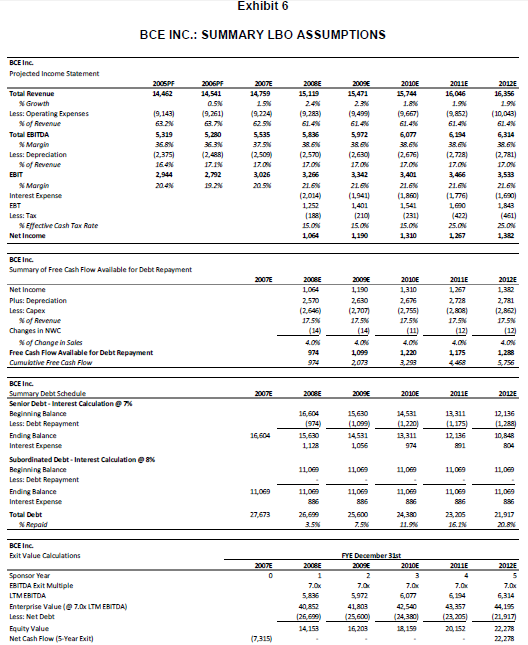

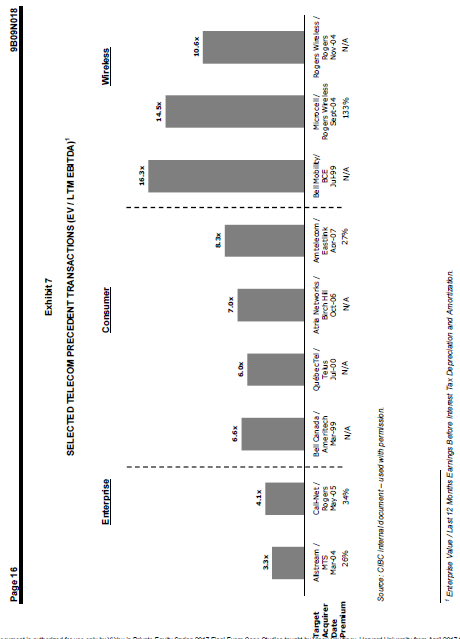

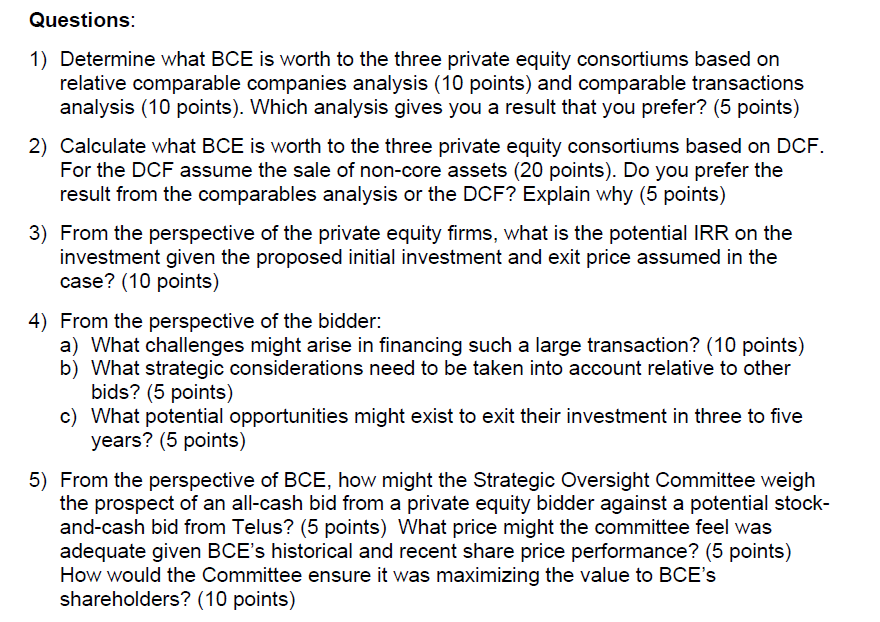

There are five questions about a case BCE in play. The 16-pages case and questions are both in the attachment. Thank you.

