Question

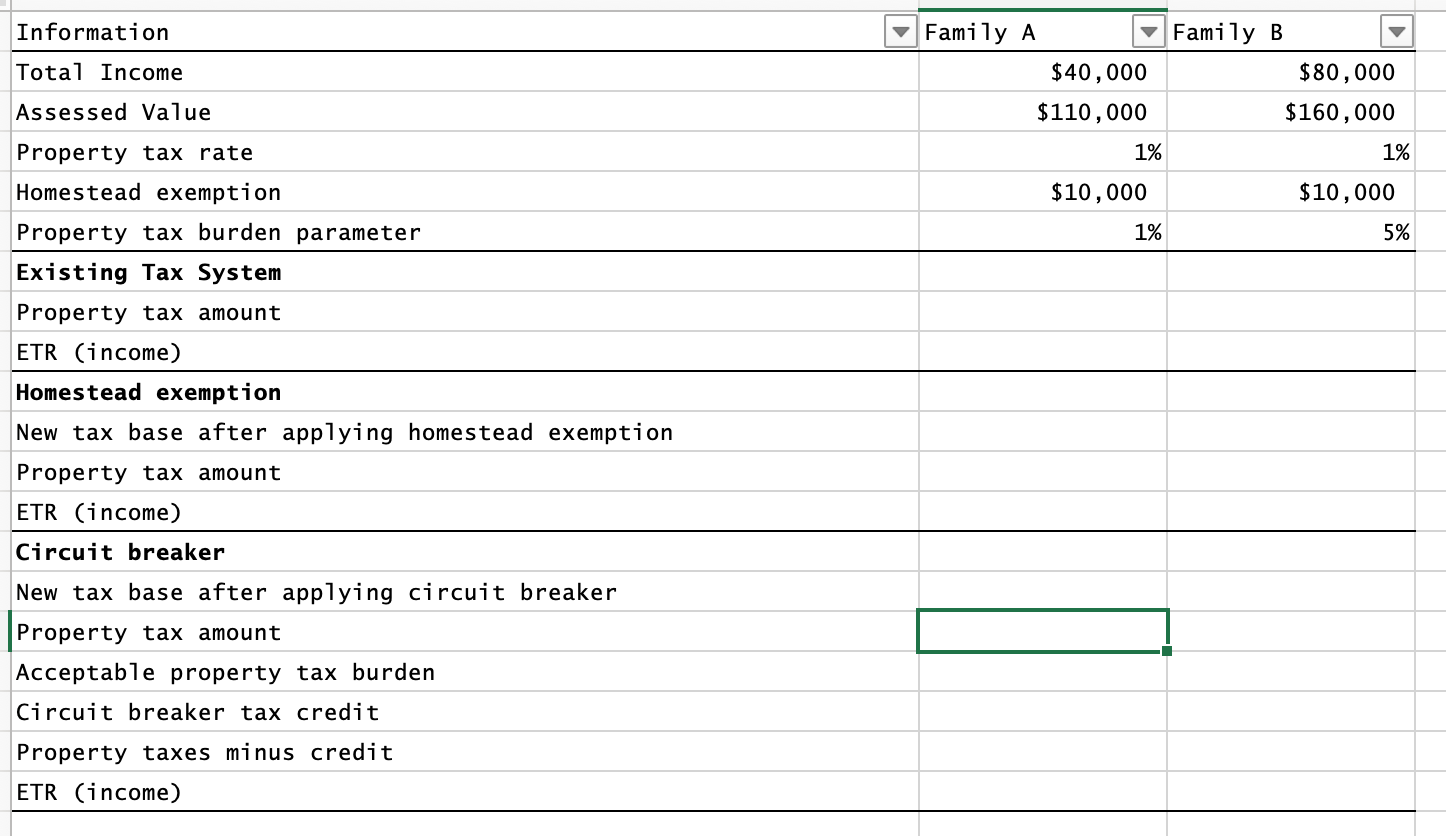

There are two families with different income and different home values. The current property tax rate is 1 % . ?The mayor of the town

There are two families with different income and different home values. The current property tax rate is ?The mayor of the town has asked you to evaluate two proposals: ?Homestead exemption and ?a circuit breaker. The homestead exemption amounts to $ ?on the assessed value of owneroccupied residential property. The circuit breaker credit CB ?is equal to CBPTbI ?The variables PT ?I, and b are the property tax payment, income, and share of income considered to be a high, respectively. The value of b is ?When the property tax payment exceeds the acceptable property tax burden, ie ?bI ?the difference is the income tax credit. If bIPT ?then the credit is set equal to zero. Complete the table in the sheet PROPERTY TAX BREAKS based on the information given. Evaluate all three tax systems ie ?current, homestead exemption, and circuit breaker ?in terms of vertical equity based on income

Information Total Income Assessed Value Property tax rate Homestead exemption Property tax burden parameter Existing Tax System Property tax amount ETR (income) Homestead exemption New tax base after applying homestead exemption Property tax amount ETR (income) Circuit breaker New tax base after applying circuit breaker Property tax amount Acceptable property tax burden Circuit breaker tax credit Property taxes minus credit ETR (income) Family A Family B $40,000 $110,000 $80,000 $160,000 1% 1% $10,000 $10,000 1% 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

How about we finish up the table in light of the gave data and the recipes to the estate exception and electrical switch Existing Duty Framework Curre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started