Answered step by step

Verified Expert Solution

Question

1 Approved Answer

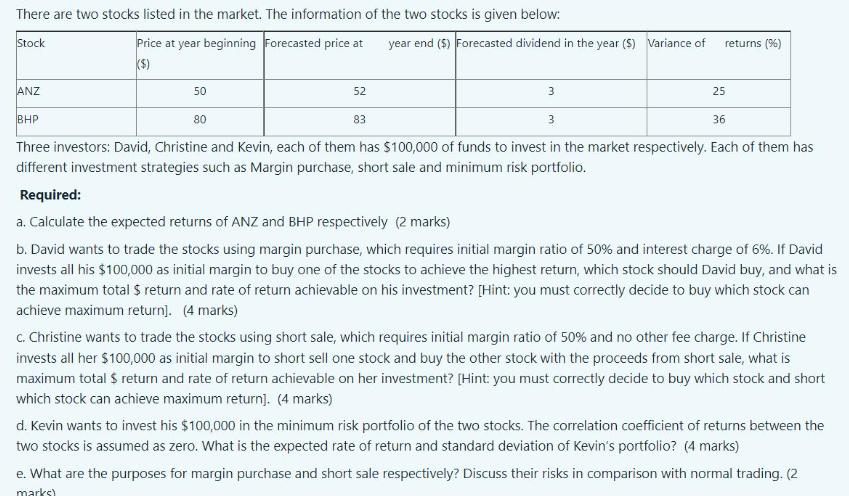

There are two stocks listed in the market. The information of the two stocks is given below: Stock Price at year beginning Forecasted price

There are two stocks listed in the market. The information of the two stocks is given below: Stock Price at year beginning Forecasted price at year end ($) Forecasted dividend in the year (5) Variance of returns (%) ($) ANZ 50 BHP 80 52 83 3 3 25 36 Three investors: David, Christine and Kevin, each of them has $100,000 of funds to invest in the market respectively. Each of them has different investment strategies such as Margin purchase, short sale and minimum risk portfolio. Required: a. Calculate the expected returns of ANZ and BHP respectively (2 marks) b. David wants to trade the stocks using margin purchase, which requires initial margin ratio of 50% and interest charge of 6%. If David invests all his $100,000 as initial margin to buy one of the stocks to achieve the highest return, which stock should David buy, and what is the maximum total $ return and rate of return achievable on his investment? [Hint: you must correctly decide to buy which stock can achieve maximum return]. (4 marks) c. Christine wants to trade the stocks using short sale, which requires initial margin ratio of 50% and no other fee charge. If Christine invests all her $100,000 as initial margin to short sell one stock and buy the other stock with the proceeds from short sale, what is maximum total $ return and rate of return achievable on her investment? [Hint: you must correctly decide to buy which stock and short which stock can achieve maximum return]. (4 marks) d. Kevin wants to invest his $100,000 in the minimum risk portfolio of the two stocks. The correlation coefficient of returns between the two stocks is assumed as zero. What is the expected rate of return and standard deviation of Kevin's portfolio? (4 marks) e. What are the purposes for margin purchase and short sale respectively? Discuss their risks in comparison with normal trading. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Expected return for ANZ 5225325 120 or 120 Expected return for BHP 8336336 120 or 120 b For margin ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started