Answered step by step

Verified Expert Solution

Question

1 Approved Answer

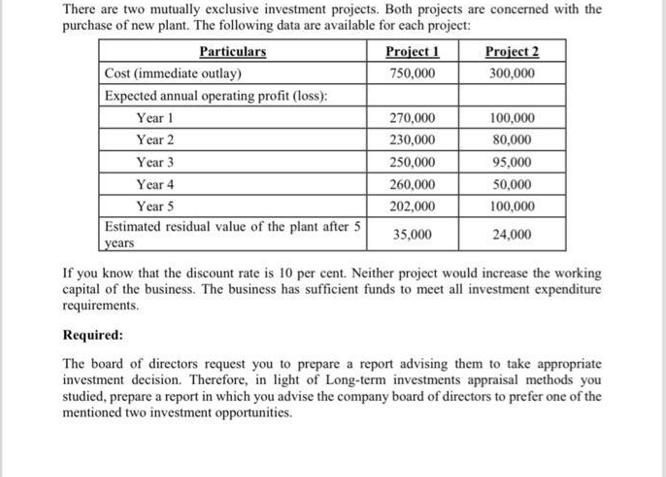

There are two mutually exclusive investment projects. Both projects are concerned with the purchase of new plant. The following data are available for each

There are two mutually exclusive investment projects. Both projects are concerned with the purchase of new plant. The following data are available for each project: Particulars Cost (immediate outlay) Expected annual operating profit (loss): Year 1 Year 2 Year 3 Year 4 Year 5 Estimated residual value of the plant after 5 years Project 1 750,000 270,000 230,000 250,000 260,000 202,000 35,000 Project 2 300,000 100,000 80,000 95,000 50,000 100,000 24,000 If you know that the discount rate is 10 per cent. Neither project would increase the working capital of the business. The business has sufficient funds to meet all investment expenditure requirements. Required: The board of directors request you to prepare a report advising them to take appropriate investment decision. Therefore, in light of Long-term investments appraisal methods you studied, prepare a report in which you advise the company board of directors to prefer one of the mentioned two investment opportunities.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

QUESTION 1 Lets calculate the NPV for each project Project 1 Cost 750000 Expected annual operating profit Year 1 270000 Year 2 230000 Year 3 250000 Year 4 260000 Year 5 202000 Residual value 35000 Dis...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started