Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are two companies, Alpha and Zeta. They are identical, in the same line of business and produce the same product, and differ only in

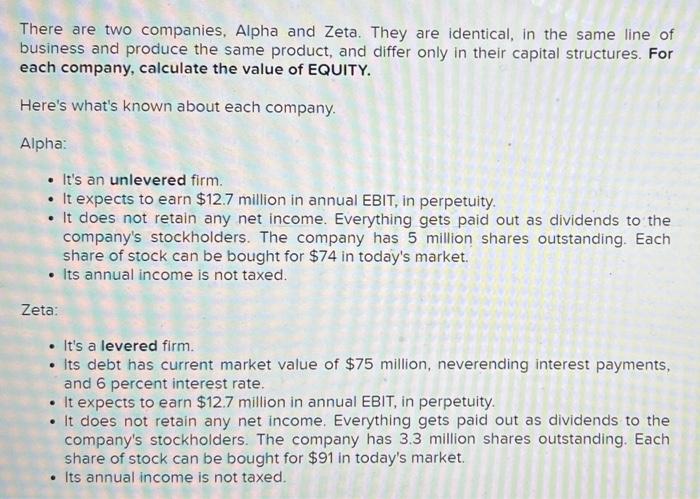

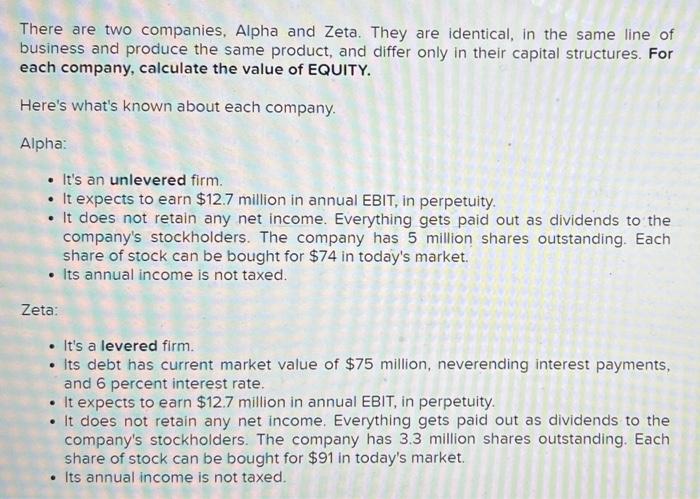

There are two companies, Alpha and Zeta. They are identical, in the same line of business and produce the same product, and differ only in their capital structures. For each company, calculate the value of EQUITY. Here's what's known about each company. Alpha: . It's an unlevered firm. It expects to earn $12.7 million in annual EBIT, in perpetuity. It does not retain any net income. Everything gets paid out as dividends to the company's stockholders. The company has 5 million shares outstanding. Each share of stock can be bought for $74 in today's market. Its annual income is not taxed. Zeta: . It's a levered firm. its debt has current market value of $75 million, neverending interest payments, and 6 percent interest rate. It expects to earn $12.7 million in annual EBIT, in perpetuity. It does not retain any net income. Everything gets paid out as dividends to the company's stockholders. The company has 3.3 million shares outstanding. Each share of stock can be bought for $91 in today's market. Its annual income is not taxed. . (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g. 1,234,567) Unlevered Lovered

There are two companies, Alpha and Zeta. They are identical, in the same line of business and produce the same product, and differ only in their capital structures. For each company, calculate the value of EQUITY. Here's what's known about each company. Alpha: . It's an unlevered firm. It expects to earn $12.7 million in annual EBIT, in perpetuity. It does not retain any net income. Everything gets paid out as dividends to the company's stockholders. The company has 5 million shares outstanding. Each share of stock can be bought for $74 in today's market. Its annual income is not taxed. Zeta: . It's a levered firm. its debt has current market value of $75 million, neverending interest payments, and 6 percent interest rate. It expects to earn $12.7 million in annual EBIT, in perpetuity. It does not retain any net income. Everything gets paid out as dividends to the company's stockholders. The company has 3.3 million shares outstanding. Each share of stock can be bought for $91 in today's market. Its annual income is not taxed. . (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g. 1,234,567) Unlevered Lovered

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started