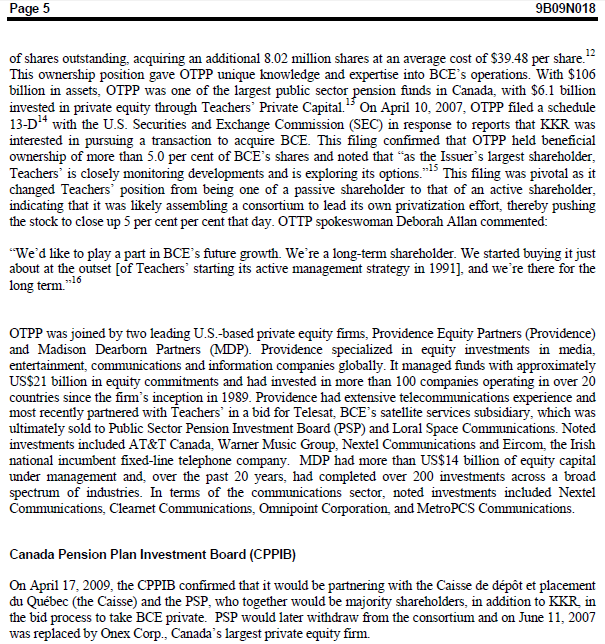

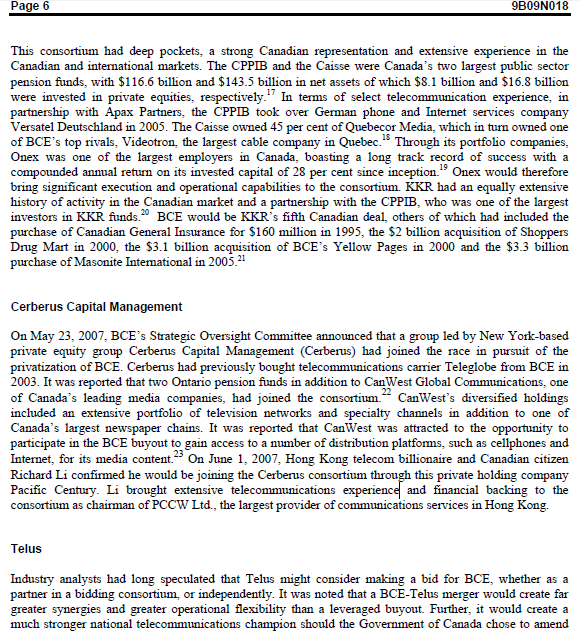

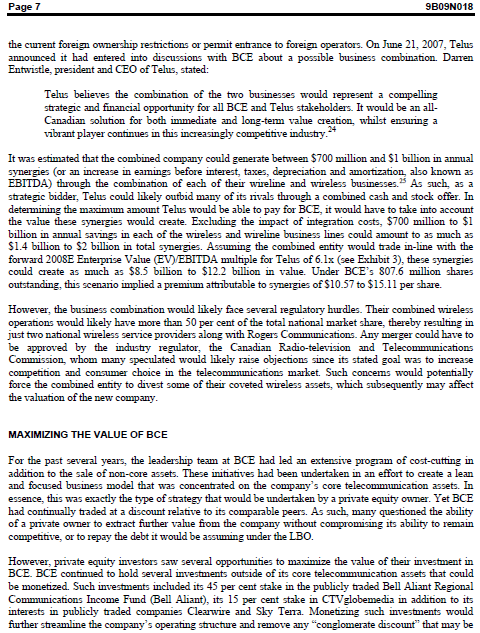

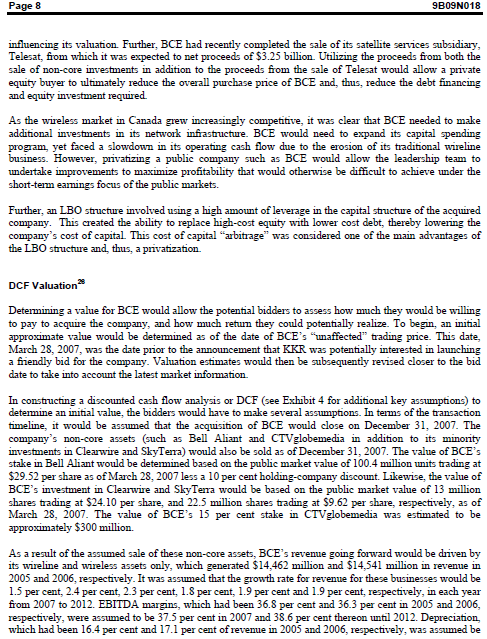

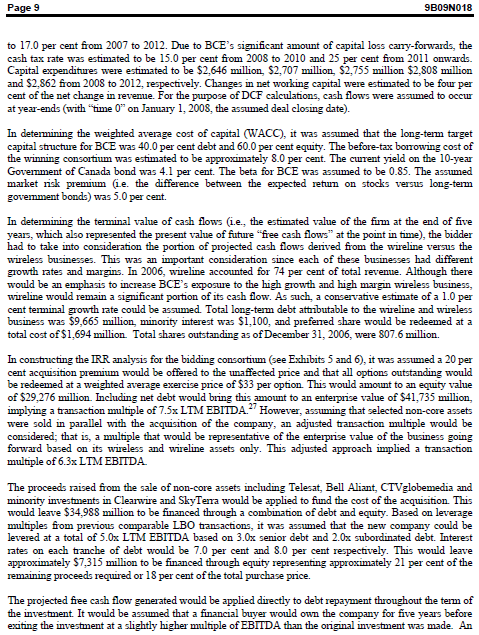

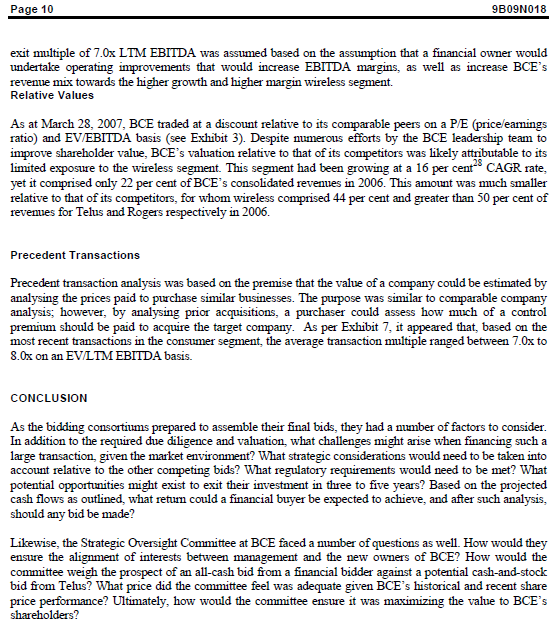

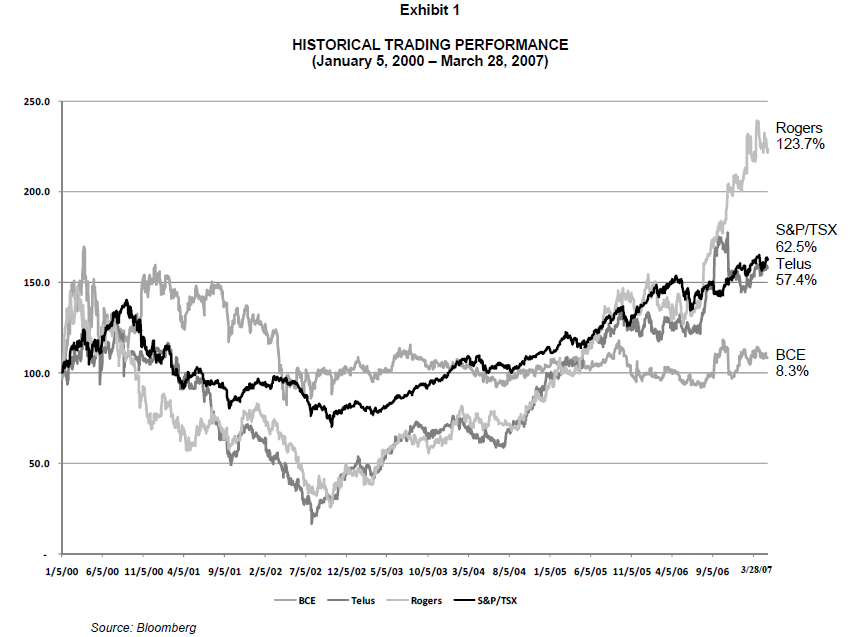

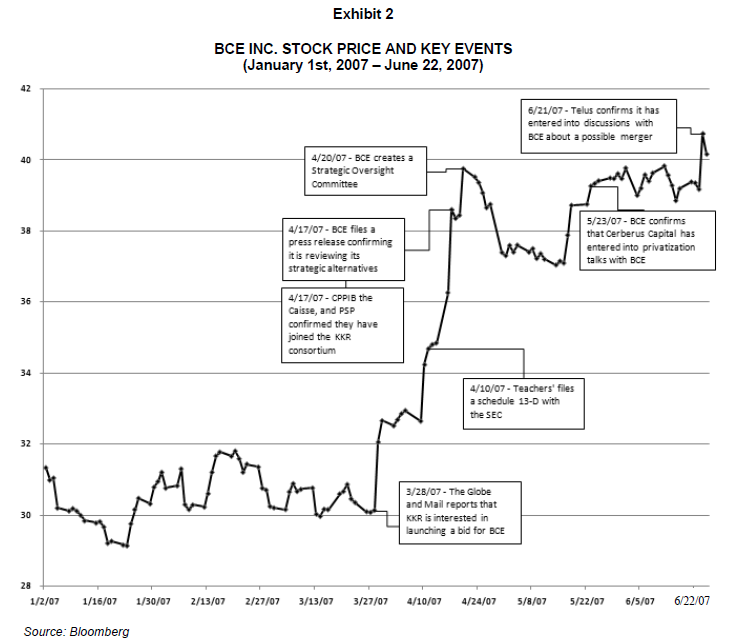

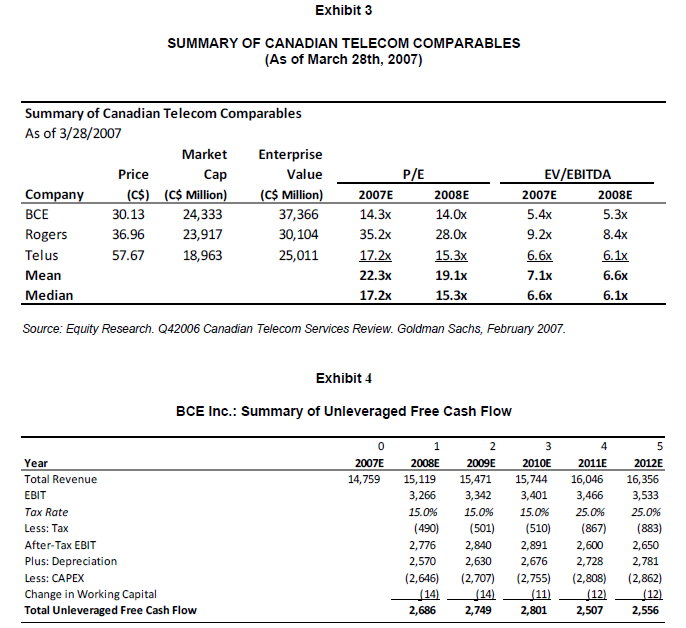

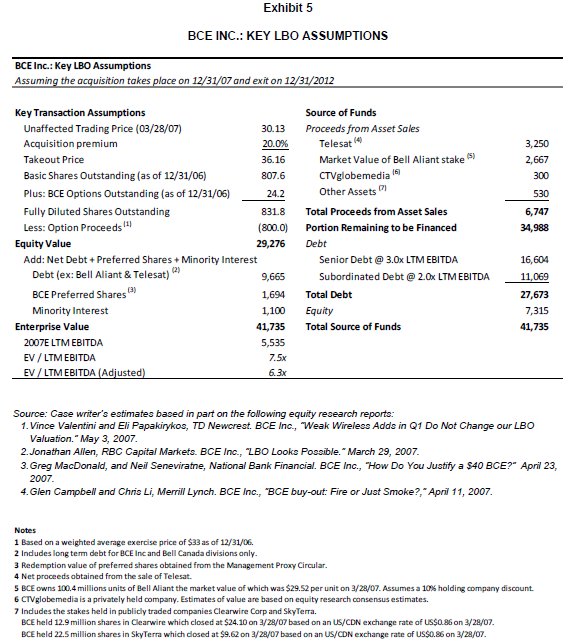

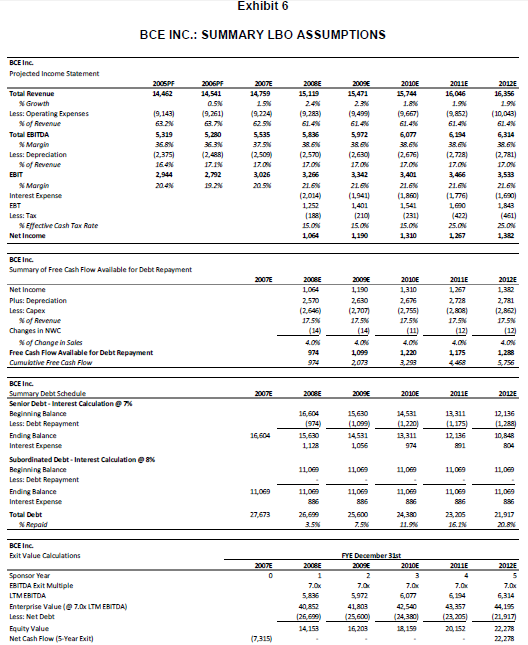

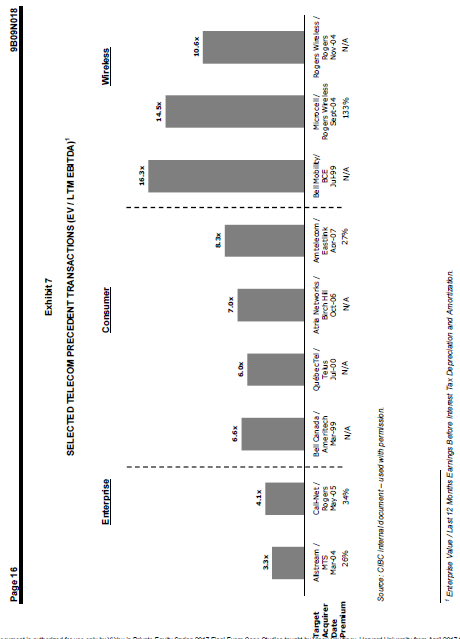

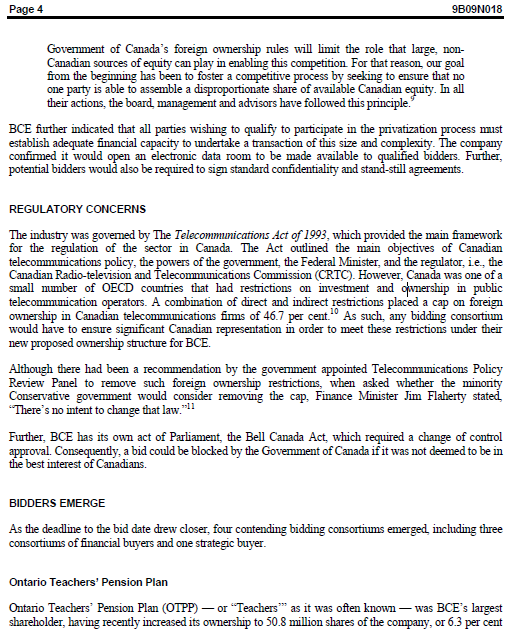

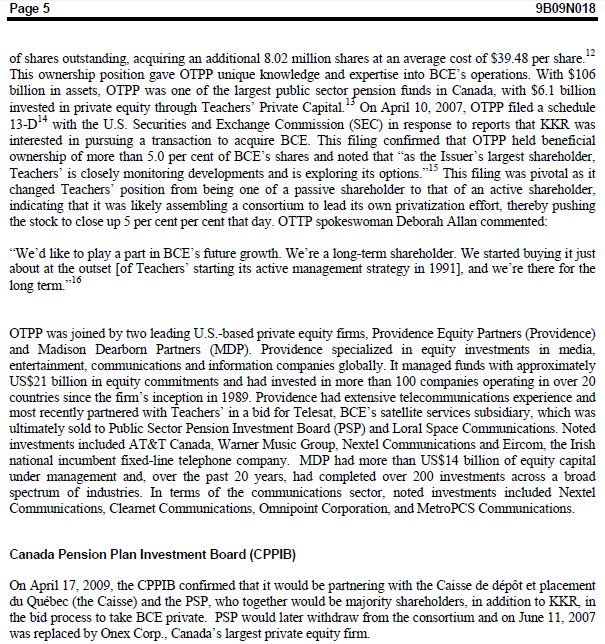

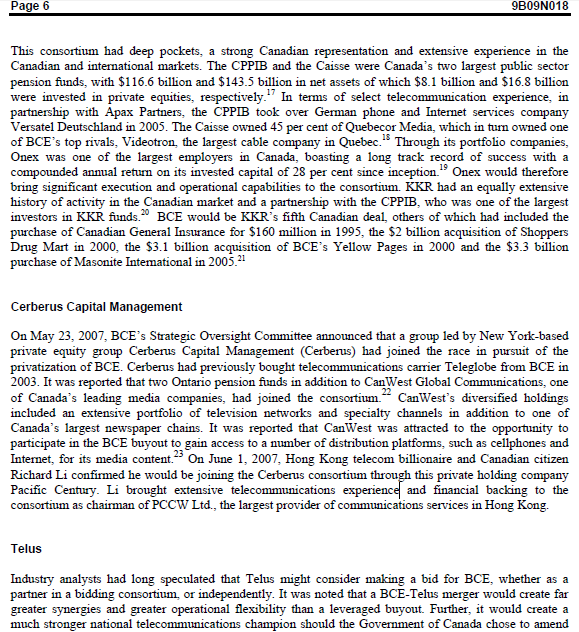

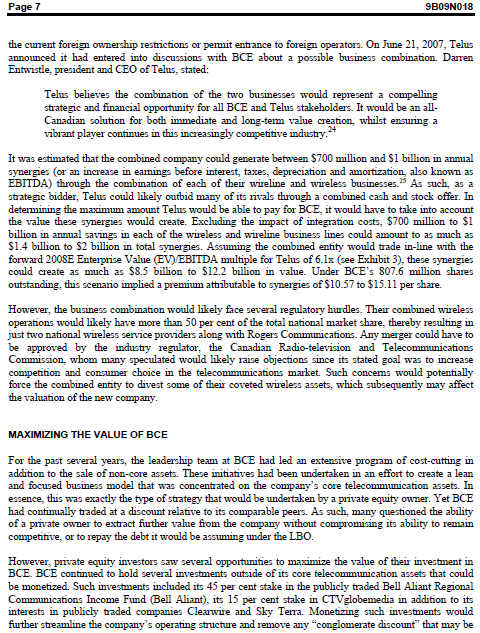

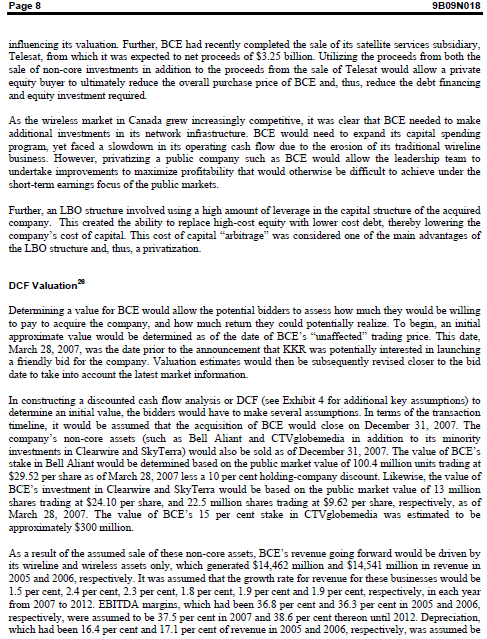

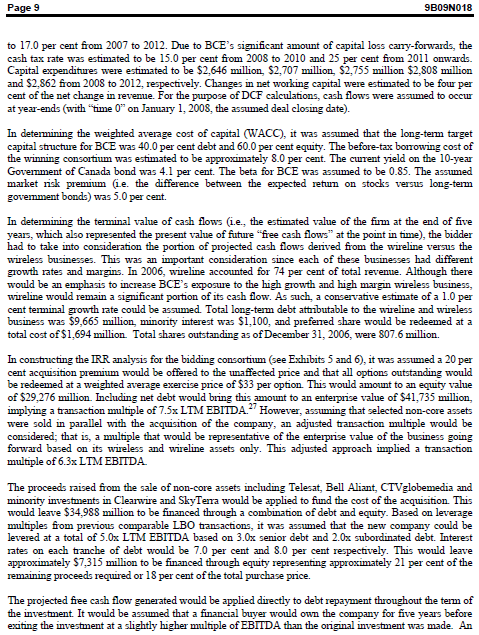

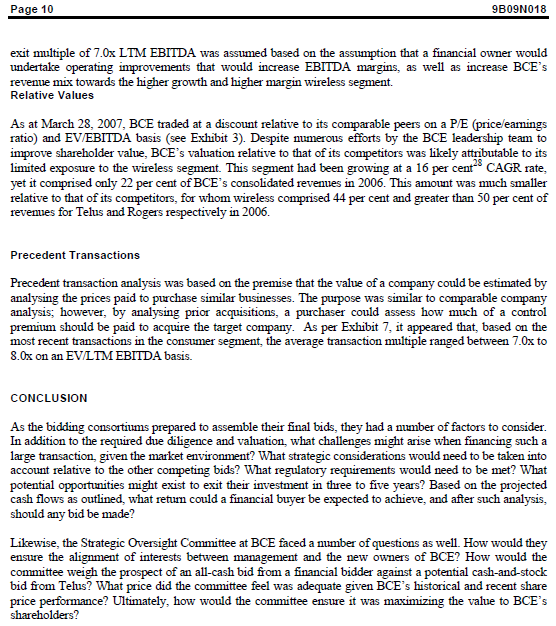

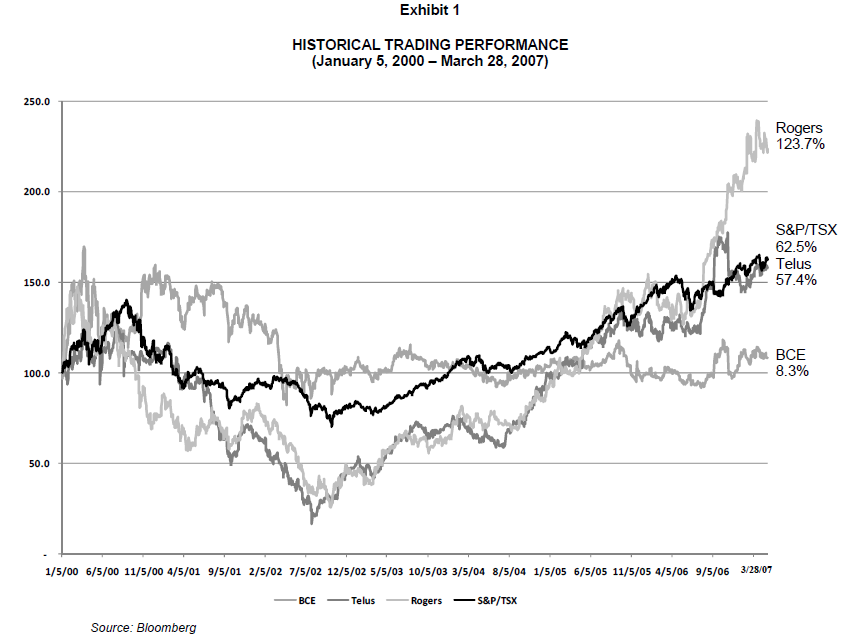

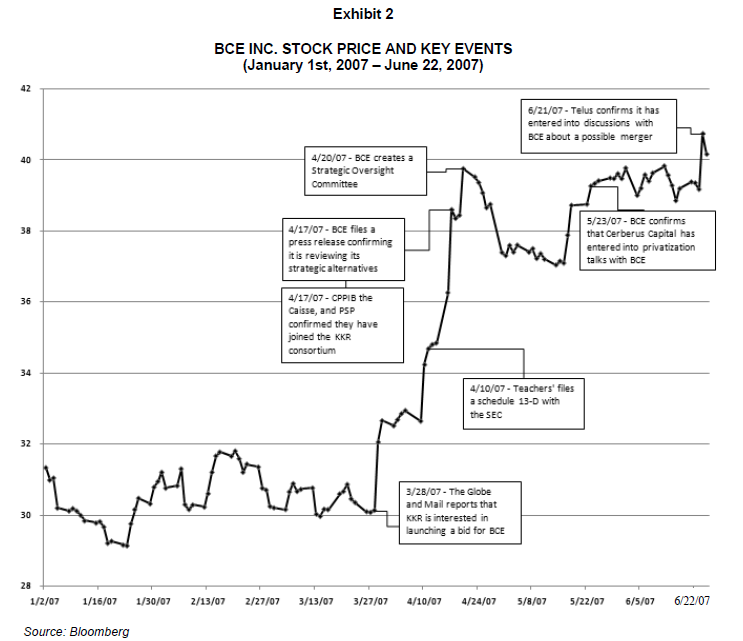

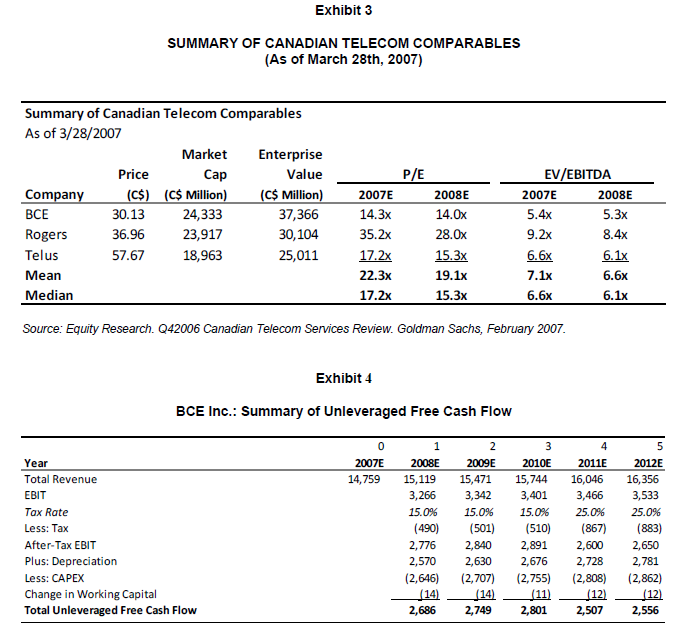

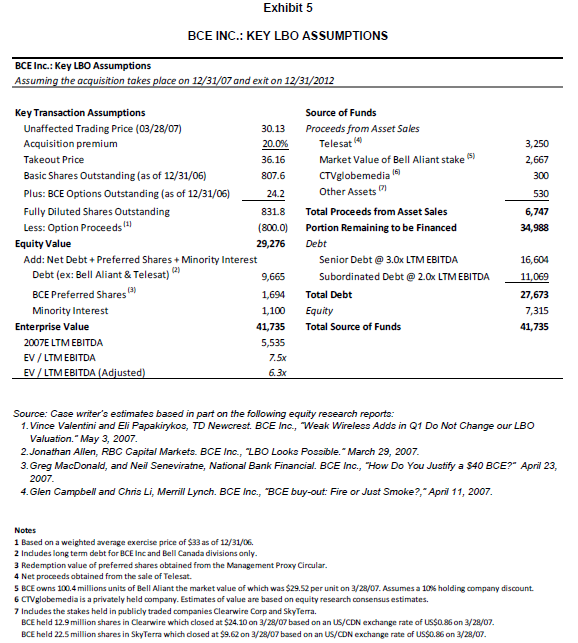

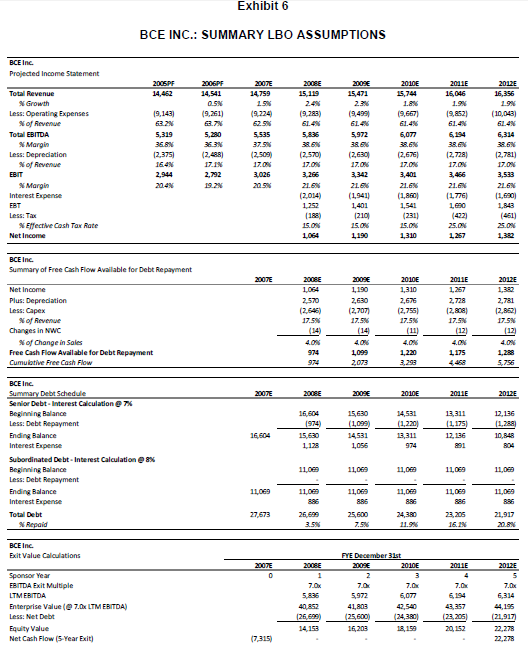

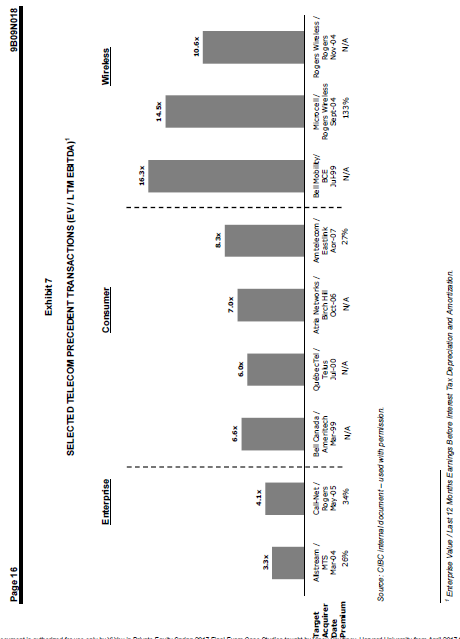

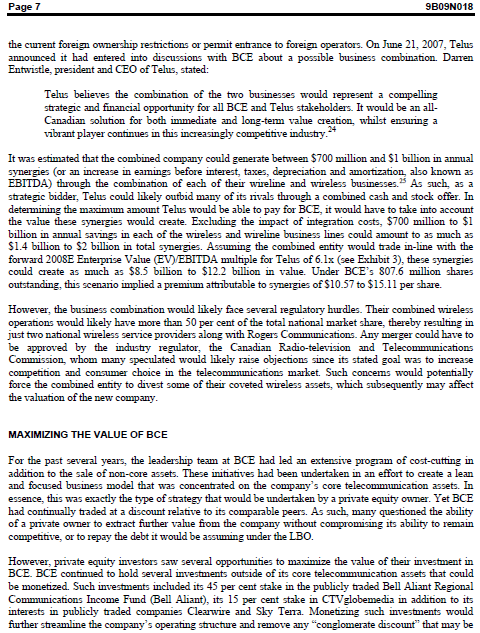

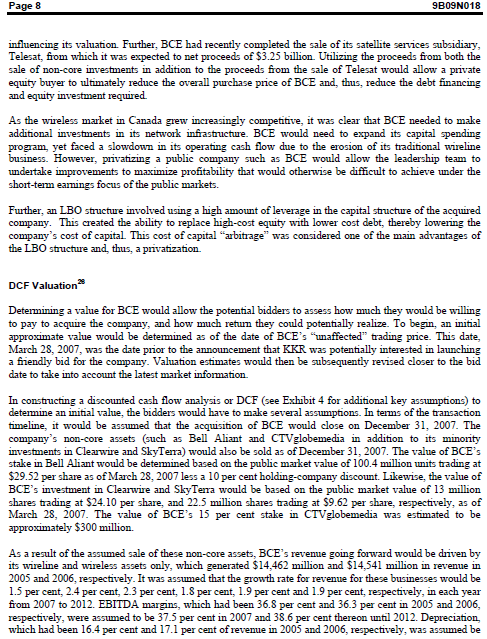

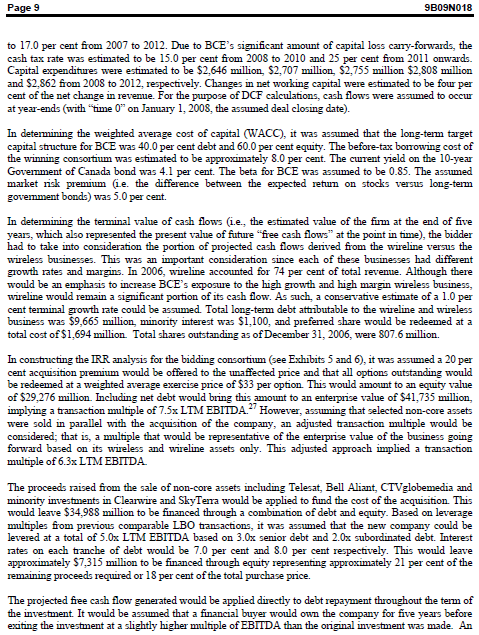

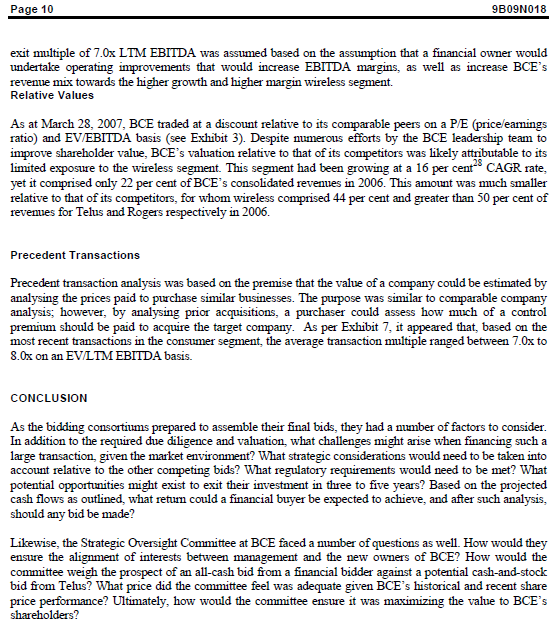

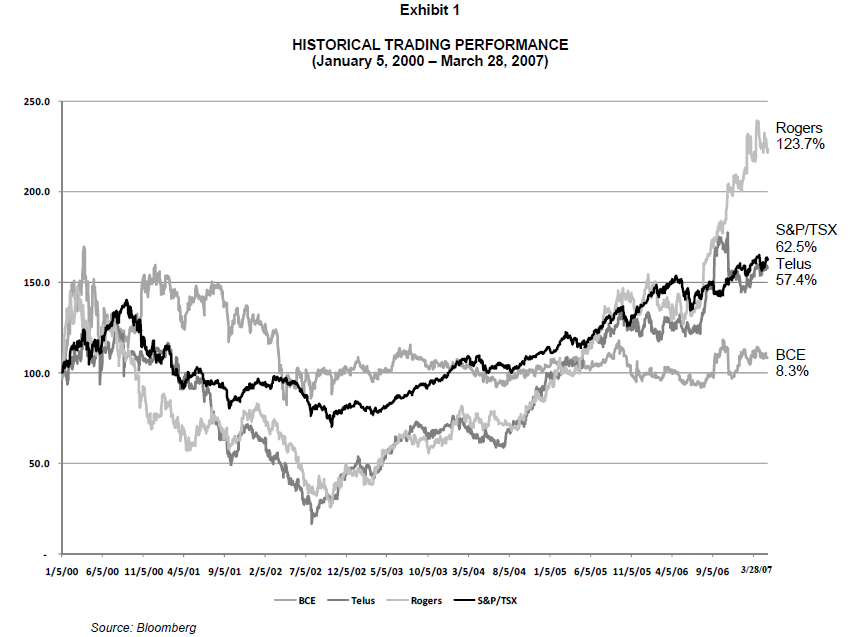

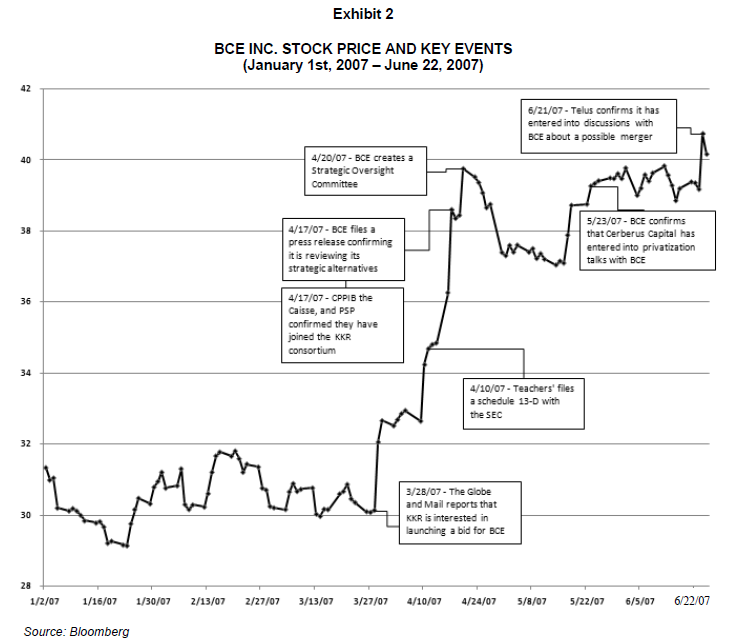

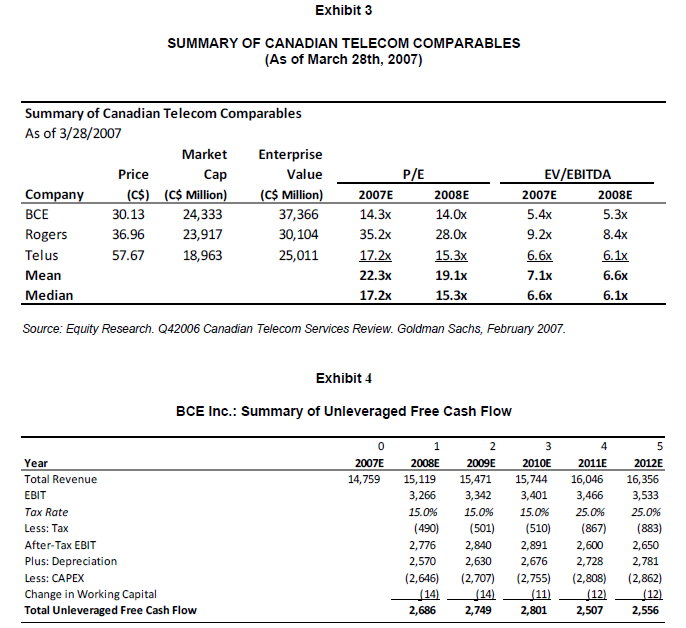

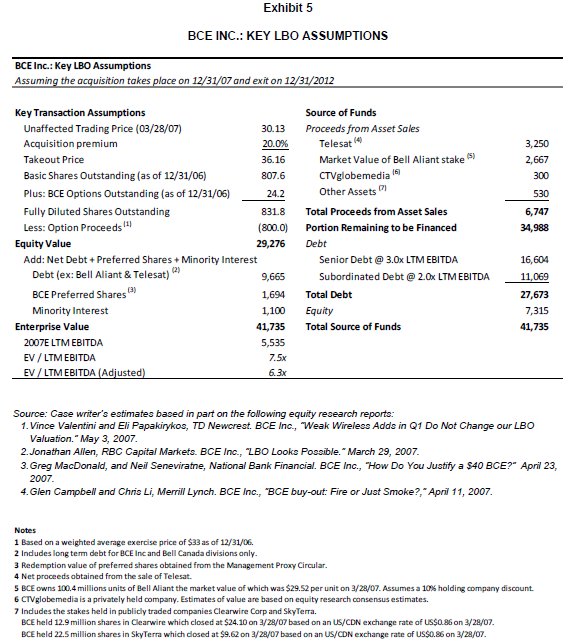

BCE |NC.: IN PLAY' Heather Tohin wrote this case under the supervision of Professor Stephen Foerster soieiy to provide materiai tor ciass discussion. The authors do not intend to iiiustrate either eti'ech've or ineective handiing of a manageriai situation. The authors may have disguised certain names and other hient'tying information to protect conden'h'aiity. ivey Management Services prohibits any form of reproduction, storage or iransmittai without its "Wen permission. Reproduction of this materiai is not covered under autiiorizah'on by any reproduction rights organization. To order copies or request permission to reproduce materiais, contact hroy Puhiisiiing, iirey Management Sendces, do Richard ivey Schooi of Business, The University of Western Ontario, London, Ontario, lCanada, NEH 3m,- phone f'i} Edi-3203; far: (519,! Edi3332; e-rnaii casesiveyuwona. Copyright E 2005], ivey Management Services Version: {A} Et-t25 By June 22, 20W, much had changed since BCE Inc. (BEE) had