Question

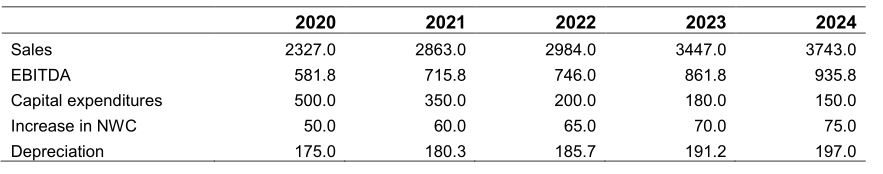

There are some information about an acquisition. A(Target) Some important accounting numbers projected for the next 5 years are as follows (all numbers are before-tax,

There are some information about an acquisition.

A(Target)

Some important accounting numbers projected for the next 5 years are as follows (all numbers are before-tax, as of the end of the fiscal year and in $ thousands)

After year 5, the winerys free cash flow (FCF) will grow at an annual rate of 3% into perpetuity. There are 200 thousand shares outstanding. The market value of equity is currently $3,500 thousand and the market value of outstanding debt is $450 thousand (assume that the share price, the value of equity, and the value of debt are given at the valuation date, i.e. end of December, 2019). The firm faces the (marginal) tax rate of 40%. The asset beta of the target (the beta of the same but all-equity firm) is 1.15.

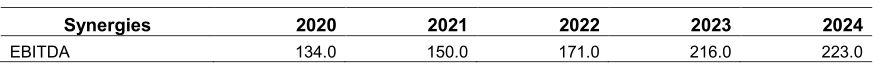

B (Acquirer)

The acquirer expects to have the following estimated synergies from the M&A and all figures are before-tax, as of the end of the fiscal year and in $ thousands:

After year 5, the free cash flow (FCF) from synergies will grow at an annual rate of 2% into perpetuity. The firm faces the (marginal) tax rate of 40%. The asset beta of the acquirer (the beta of the same but all-equity firm) is 0.8.

Note: The fiscal years of both your firm and the target end on December 31 (i.e. all projected numbers are given at the end of the fiscal year starting from exactly one year from the date of valuation).

Information about the deal/market conditions:

The target leverage (D/V) after the deal is completed is expected to be 25% (applies to both the target and the synergies). The borrowing rate (cost of capital) is 8% and the Treasury bond rate (risk-free rate) is 3%. The market risk premium is 5%.

Questions:

1. What is the maximum price per share that your firm can pay for the target based on DCF and APV methods? You can build your analysis on the following steps in your valuation:

1) Estimate the value of the levered target firm:

a. Calculate the cost of assets (unlevered equity return, i.e. cost of equity of the same but all-equity firm) for the target using CAPM

b. Calculate the cost of equity (levered equity return) for the target

c. Calculate the weighted average cost of capital (WACC) for the target

d. Estimate free cash flow (FCF) for years 2020-2024

e. Calculate the terminal value in 2024 using the APV method and the WACC method separately

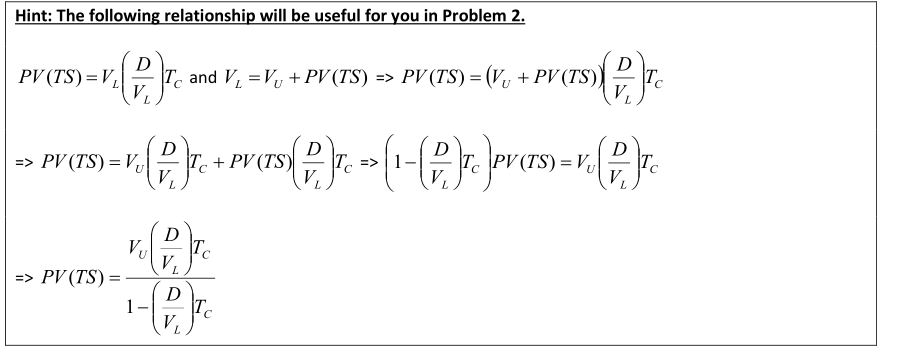

f. Calculate the value of the levered target firm using the APV method (Hint: since leverage is expected to change, D*t is not an appropriate way of estimating tax shields derive tax shields from the relation between the levered and unlevered values of the firm)

g. Calculate the value of the levered target firm using the WACC method

2) Calculate the value of synergies:

a. Calculate the cost of assets for the acquirer using CAPM

b. Calculate the cost of equity (levered equity return) for the acquirer

c. Calculate the weighted average cost of capital (WACC) for the acquirer

d. Estimate free cash flow (FCF) from synergies for years 2020-2024 using beta and growth rate of the acquirer

e. Calculate the terminal value of synergies in 2024 using the APV method and the WACC method separately

f. Calculate the value of the levered synergies using the APV method (do not forget about the tax shields)

g. Calculate the value of the levered synergies using the WACC method

3) Find the value of the targets equity to the acquirer:

a. Calculate the value of the levered target to the acquirer by adding the value of synergies to the value of the levered target firm

b. Subtract the amount of outstanding debt to get the value of equity

d) Calculate the maximum price per share that the acquirer can pay for the target

2. If your firm announces the deal in December 2019, what is the expected return on the targets equity at the announcement (based on both DCF and APV methods)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started