Question

There are three underlying assets in an investment pool. Each has a 6% chance of defaulting. If an asset does not default it pays

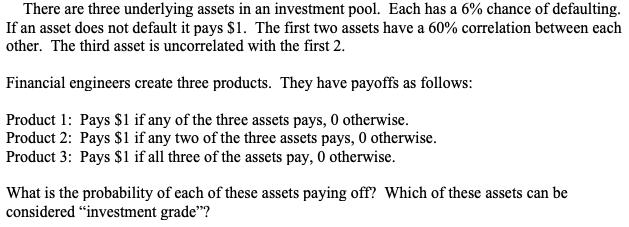

There are three underlying assets in an investment pool. Each has a 6% chance of defaulting. If an asset does not default it pays $1. The first two assets have a 60% correlation between each other. The third asset is uncorrelated with the first 2. Financial engineers create three products. They have payoffs as follows: Product 1: Pays $1 if any of the three assets pays, 0 otherwise. Product 2: Pays $1 if any two of the three assets pays, 0 otherwise. Product 3: Pays $1 if all three of the assets pay, 0 otherwise. What is the probability of each of these assets paying off? Which of these assets can be considered "investment grade"?

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Producli product 2 Products are formed by three underlying asset Each anser has a 6 chance of defaul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of economics

Authors: N. Gregory Mankiw

6th Edition

978-0538453059, 9781435462120, 538453052, 1435462122, 978-0538453042

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App