held its 2W? business review investor conference call in early December EDDIE. The company was now "in play" as a potential merger partner or private equity acquisition target. ECE had struggled to keep pace witl'i the rapid development of the wireless market and, in turn, stem the erosion of its traditional wireline business.2 The leadership team at BEE had committed to go forward in 200? with a plan to shore up its legacy wireline business and convert TU per cent of the company's revenues to growthbased businesses such as wireless, video, data and high- speed Internet by 2009'. However, the market remained unconvinced that the leadership team could drive improved shareholder value, as evidenced by BEE stock price performance [see Exhibit 1}. With ECE's stable cash ows, modest leverage, low valuation multiples and no controlling ownership block, private equity investors became increasingly interested in acquiring one ofCanada's most widely held companies. [in March 29', 200?, the Globe and Mail, lI'L'anadas leading national newspaper, reported that one of the world's most powerful private equity rms, New York-based Kohlberg Kravis 3r. Roberts {KICK}, had held informal meetings with BCE executives in the hopes of launching a friendly takeover bid for the company}3r (in March 23, 200?, ECE's stock price had closed at $30134 per share her a total market value of approximately $24.3 billion.5 As typical successful acquisitions occurred at premiums of 2!} per cent or more, this gure implied an equity purchase price of approximately $3D billion, potentially making this speculated transaction the largest acquisition in Canadian corporate history. In response, BCE promptly led a press release, stating: "At the request of the [Toronto Stock Exchange] hilarket Regulation Services, BEE today issued a statement to conrmthe fact that there are no ongoing discussions being held with any private equity investor with respect to any privatization of the Company or any similar transaction."l5 Pages saosnma of shares outstanding, acquiringanadditimal 8.1212 millionsharesatanaveragecostof $39.431H5h31'." Ihis ownership position gave l[IICI'P'P'uniqueknowledge andeapertiseintoBCE's operations. Wid1$1tlo billioninassets,DITPwasoneofielargestjarbhcsecthIensionmdsmCanadawithl billion investedinprivate equityironghTeachers' Private Capital1 OnApril 