Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are no additional information required. Please answer the questions based on the provided information, as told by my lecturer. Question 4 (10 Marks) On

There are no additional information required. Please answer the questions based on the provided information, as told by my lecturer.

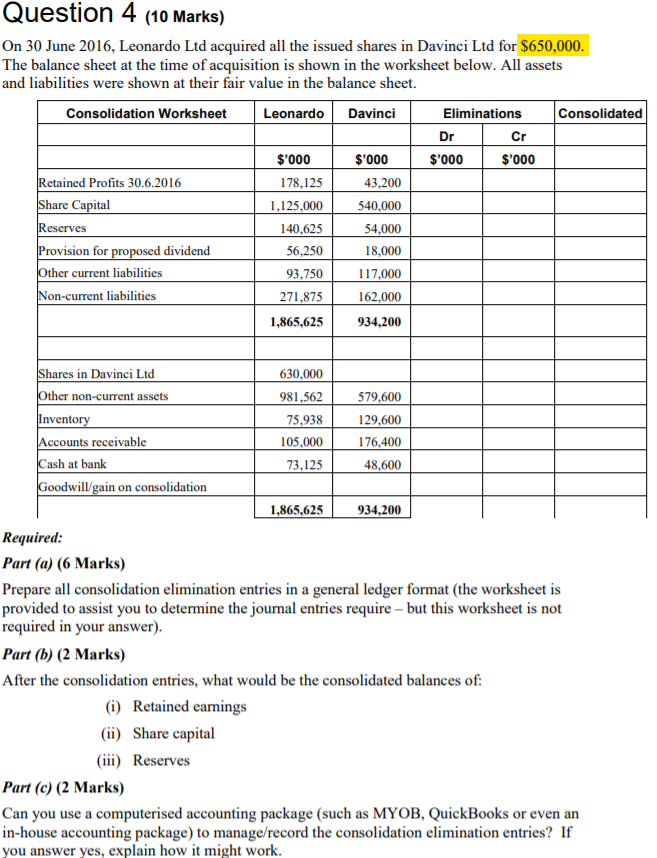

Question 4 (10 Marks) On 30 June 2016, Leonardo Ltd acquired all the issued shares in Davinci Ltd for $650,000 The balance sheet at the time of acquisition is shown in the worksheet below. All assets and liabilities were shown at their fair value in the balance sheet. Consolidation Worksheet Leonardo Davinci Eliminations Consolidated $'000 $'000 $000 $000 43,200 540,000 54,000 18,000 117,000 162,000 934,200 ained Profits 30.6.2016 178,125 1,125,000 140,625 56,250 93,750 271,875 hare Capital eserves sion for d dividend ther current liabilities on-current liabilities 1,865,6259 Shares in Davinci Ltd 630,000 981,562 75,938 105,000 73,125 ther non-current assets 579,600 129,600 176,400 48,600 nven ccounts receivable ash at bank oodwill/gain on consolidation 1,865,625 934,200 Required Part (a) (6 Marks) Prepare all consolidation elimination entries in a general ledger format (the worksheet is provided to assist you to determine the journal entries require-but this worksheet is not required in your answer) Part (b) (2 Marks) After the consolidation entries, what would be the consolidated balances of (i) Retained earnings (ii) Share capital (iii) Reserves Part (c) (2 Marks) Can you use a computerised accounting package (such as MYOB, QuickBooks or even an in-house accounting package) to manage/record the consolidation elimination entries? If you answer yes, explain how it might work Question 4 (10 Marks) On 30 June 2016, Leonardo Ltd acquired all the issued shares in Davinci Ltd for $650,000 The balance sheet at the time of acquisition is shown in the worksheet below. All assets and liabilities were shown at their fair value in the balance sheet. Consolidation Worksheet Leonardo Davinci Eliminations Consolidated $'000 $'000 $000 $000 43,200 540,000 54,000 18,000 117,000 162,000 934,200 ained Profits 30.6.2016 178,125 1,125,000 140,625 56,250 93,750 271,875 hare Capital eserves sion for d dividend ther current liabilities on-current liabilities 1,865,6259 Shares in Davinci Ltd 630,000 981,562 75,938 105,000 73,125 ther non-current assets 579,600 129,600 176,400 48,600 nven ccounts receivable ash at bank oodwill/gain on consolidation 1,865,625 934,200 Required Part (a) (6 Marks) Prepare all consolidation elimination entries in a general ledger format (the worksheet is provided to assist you to determine the journal entries require-but this worksheet is not required in your answer) Part (b) (2 Marks) After the consolidation entries, what would be the consolidated balances of (i) Retained earnings (ii) Share capital (iii) Reserves Part (c) (2 Marks) Can you use a computerised accounting package (such as MYOB, QuickBooks or even an in-house accounting package) to manage/record the consolidation elimination entries? If you answer yes, explain how it might workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started