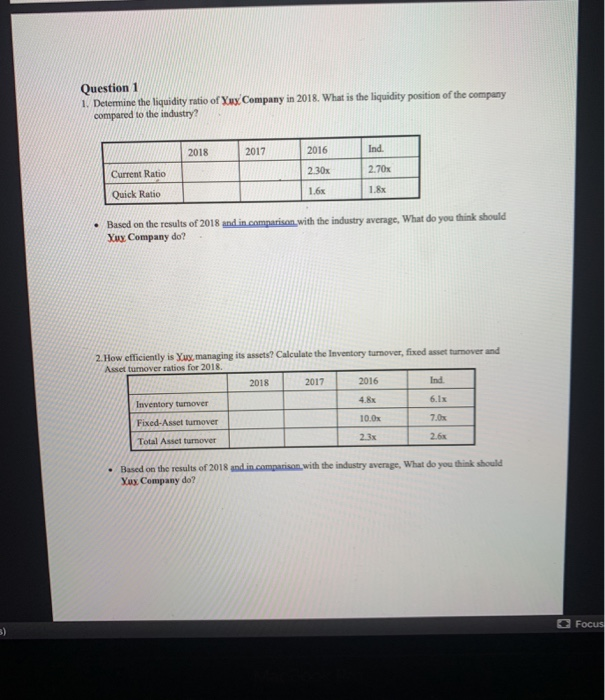

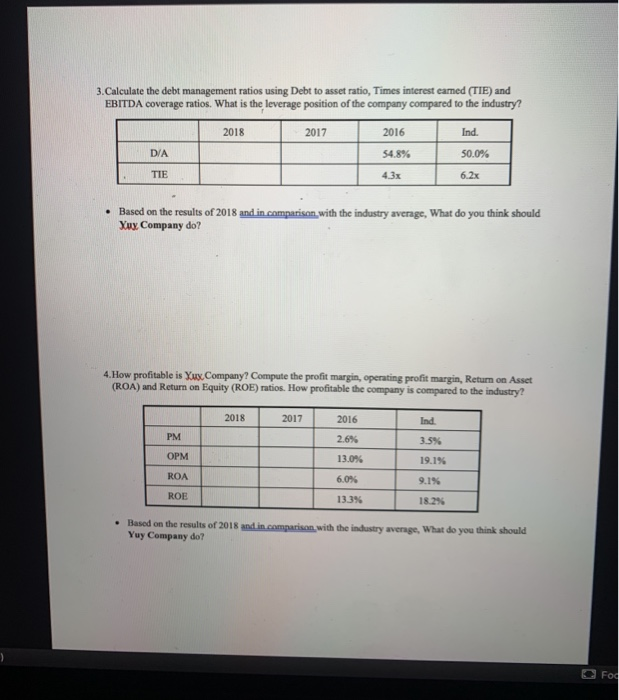

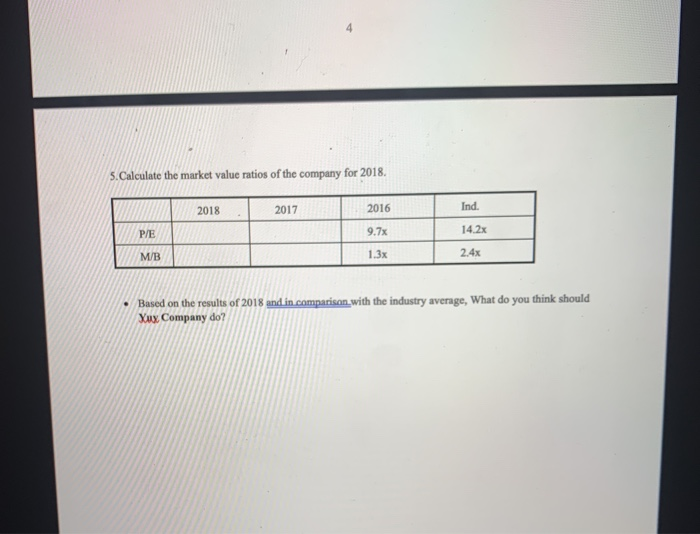

Au bolcuole Normal No Spacing Heading 1 Yux Construction Company Financial Stat. Balance sheet 2018 2017 Formulae Current ratio Current assets/Current 585,632 878,000 $7,282 632,160 Liabilities Aucts Cash Account receivable (A/R) Inventories Total current Asset Gross Fixed Assets Less: Depreciation Net Fixed Assef Total Asset 1.716,480 2,680,112 1,197,160 380,120 817,040 3,497,152 1,287,360 1,926,802 1,202,950 263,160 939,790 2,866,592 Inv. turnover - Sales / Inventories FA turnover - Sales / Net fixed assets TA turnover = Sales / Total assets Debt ratio - Total debt / Total assets TIE -EBIT/Interest expense Profit margin-Net income / Sales Operating profit margin-EBIT/Sales ROA - Net income / Total assets ROE - Net income / Total common equity PE -Price/Earnings per share M/B - Mkt price per share / Book value per share DuPont Analysis ROE formula: ROE-(Profit margin) x (TA turnover) (Equity multiplier) ROE - (NI/Sales) x (SalesTA) (TAEquity) 436,800 300,000 408,000 1.144,800 Liabilities and Equity Accounts payable Notes payable Accruals Total Current Liability Long-term debt Common stock Retained Farnings Total Equity Total Liability and Equity 524,160 636,808 489,600 1,650,568 400.000 1,721,176 231,176 1.952 352 3,497,152 723.432 460,000 32.592 492.592 2.866,592 Income statement Other data $7,035,600 5,875,992 550.000 550.000 609.608 1169 2017 $6.034.000 5,528.000 519.988 (13,988 116.96 No. of shares Sales Cost of Goods Sold Other expenses EBITDA Depreciation and Amortizations Earnings before int. & tax (ERIT Interest expenses Earnings before 2018 250,000 $1,014 SO 220 $12.17 $40.000 2017 100.000 $1.602 $0.110 $2.25 492,648 (130,98) Stock Price Leases $40.000 20.00 422,640 136,012 266,960) Net income 169.05 253,584 (106,784 (160,176 States) Focus Question 1 1. Determine the liquidity ratio of Yux Company in 2018. What is the liquidity position of the company compared to the industry? 