10,2901, CITPP ledaschedule 13D"with1eU.S_ Securities andEachange Commission {SEleinresponsetorepm'tsthatICICRwas mtaestedmmMgaoansacmmacmumBCEmsMgcmrmedmDIPPhddbmed ownershipofrrsirethaniperoentofECE'ssharesandnntediat"astbelssuer'slargostsharelmld, Teachers" is closelymonitonngdevelopmentsamiisexploringitsoptions_"15Thislingwaspivotalasit changed Teachers' position from being one of a passive shareholder to that of an active shareholder, indicating that itwaslilrely assemblingaconsortiumtolead its own privatization effort,therebypushing thestmkhclmenpipermmpaomtthmdaymspokeswommDeborahAmcommmned 'We'd like to play a part in BCE's future growth. We're a long-term shareholder. We started buying it just about at daemoutset [of Teachers" starting its active management strategy in 1991], and we're there for the long term." CITPP was joined by two leading [ISbased private equity rms, I'rovidmce Equity Partners {Providenoe} mMamsthmbmanmasmJPlPrmidencespedahmdmeqrotvaesmmmm entertainment, comrmrnications and mforrnalion companies globally. It managed funds with approximately US$21 billion inequitycomminncntaandhadinvestedmnmredian IDDcompames operating inover2tl cormtries since the rm's inception in 1939. Providence had extensive teleoomrmrnications experienoe and mast reoeny partnered with Teachers" in a hid for Telesat, BCE's satellite serving subsidiary, which was rrltirnately sold to Public Sector Pension Investment Board {PEP} and Loral Spaoe IComrrurnircations. Noted investments included ATdcT Canada, WmMSiC Group, Neaiel Commmaicatims and Eircom, tthrish national incumbent xed-line telephone company. MDP had more than US$14- billion of equity capital mdmmanagmmntanimrerthepastmyears,hadoompletedmmvemts acrossabroad spectrum of industries. In terms of the commimicatirms sector, noted investments included Nextel Communications, Clearnct Comnnmications, llClrmJipuoint Corporation, and MetroPCS Comnnmications. Canada Pension Plan Investment Board [CPPIB} DnApril112999,theCPPlIBoonrroediatitwrarldbepartrteringwiitheaissededepdtetplacement duQue'bec {the Caisse} and thePSP, who together wouldbe majority shareholders, inaddition toKKR, in mob-idprooesstotalreBCEprivate. PSPwouldlaterndrdrawomtbeoonsortiumandonJune 11, 299? wasreplacedbyihamtcsp.,anada'slargestpaivateequityrm Page 6 QBDQIHMB MWhaddeeppmkeasMgCuadimrepmsmmonmdexmiveespaimcemme