Question

Salmon Company, a calendar year taxpayer, incurred the following start-up expenditures before the opening of its new health and fitness center. Rent on commercial

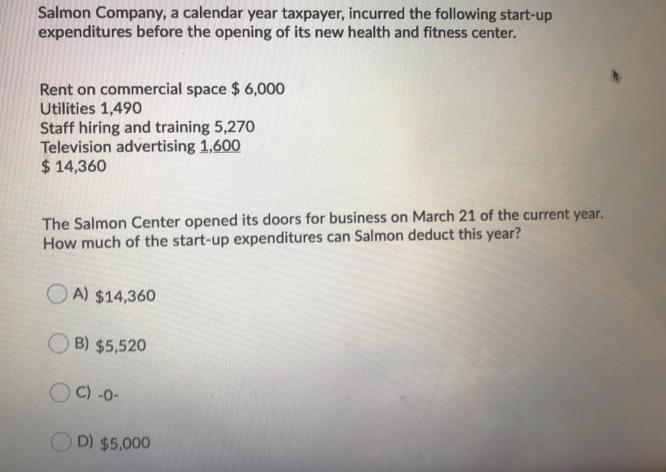

Salmon Company, a calendar year taxpayer, incurred the following start-up expenditures before the opening of its new health and fitness center. Rent on commercial space $ 6,000 Utilities 1,490 Staff hiring and training 5,270 Television advertising 1,600 $ 14,360 The Salmon Center opened its doors for business on March 21 of the current year. How much of the start-up expenditures can Salmon deduct this year? A) $14,360 B) $5,520 OC) -0- D) $5,000

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Salmon Company total Startup expenditure ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Accounting An Integrated Approach

Authors: Penne Ainsworth, Dan Deines

6th edition

78136601, 978-0078136603

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App