There are three parts of questions

Part III a,b,c,d

Part II (a) and (b)

Part III (a) and (b)

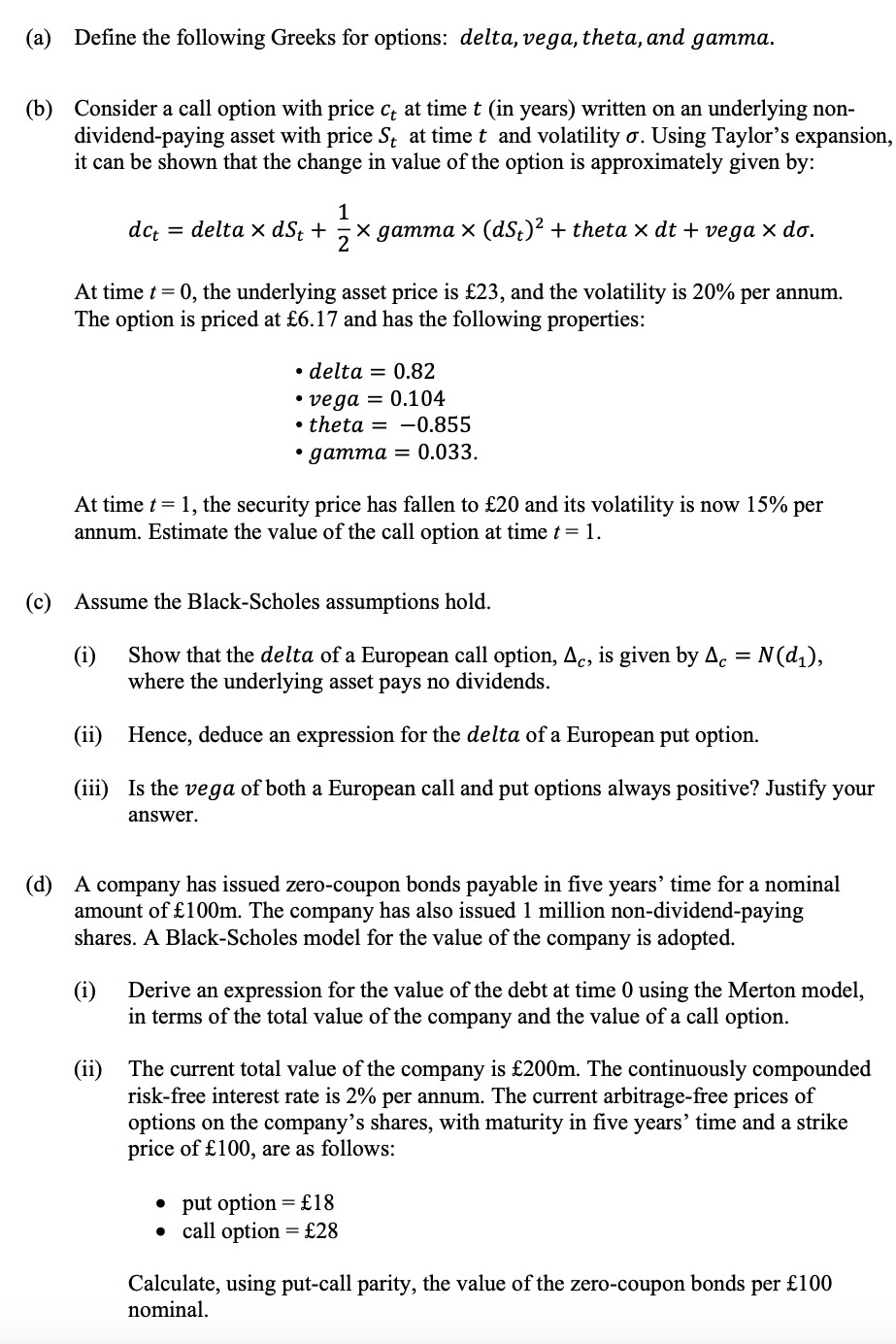

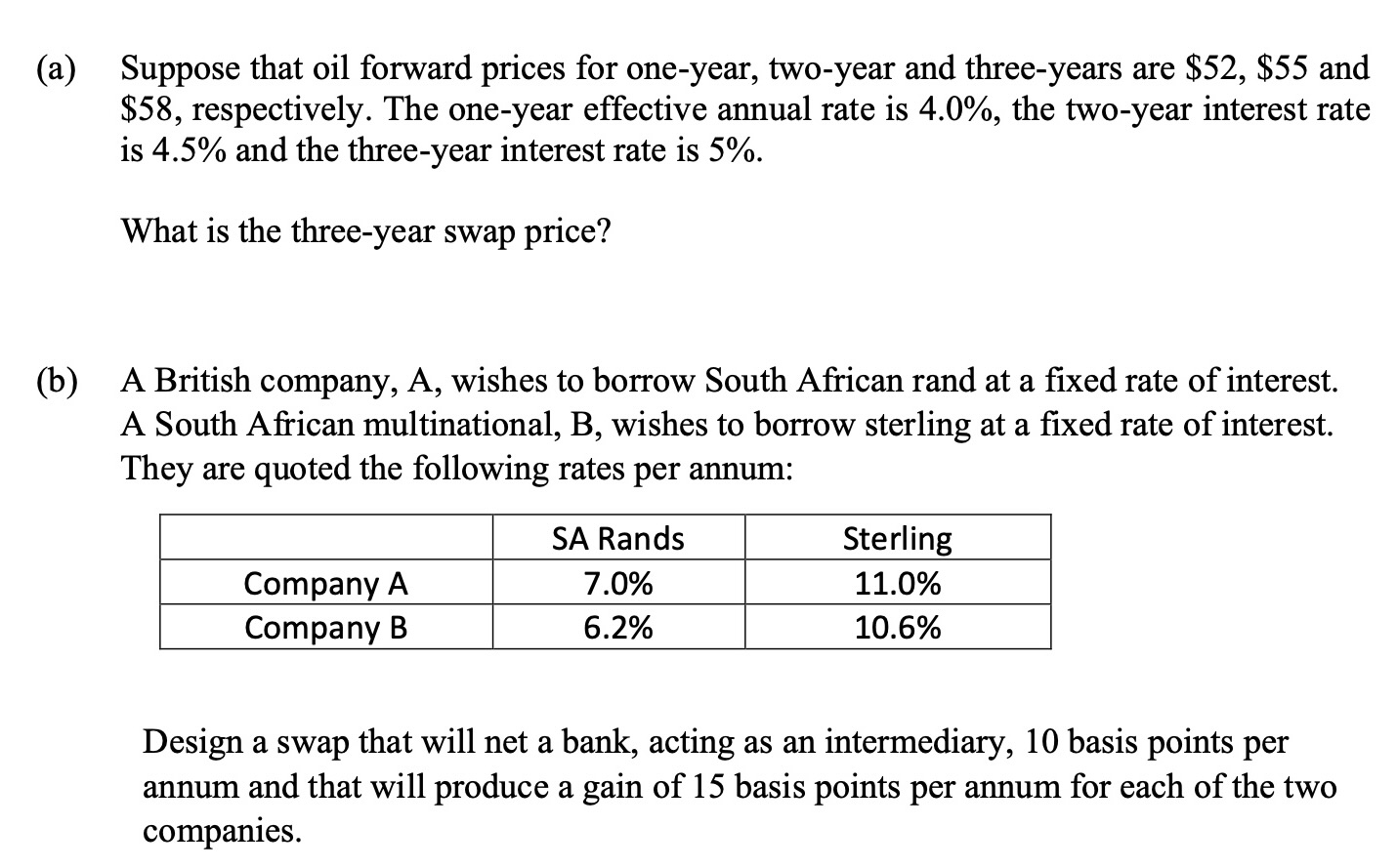

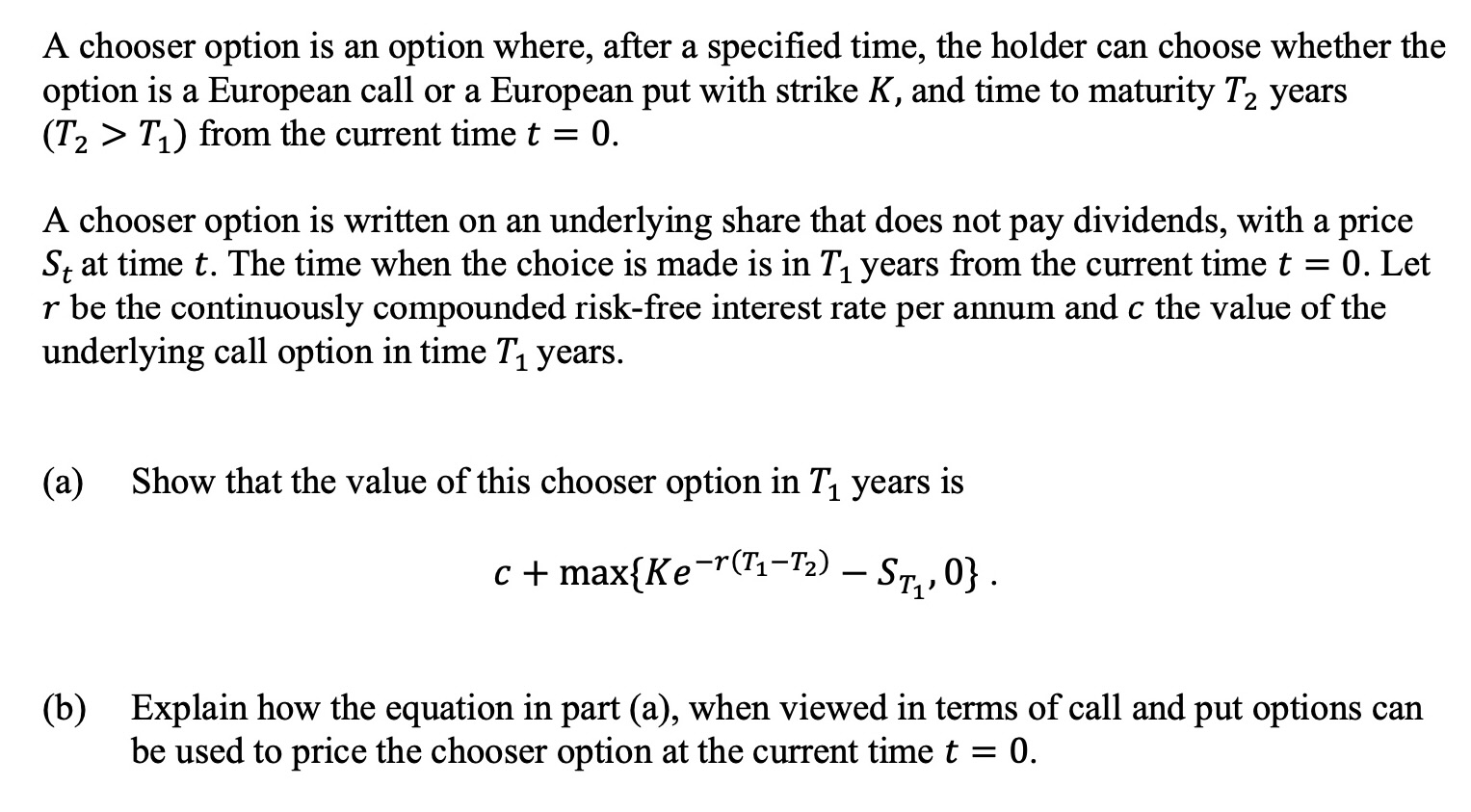

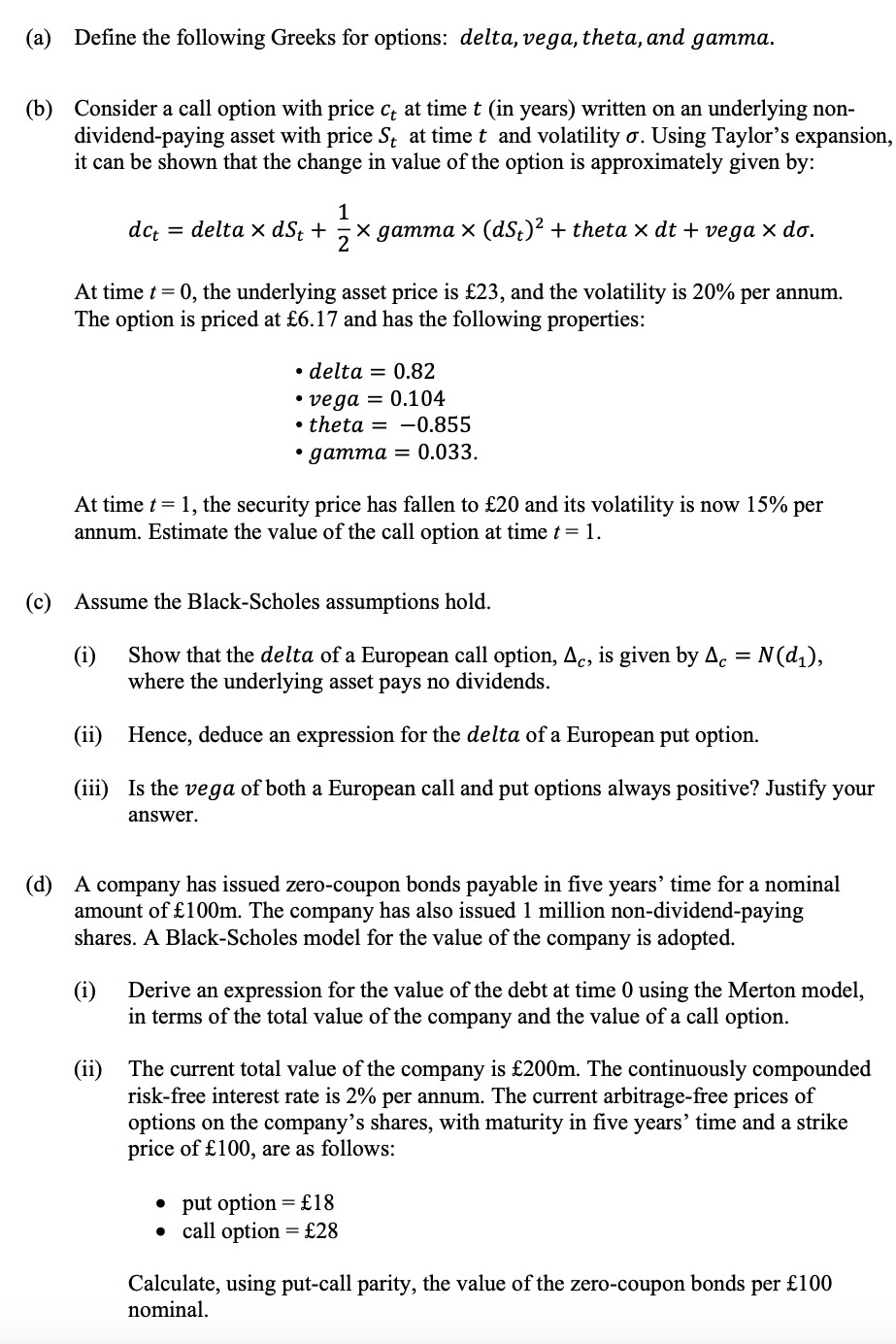

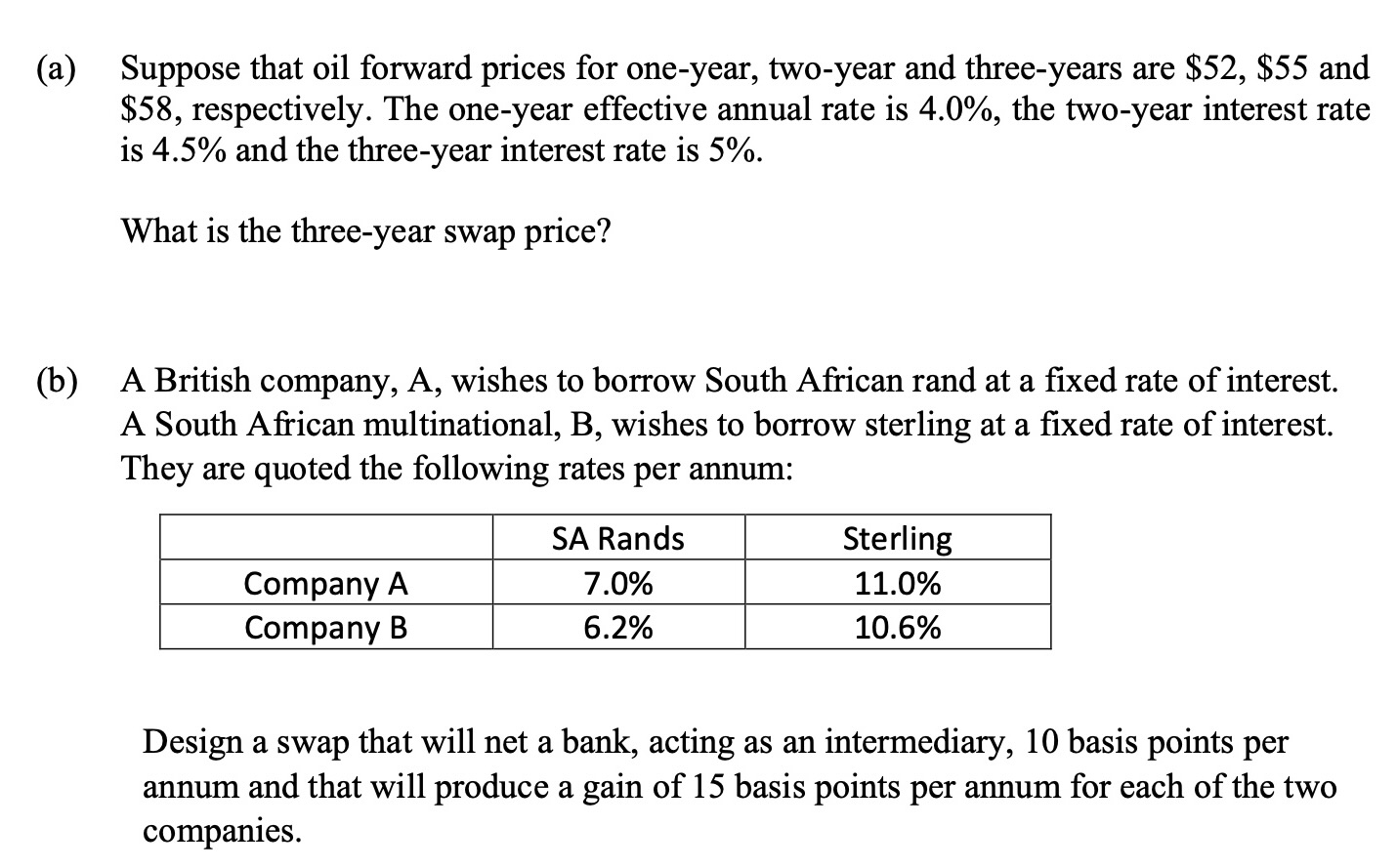

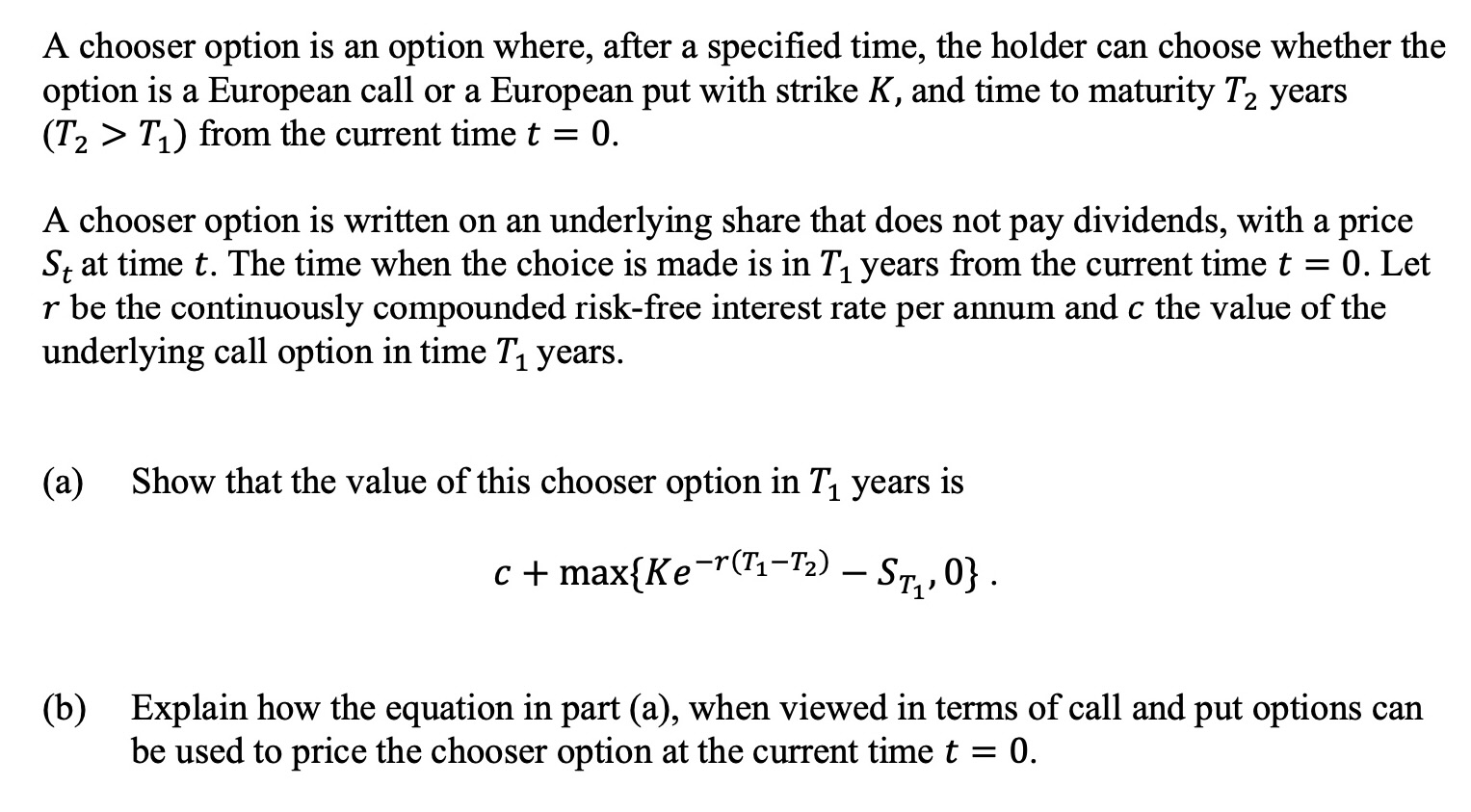

(b) Consider a call option with price ct at time t (in years) written on an underlying nondividend-paying asset with price St at time t and volatility . Using Taylor's expansion, it can be shown that the change in value of the option is