Canadianandinternationalumtem. TheCI'I'IBanddleCaissewereCanada'sMolargsestpublicseoqu pensionfunds,w1th$lllihrlhonand$1435hillion1nruetassemofwh1oh$8lhilhonandillibilhon were invested in private equities, raspectiuetjnl In terms of select telecommunication experimoe: in partnership 1with Apax Partners: the CPPIB took over German phone and Intermt services company 1FiersatelIl'e'utschlacuizli-I1211315.'IheCaisseownedtlp-eroerltofuebeoorluledia,whichinturnowrsidone of aces tJopIIiT.-'als=1'Lfivtle-tilntl'tln= me largest cable companjerueh-ec." Through its pmtfolio companies, DnexwasoneoftbelaigestemployersinCanada,hoastingalongtrackreoordot'successwitha compoundedannualreturnonitsirmestedcapitalot'ESpercentsirceimeptionmnezswmldtherefore bring signicant execution and operational capabilities to the consmtium. ICKRhad an equalljrextensive histoijrofactitityinieCanadianmmtetandaparhershipwithleCPPIB,whowasuneufthelarge investorsinl'EKltt-'unnfls.In BCEwoquheKKR'slhCanadiandeaLothersofwhichhadmcludedthe pmchaseofCamdianGeralInsiranceJrSlmiloninlWile$2billionacquisitionof5hoppers Drug Mart in 20110: the $3.1 billion acquisition of BCE's Yellow Pages in 2001!} and the $3.3 billion purchaseot'llntlasoniteluteclnationalinltlv'tl'i21 Com-ems Capital Management On May 23, INT, BCE's Strategic Dinersight Committee announmd that a group led by New Yorkbased puisateequitpgroupCerb-elusCapitalManagennu {Cerberus} hadjoinedtheraoeinpursuitofthe puisatization ofBCE. Cerberus had previously bought teleoomruunications carrier Teleglohe om BCE in 2003. It was reported that two Ontario pension funds in addition to CanWest Global Comnmnioations, one of Canada s leading media companies, had juiced the consmtiim CanWest's diversied holdings included an extensive pm'tfolio of television networks and specialty channels in addition to om: of Canada'slargeatnewspaperchaim. ItwasrepmtedthatCanWestwasattractedtuseoppm'umityto participateintteBCE layouttogainaclllstoamimberofdishihutionplatfonns: suchasoellphoresand Internet, foritsnmdia oontent Dnhme 1, sum: HongKongtelecombillionaireandCanadiancitisen RichardlioonrnmedhewoldbejoiuingtheCerherus oonsortinmthrou thisprit-'ateholdingcompany Pacic Century. Li brought extensive telecommunications experienc and namial backing to the consmtnimaschaiimanofPCCWLtd, thelargeproviderofcomnnmications