2018 2017 2016 Current Ratio 230x 2.70 Quick Ratio Based on the results of 2018 and in comparison with the industry average, What do you think should Xuy Company do? 2. How efficiently is Yux, managing its assets? Calculate the Inventory turnover, fixed asset tumover and Asset turnover ratios for 2018 2018 2017 2016 Ind Inventory tumover 4.8x 6.1 x Fixed-Asset tumover 10.0x 7.0% Total Asset turnover 2.6% din.comparison with the industry average What do you think should . Based on the results of 2018 Yux Company do? C Focus 3.Calculate the debt management ratios using Debt to asset ratio, Times interest earned (TIE) and EBITDA coverage ratios. What is the leverage position of the company compared to the industry? 2018 2017 2016 Ind. D/A 54.8% / 50.0% 43x | 6.2x . Based on the results of 2018 and in comparison with the industry average, What do you think should Xuy Company do? 4. How profitable is Yux.Company Compute the profit margin, operating profit margin, Return on Asset (ROA) and Return on Equity (ROE) ratios. How profitable the company is compared to the industry? 2018 2017 Ind 3.5% PM 2016 2.6% 13.0% 6,0% OPM 19.1% ROA 9.19 ROE 13:35 18.2% Based on the results of 2015 din.comparison with the industry everge. What do you think should Yuy Company do? Fo 5. Calculate the market value ratios of the company for 2018. 2018 2017 2016 Ind. P/E 9.7x 14.2x MB 1.3% 2.4x Based on the results of 2018 and in comparison with the industry average, What do you think should Yux Company do Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started