Answered step by step

Verified Expert Solution

Question

1 Approved Answer

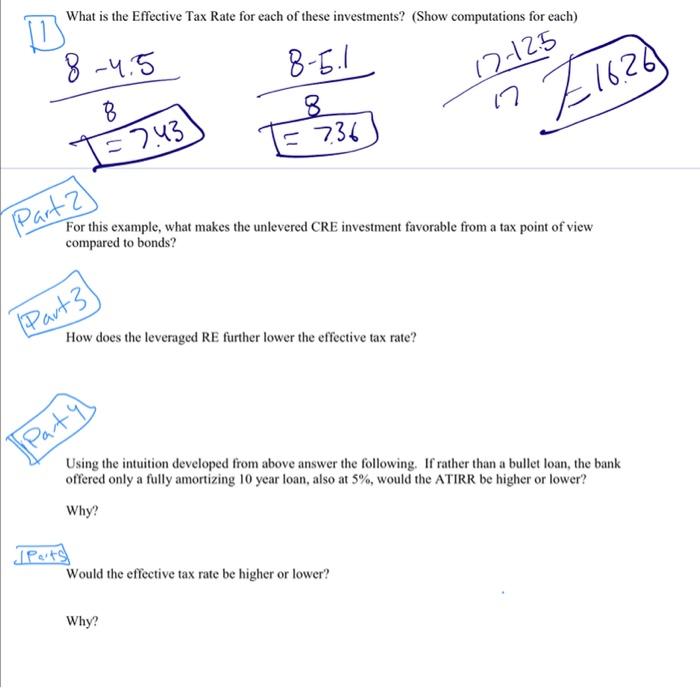

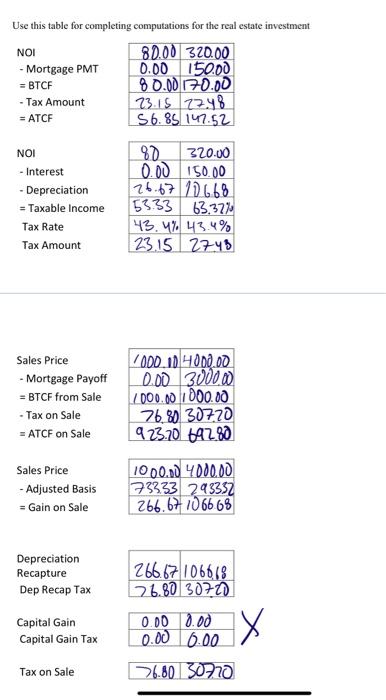

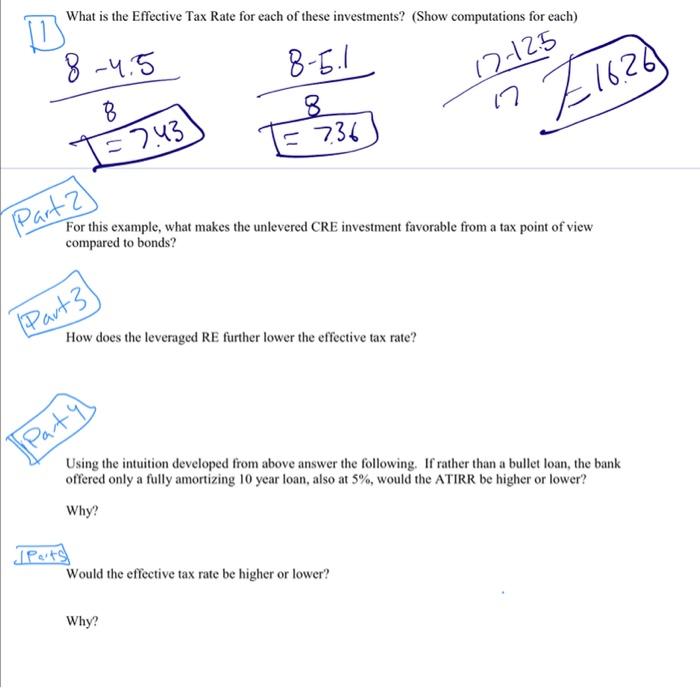

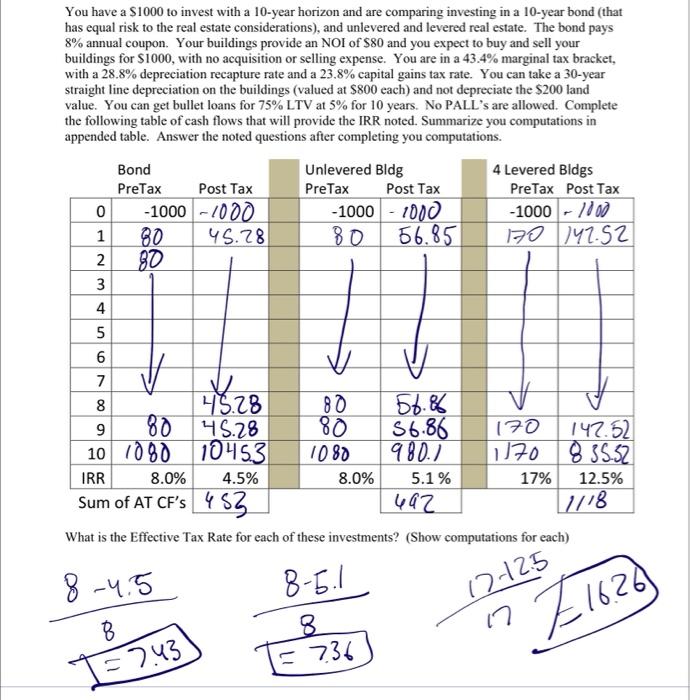

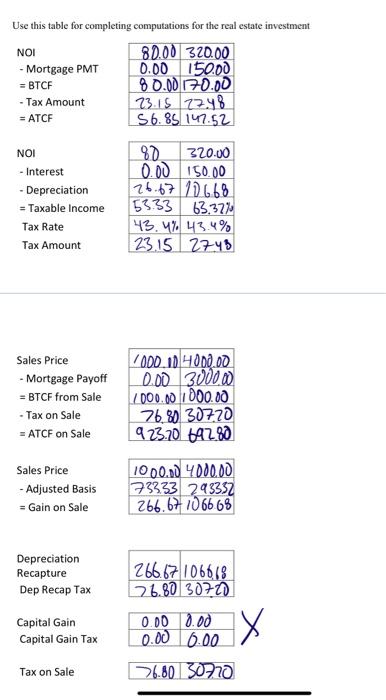

there are five parts to this question, Numbers are provided What is the Effective Tax Rate for each of these investments? (Show computations for each)