senicesinHongKong. Telus IndustrjranaljrstshadlongspeculatedmatTelusmightconsider makingabidt'orBCE, whetherasa partnerinahiddmg oomortinm= orindependaatly. Itwasnote-duataBCETelusinergerwcslldm'eatefar greater symgies and greater operational exil'uilitj,r than a leveraged buyout. Fur'ier, it 1would create a much stronger national telecomnnmications champion should the Governnrm ofCanada chose to amend 1 510 mu 1 50.0 100.0 50.9 "SM "5!" 1115mm: SIS-"1'1 HEIDI HEIDI 11475!" MW "ISM 3mm SEEM HEM "SIDS HIRE-'5 HEM "SIDE m Exhibit 1 HISTORICAL TRADING PERFORMANCE {January 5, 29911 March 28, 2007] Somme: Bfuambery nl: Tbh; lngers 5&Psl: Rogers 123.7% ESPNSK 52.5% Talus 514% BCE 3.3% Exhibit 3 SUMMARY DF CANADIAN TELECDM CDMPARABLES {A5 of March 23th, 2952'] Su mrnarf of Canadian Te lemm Comparables As of 33'251'2002 Ma rket Enterprise Price Cap Value PIE EW'E BITDA CumEEInI 1123! FE "lion! !E$ "lion! IIIITE I'D-DEE I'D-DTE 111111115 BEE 35.13 24,333 32,355 14.31: 14.01: 5.41: 5.311 Rogers 35.95 23,912 35,154 35.21: 23.01: 9.21: 3.411 Telus 52.5}' 15,953 25,511 E 15.31: m E Mean 22.3): 19.111 2.111 5.51 Median 12.211 15.311 5.511 5.111 Somoe: Equity 5351111111211. 5142006 Camden Teieoom Ber-1151:1515 Review. Gddmari Sachs, Febnmnr 2012?. Exhibit 4 BEE Inc.: Summary of Unleveraged Free Cash FI-t11111r [i 1 2 3 4 5 'I'EIr M m 21:15: 21111:: ELIE HIDE Total Revenue 14,159 15,1111 15,411 15,141 11311115 15,356 EBIT 3,2515 3.142 3,4111 3,455 3,511 To: Rate H.095 15.055 15.095 3.095 5.095 LESS: Till [490} {5011 i510! 1351'} [333} After-Tax EBIT 2,1115 2,3411 1,3111 2,6111 2,5511 Plus: Depreciation 2,50 2,630- 2,5'1"5 2,225 2,231 LESS: G'I-PE' [215451' ilmi {1155i [213133] [213511 Change in Working Capital 1141 l 141 I11: [12h [Qt Told Unlewm Free Cull Flow 2,585 2,219 1,!!! 2,511? 2,555 Exhibit 5 BEE INC; KEY LBI'JI ASSUHP'I'IDNS Milne: Keylllssuwms Aisle-nil the ' ' feta" an 3 andexitan 1 2312' lei-Transihn Mum Source of Fund: Unaffected deirg Pride [WWI]?! 50.13 medsfram #5555915 Acquisition pmmium Telesat" 135D Talieuut Prime SE15 Market Va lue Elf Bell Aliant stake" 2,65! Basil: Shares uislandings D'i WWW] 3:115 Cngubernedia IEI II] Plus: ErC'E Dpunsulstandi ngl[as ufilf} Ell-.2 Dtherhssels I31 53] FullyI Diluted Share5 Dutstanding 331.8 Tulid Pmmeds nmAeset HE em Less: Dptiun Pmeds'" {emu} Pmmlemairing tube nna-nad 31,93: emltwalm H.115 mint