approximately given by: dct=deltadSt+21gamma(dSt)2+thetadt+vegad. At time t=0, the underlying asset price is 23, and the volatility is 20% per annum. The option is priced at 6.17 and has the following properties: - delta =0.82 - vega =0.104 - theta =0.855 - gamma =0.033 At time t=1, the security price has fallen to 20 and its volatility is now 15% per annum. Estimate the value of the call option at time t=1. (c) Assume the Black-Scholes assumptions hold. (i) Show that the delta of a European call option, c, is given by c=N(d1), where the underlying asset pays no dividends. (ii) Hence, deduce an expression for the delta of a European put option. (iii) Is the vega of both a European call and put options always positive? Justify your answer. (d) A company has issued zero-coupon bonds payable in five years' time for a nominal amount of 100m. The company has also issued 1 million non-dividend-paying shares. A Black-Scholes model for the value of the company is adopted. (i) Derive an expression for the value of the debt at time 0 using the Merton model, in terms of the total value of the company and the value of a call option. (ii) The current total value of the company is 200m. The continuously compounded risk-free interest rate is 2% per annum. The current arbitrage-free prices of options on the company's shares, with maturity in five years' time and a strike price of 100, are as follows: - put option =18 - call option =28 Calculate, using put-call parity, the value of the zero-coupon bonds per 100 nominal. a) Suppose that oil forward prices for one-year, two-year and three-years are $52,$55 and $58, respectively. The one-year effective annual rate is 4.0%, the two-year interest rate is 4.5% and the three-year interest rate is 5%. What is the three-year swap price? ) A British company, A, wishes to borrow South African rand at a fixed rate of interest. A South African multinational, B, wishes to borrow sterling at a fixed rate of interest. They are quoted the following rates per annum: Design a swap that will net a bank, acting as an intermediary, 10 basis points per annum and that will produce a gain of 15 basis points per annum for each of the two companies. A chooser option is an option where, after a specified time, the holder can choose whether the option is a European call or a European put with strike K, and time to maturity T2 years (T2>T1) from the current time t=0. A chooser option is written on an underlying share that does not pay dividends, with a price St at time t. The time when the choice is made is in T1 years from the current time t=0. Let r be the continuously compounded risk-free interest rate per annum and c the value of the underlying call option in time T1 years. (a) Show that the value of this chooser option in T1 years is c+max{Ker(T1T2)ST1,0} (b) Explain how the equation in part (a), when viewed in terms of call and put options can be used to price the chooser option at the current time t=0