there are five parts to this question, Numbers are provided

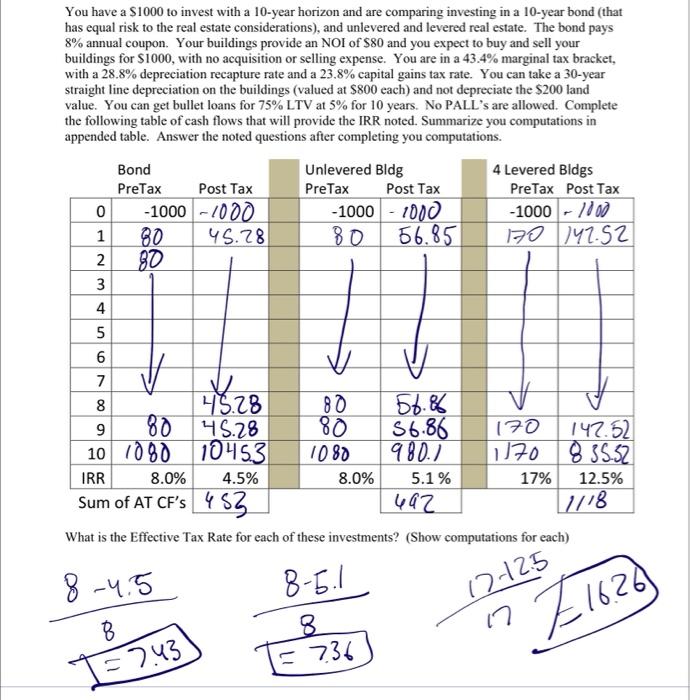

What is the Effective Tax Rate for each of these investments? (Show computations for each) 8-4.5 B-5.1 (2125 17 116.26 8 8 = 736 = 743 Part 2) For this example, what makes the unlevered CRE investment favorable from a tax point of view compared to bonds? (Part3 How does the leveraged RE further lower the effective tax rate? Party Using the intuition developed from above answer the following. If rather than a bullet loan, the bank offered only a fully amortizing 10 year loan, also at 5%, would the ATIRR be higher or lower? Why? Parts) Would the effective tax rate be higher or lower? Why? You have a $1000 to invest with a 10-year horizon and are comparing investing in a 10-year bond (that has equal risk to the real estate considerations), and unlevered and levered real estate. The bond pays 8% annual coupon. Your buildings provide an NOI of $80 and you expect to buy and sell your buildings for $1000, with no acquisition or selling expense. You are in a 43.4% marginal tax bracket, with a 28.8% depreciation recapture rate and a 23.8% capital gains tax rate. You can take a 30-year straight line depreciation on the buildings (valued at $800 each) and not depreciate the $200 land value. You can get bullet loans for 75% LTV at 5% for 10 years. No PALL's are allowed. Complete the following table of cash flows that will provide the IRR noted. Summarize you computations in appended table. Answer the noted questions after completing you computations. 0 NP 3 Bond Unlevered Bldg 4 Levered Bldgs PreTax Post Tax Pre Tax Post Tax PreTax Post Tax 0 -1000 -1000 -1000 - 1000 -1000 - 1100 1 00 45.28 80 66.85 70 147.52 2 80 3 4 5 6 v 7 8 45.28 80 56.85 9 80 45.28 80 56.86 170 147.52 10 1080 10453 1080 980.2 1170 8.35.52 IRR 8.0% 4.5% 8.0% 5.1% 17% 12.5% Sum of AT CF's 453 492 1718 What is the Effective Tax Rate for each of these investments? (Show computations for each) 09 V V 00 8-4.5 B-6.1 12-125 E 16.26 8 1= 743) = 8 = 736 Use this table for completing computations for the real estate investment NOI 80.00 320.00 - Mortgage PMT 0.00 150.00 = BTCF 80.00 70.00 - Tax Amount 23.18 1248 = ATCF 56.85 147.52 NOI - Interest - Depreciation = Taxable income Tax Rate Tax Amount 80 320.00 0.00 150.00 26.67 18668 53.33 63.32% 43.4% 43.4% 23.15 274B Sales Price - Mortgage Payoff = BTCF from Sale - Tax on Sale = ATCF on Sale 000.10 4000.00 0.00 300000 1000.00 1000.00 76.80 307.20 923.20 44280 Sales Price -Adjusted Basis = Gain on Sale 1000.00 4000.00 23333 293352 266.67 706668 Depreciation Recapture Dep Recap Tax 266.67 106618 176.80 30720 0.00 0.00 Capital Gain Capital Gain Tax 0.00 0.00 IX Tax