Add: NetDebt 1 Preferred Share: 1! lullim'alr'itllI Interest Senior Debt @ 3.01 LTM EBITDA 16.511 Debt In: Hell lial-IE Telesa'tl "' 9,555 Subm'dinated Debt 9 1m LTM EBITDA 11,059 BEE Preferred Shares" 1,595. THE Debt 11,513 Mi naritylnu: rest 11m Equity 1315 Eirrpre'dm 1.1.15 Tali Saute ltd Finds $1,335 m LTM EBITDA 5,535- E'U' f LTM EBITDIIL 15: EU LTM EBITEM ulti' usbed 6.3x Serumsm Wammmmmmmemmmm Lil'fnaevalerdhjdePapa-ylme, TDMeuueetBGE-rel "Mdmmafamtmngewm Fakeaenfuayam Emma-1AM, REC Gafafa'kefeBGEm, mmm.'m, 300?. ireg-Haeonald, ardeiereuahe' Nau-nal'anknandai. HGEh-m., Ttha mews-$4036.??? Amiga, 3M1 4.6m Ganpbearu'nisu, "31-11!me SEEM, 'HGEMautre arMSnmkei'pri 11'; 2:157. Hull: 1 Band mau'elrtedlmageeeenisepr'eenflolWJLl 1 Includes hum debt inrl-CElneanud Bellanach dll'lslurl: only. 3- Rednel'nptlnn nine val [I'lfll'l'ld hm uIiIIneid [m Ihe Weren't Pruner Clrml-L 4 Hetpuceuknbtalredmtl-niea'iTele-. 5- &1er: Ill-I- mllllnrei unlll. n'f lell Nian'l: Ihe rrurhe'l: line nl'll'hlnh Inc: $3.52 per Lain-1 SEW. hurries I 111% huldlr' m demur. In EI'U'gInIlrIu-dll I: I pill-null; held temp-w. [mime-be: alwlue are based on unlit-ll reels-eh. tenure-u: estimates. 1' Includes ''Ie shines held In publicly 'Indld noun-dc: Cleamdlle Corp and Shfl'em. BEE held 119 mllllunIaruln-el'line lhldiduediilm yfl'hled an enmelm rle elm an: I'm. BII held 215 rI1IIIInn dun-LI. In Elk-[Tern which: closed atm Slim Imed an In want "I" rt of US$15 urn rm. Exhibit 6 BEE INC; SU IIIIIEAR'I" LB'GII ASSUMPTIONS 51:211.; mama Immm m1" mar m n- u: m 1115 an: mm m 1.1.31.1 1.1.1111 1.5.1.: 1.1.111 5.111 1:11: 15.11; 1111-11-11 11311 1511 2111 2.11: 1.11: 1.111 1.111: hm: mun-m1:- H.145! 15.2511 15131-1: cum [9.1a 5.55} Ilmr [mu-E] 11qu an an; an 51.1! 51.111 1111: 51.111 M mum 1.11.1: m 1.515 an 5,911 am 11111 1.111 'lm 35.111: 3531; 1251: 1115: its: in: an: m Ins: our-mum 11.3151 11.1131 11.511: 12.51:: [2.1m 1.1.5151 Izmi- ll?!" sum 115111 111.11; 1:115 11m 12m 12m 13.131; 1:111; Eur 1.111 rm 3.1111 1.15 1.31: m 3.3 1:11 lm m 5.21; 2:51: 21.51: 2151: 151: 11.31 21.11: mm [M [1.5111 [1.11611 ILT-'- Ital] an 1.15: 1.1111 1.511 1.311 1.1m Ins.- III ll Ill-III IE} 1111'] DEL] uwmmm 15.91: 1.11111: 1.5131: 1513: 3.111: mum w 1.191 1.3111 1.13 m are": mar Hum Hm. mnmm W m n all m 11:15 11111: HItlnmml- 1.1151 1.11:: 1.3111 1.113 1.! Hus: DIprIdIm 2.51: 2.31 155 1.7211 1.1: li! {hp-x [2.55: [2.11111 [1.51 IIHIH ILHJ tag-Mm 11a 1151: 1:51: 1:11; 1131: Walnut": 11:1 [1-11 [1.11 [1.11 11.11 1:51 mm 1m: 4m 4m .1131 .1111: 1111: Hu- an mmulnrnm ml! m 1.11! 