Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there are a and b parts I need both to be done because its one question Question 1 Horvat Q10(a) Mr Arvind owns his thread

there are a and b parts I need both to be done because its one question

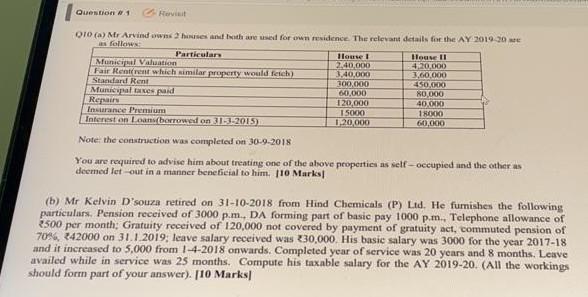

Question 1 Horvat Q10(a) Mr Arvind owns his thread for own residence. The relevant details for the AY 2019-30 Particular Blouse 1 House 11 Municipal Valuation 2240,000 4,20,000 Fair Renrent which similar property would fetch) 3:40.000 1/60000 Standard Rene 100,000 450,000 Municipales paid 60.000 80.000 Repair 120,000 400O Insurance Premium 1500 1 BOXXO Interest on Loansborrowed on 31.3.2015) 1. 20.000 60.000 Note: the construction was completed on 30.9.2018 You are required to advise him about treating one of the above properties as self-occupied and the others deemed let out in a manner beneficial to him, 110 Marks (b) Mr Kelvin D'Souza retired on 31-10-2018 from Hind Chemicals (P) Ltd. He furnishes the following particulars. Pension received of 3000 p.m., DA forming part of basic pay 1000p.m., Telephone allowance of 2500 per month; Gratuity received of 120,000 not covered by payment of gratuity act, commuted pension of 70%, 242000 on 31.1.2019, leave salary received was 230,000. His basic salary was 3000 for the year 2017-18 and it increased to 5,000 from 1-4-2018 onwards. Completed year of service was 20 years and 8 months. Leave availed while in service was 25 months. Compute his taxable salary for the AY 2019-20. (All the workings should form part of your answer). [10 MarksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started