Answered step by step

Verified Expert Solution

Question

1 Approved Answer

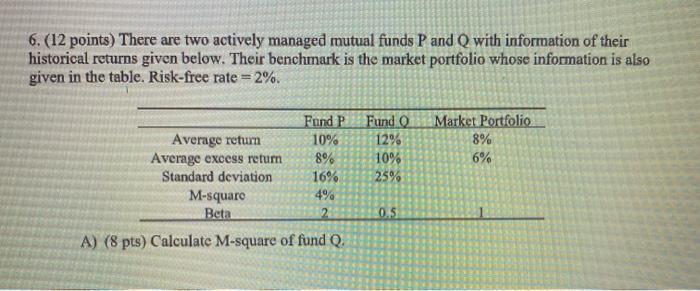

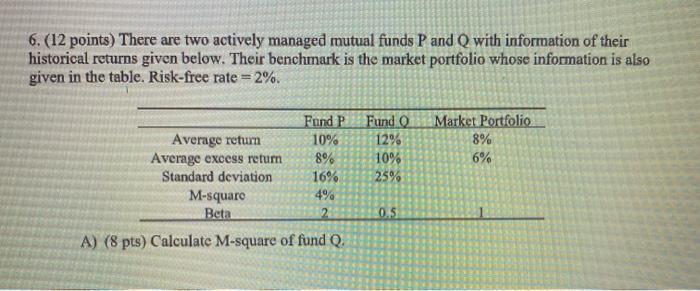

There are two actively managed mutual funds P and Q with information of their historical returns given below. Their benchmark is the market portfolio whose

There are two actively managed mutual funds P and Q with information of their historical returns given below. Their benchmark is the market portfolio whose information is also given in the table. Risk-free rate = 2%.

A. Calculate M-square of Fund Q.

B. Calculate the treynor measure of fund P and Q

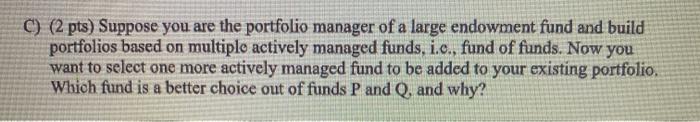

C. Suppose you are the portfolio manager of a large endowment fund and build portfolios based on multiple actively managed funds, i.cfund of funds. Now you want to select actively managed fund to be added to your existing portfolio, Which fund is a better choice out of funds P and Q, and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started