1.1111 1.135 1.3 mmmmm 531 am in 13 ga- 3cm; mm m n- 11: 11111: 111115 11111: mm-mm-n Muir's-mu 15.511 15.3: 11-.5a1 13.3.1.1 1.1.13 nus: mmm In: [Ly [1.1311I ".1351- Im madam!- mm-I 15.131 11.5a1 13.311 1.1135 mm mm 1,131 use 511 131 11:11 W 11-11: - mun w:- | n: mum 11.1111 11.1159 11.1151 1.1.1119 11.11111 Luna-111mm . . . . madam!- 1.1.1111 11.1191 11.111111 11.11111 1.1.1119 11.11119 mm 1115 use an; as. as nun-u 11.53 m Liam 11.311 311:. 21.11: 11m 3.1.1: 151: 11.51: 11511; M 11111; Emu-alum H'E mm m n- 11: 11111: 111115 111115 spawn: n 1 l a 1 5 mam-um- :In: "1.11 "m: 111: mu mum in: 5512 am 551 5.31.1 wuuauqlwmlmmm 111.2: 11.113 2.511 13.1.? "1.15 It": II'EDIII IE 125m IE [REEF [3111?] Bum-u 11.15: 15.113 11.151 mm 2.211 Mmhm-'n'w am 11,315. . . . . 11.213 Questions: 1) 2) 3) 4) 5) Determine what BCE is worth to the three private equity consortiums based on relative comparable companies analysis (10 points) and comparable transactions analysis (10 points). Which analysis gives you a result that you prefer? (5 points) Calculate what BCE is worth to the three private equity consortiums based on DCF. For the DCF assume the sale of non-core assets (20 points). Do you prefer the result from the comparables analysis or the DCF? Explain why {5 points) From the perspective of the private equity rms, what is the potential IRR on the investment given the proposed initial investment and exit price assumed in the case? {10 points) From the perspective of the bidder: a} What challenges might arise in nancing such a large transaction? (10 points) b} What strategic considerations need to be taken into account relative to other bids? (5 points) c) What potential opportunities might exist to exit their investment in three to ve years? (5 points) From the perspective of BCE, how might the Strategic Oversight Committee weigh the prospect of an all-cash bid from a private equity bidder against a potential stock- and-cash bid from Telus? (5 points) What price might the committee feel was adequate given BCE's historical and recent share price performance? (5 points) How would the Committee ensure it was maximizing the value to BCE's shareholders? (10 points)