Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are three investors (Nasser, Yasser, Moataz, and Aiham) in Muscat, Oman, who prefer to each utilize different financial investment schemes to preserve or

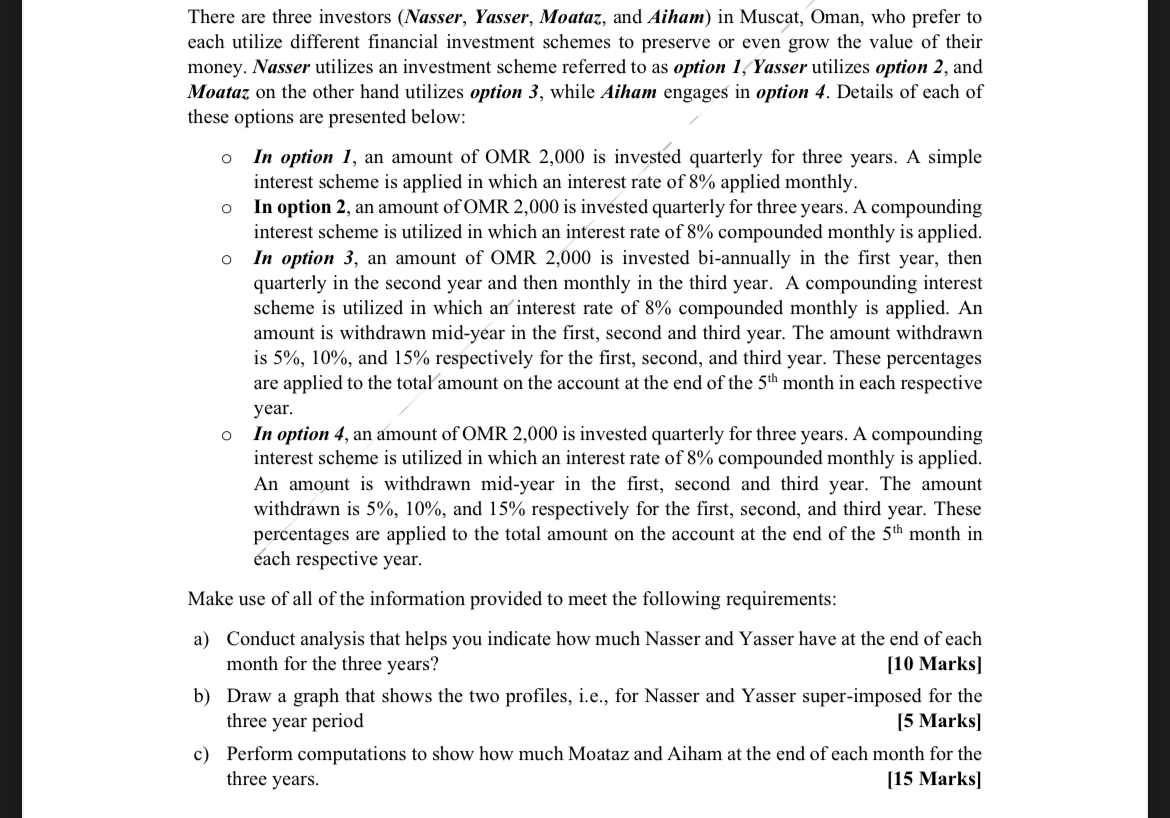

There are three investors (Nasser, Yasser, Moataz, and Aiham) in Muscat, Oman, who prefer to each utilize different financial investment schemes to preserve or even grow the value of their money. Nasser utilizes an investment scheme referred to as option 1, Yasser utilizes option 2, and Moataz on the other hand utilizes option 3, while Aiham engages in option 4. Details of each of these options are presented below: In option 1, an amount of OMR 2,000 is invested quarterly for three years. A simple interest scheme is applied in which an interest rate of 8% applied monthly. In option 2, an amount of OMR 2,000 is invested quarterly for three years. A compounding interest scheme is utilized in which an interest rate of 8% compounded monthly is applied. In option 3, an amount of OMR 2,000 is invested bi-annually in the first year, then quarterly in the second year and then monthly in the third year. A compounding interest scheme is utilized in which an interest rate of 8% compounded monthly is applied. An amount is withdrawn mid-year in the first, second and third year. The amount withdrawn is 5%, 10%, and 15% respectively for the first, second, and third year. These percentages are applied to the total amount on the account at the end of the 5th month in each respective year. In option 4, an amount of OMR 2,000 is invested quarterly for three years. A compounding interest scheme is utilized in which an interest rate of 8% compounded monthly is applied. An amount is withdrawn mid-year in the first, second and third year. The amount withdrawn is 5%, 10%, and 15% respectively for the first, second, and third year. These percentages are applied to the total amount on the account at the end of the 5th month in each respective year. Make use of all of the information provided to meet the following requirements: a) Conduct analysis that helps you indicate how much Nasser and Yasser have at the end of each month for the three years? [10 Marks] b) Draw a graph that shows the two profiles, i.e., for Nasser and Yasser super-imposed for the three year period 15 Marks) three years. c) Perform computations to show how much Moataz and Aiham at the end of each month for the [15 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started