Question

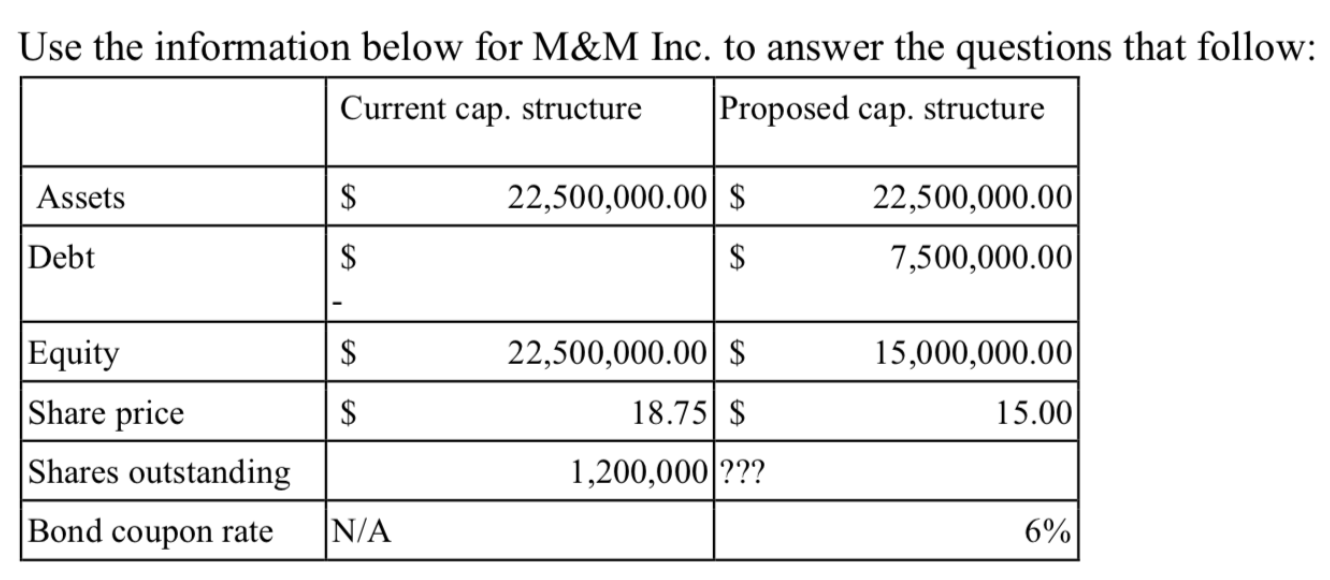

There are no taxes. EBIT is expected to be $2.625 million, but could be as high as $3.375 million if an economic expansion occurs, or

There are no taxes. EBIT is expected to be $2.625 million, but could be as high as $3.375 million if an economic expansion occurs, or as low as $1.875 million if a recession occurs. All values are market values.

**Don't need question 1-3 answered! just there incase needed for the rest of the questions.**

-

What is EPS under the current capital structure if there is a recession?

-

What is EPS during an expansion for the proposed capital structure?

-

What is ROE for the proposed capital structure if the expected state occurs?

-

What is the break-even EPS for these two capital structures?

-

Will the proposed capital structure affect the total value of the firm? Discuss.

-

Suppose now that corporate taxes are in effect at a rate of 40.00% (this assumption will

also hold for g. and h.). What is the cost of equity for the unlevered firm based on

expected EBIT?

-

What is the cost of equity of the levered firm?

-

What is the value of the levered firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started