Answered step by step

Verified Expert Solution

Question

1 Approved Answer

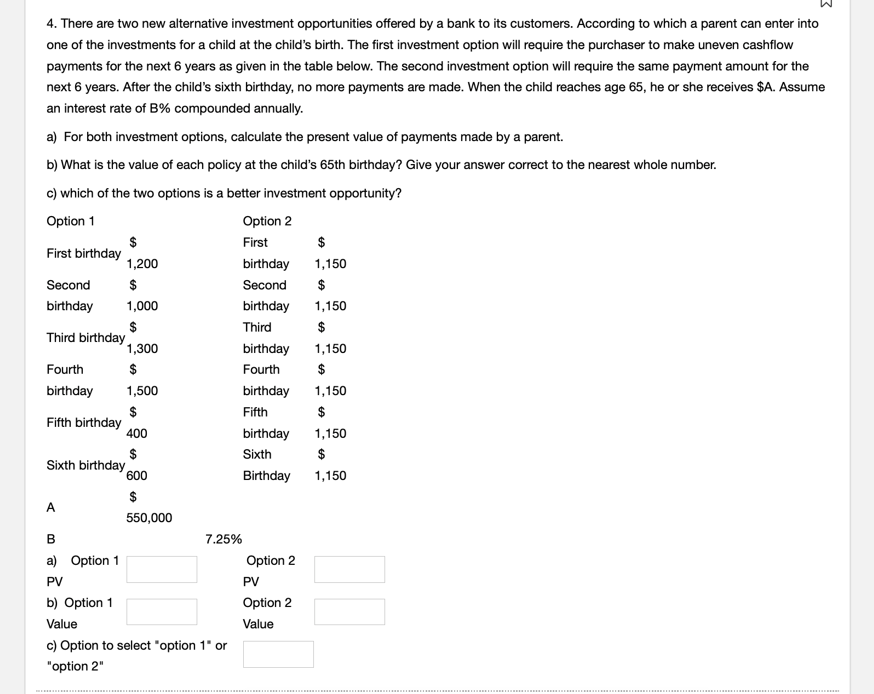

There are two new alternative investment opportunities offered by a bank to its customers. According to which a parent can enter into one of the

There are two new alternative investment opportunities offered by a bank to its customers. According to which a parent can enter into

one of the investments for a child at the child's birth. The first investment option will require the purchaser to make uneven cashflow

payments for the next years as given in the table below. The second investment option will require the same payment amount for the

next years. After the child's sixth birthday, no more payments are made. When the child reaches age he or she receives $ Assume

an interest rate of compounded annually.

a For both investment options, calculate the present value of payments made by a parent.

b What is the value of each policy at the child's th birthday? Give your answer correct to the nearest whole number.

c which of the two options is a better investment opportunity?

A

a Option

PV

b Option

Value

Option

PV

Option

Value

c Option to select "option or

"option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started