on Sale 76.80130770 What is the Effective Tax Rate for each of these investments? (Show computations for each) 8-4.5 B-5.1 (2125 17 116.26 8 8 = 736 = 743 Part 2) For this example, what makes the unlevered CRE investment favorable from a tax point of view compared to bonds? (Part3 How does the leveraged RE further lower the effective tax rate? Party Using the intuition developed from above answer the following. If rather than a bullet loan, the bank offered only a fully amortizing 10 year loan, also at 5%, would the ATIRR be higher or lower? Why? Parts) Would the effective tax rate be higher or lower? Why? You have a $1000 to invest with a 10-year horizon and are comparing investing in a 10-year bond (that has equal risk to the real estate considerations), and unlevered and levered real estate. The bond pays 8% annual coupon. Your buildings provide an NOI of $80 and you expect to buy and sell your buildings for $1000, with no acquisition or selling expense. You are in a 43.4% marginal tax bracket, with a 28.8% depreciation recapture rate and a 23.8% capital gains tax rate. You can take a 30-year straight line depreciation on the buildings (valued at $800 each) and not depreciate the $200 land value. You can get bullet loans for 75% LTV at 5% for 10 years. No PALL's are allowed. Complete the following table of cash flows that will provide the IRR noted. Summarize you computations in appended table. Answer the noted questions after completing you computations. 0 NP 3 Bond Unlevered Bldg 4 Levered Bldgs PreTax Post Tax Pre Tax Post Tax PreTax Post Tax 0 -1000 -1000 -1000 - 1000 -1000 - 1100 1 00 45.28 80 66.85 70 147.52 2 80 3 4 5 6 v 7 8 45.28 80 56.85 9 80 45.28 80 56.86 170 147.52 10 1080 10453 1080 980.2 1170 8.35.52 IRR 8.0% 4.5% 8.0% 5.1% 17% 12.5% Sum of AT CF's 453 492 1718 What is the Effective Tax Rate for each of these investments? (Show computations for each) 09 V V 00 8-4.5 B-6.1 12-125 E 16.26 8 1= 743) = 8 = 736 Use this table for completing computations for the real estate investment NOI 80.00 320.00 - Mortgage PMT 0.00 150.00 = BTCF 80.00 70.00 - Tax Amount 23.18 1248 = ATCF 56.85 147.52 NOI - Interest - Depreciation = Taxable income Tax Rate Tax Amount 80 320.00 0.00 150.00 26.67 18668 53.33 63.32% 43.4% 43.4% 23.15 274B Sales Price - Mortgage Payoff = BTCF from Sale - Tax on Sale = ATCF on Sale 000.10 4000.00 0.00 300000 1000.00 1000.00 76.80 307.20 923.20 44280 Sales Price -Adjusted Basis = Gain on Sale 1000.00 4000.00 23333 293352 266.67 706668 Depreciation Recapture Dep Recap Tax 266.67 106618 176.80 30720 0.00 0.00 Capital Gain Capital Gain Tax 0.00 0.00 IX Tax on Sale 76.80130770

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started