Answered step by step

Verified Expert Solution

Question

1 Approved Answer

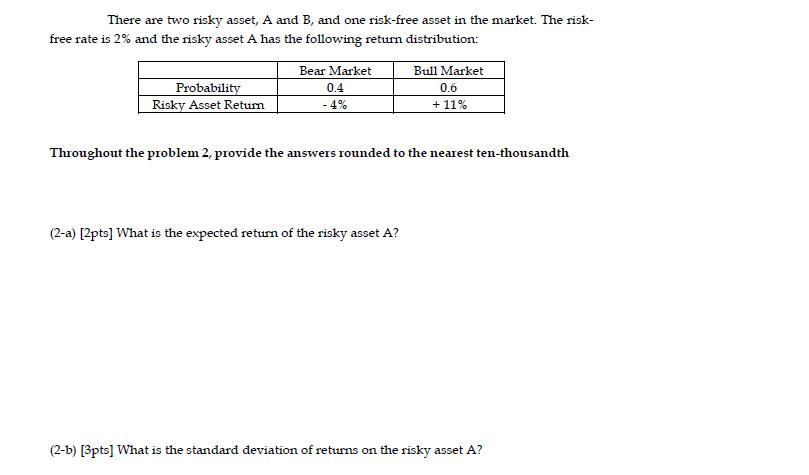

There are two risky asset, A and B, and one risk-free asset in the market. The risk- free rate is 2% and the risky

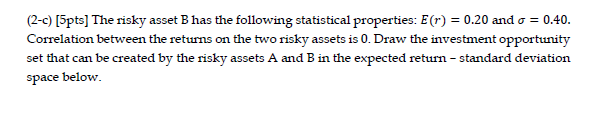

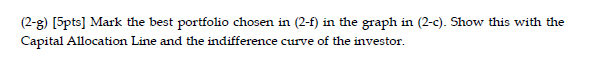

There are two risky asset, A and B, and one risk-free asset in the market. The risk- free rate is 2% and the risky asset A has the following return distribution: Probability Risky Asset Return Bear Market 0.4 - 4% Bull Market 0.6 + 11% Throughout the problem 2, provide the answers rounded to the nearest ten-thousandth (2-a) [2pts] What is the expected return of the risky asset A? (2-b) [3pts] What is the standard deviation of returns on the risky asset A? (2-c) [5pts] The risky asset B has the following statistical properties: E(r) = 0.20 and a = 0.40. Correlation between the returns on the two risky assets is 0. Draw the investment opportunity set that can be created by the risky assets A and B in the expected return - standard deviation space below. (2-g) [5pts] Mark the best portfolio chosen in (2-f) in the graph in (2-c). Show this with the Capital Allocation Line and the indifference curve of the investor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these questions well use the expected return and standard deviation formulas for probabilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started