Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are two stocks: Totally Fake Stock (TFS) and Imaginary Industries Inc. (III). Both stocks are trading at $100 / share. Alicia and Bashir

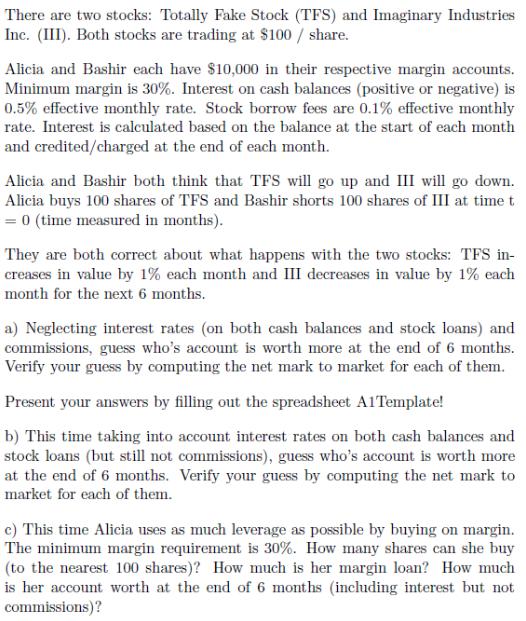

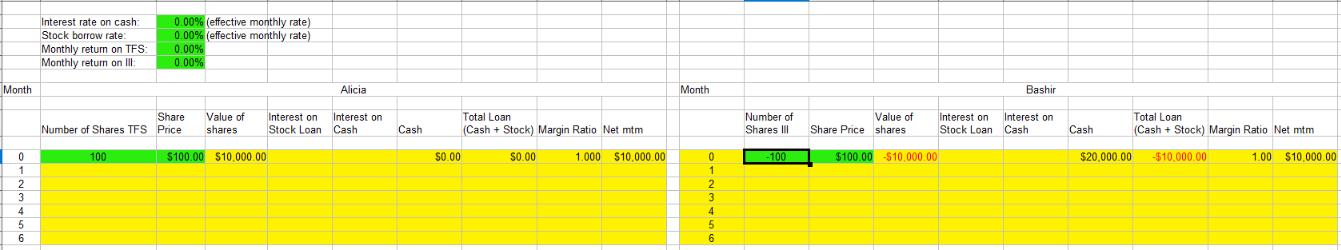

There are two stocks: Totally Fake Stock (TFS) and Imaginary Industries Inc. (III). Both stocks are trading at $100 / share. Alicia and Bashir each have $10,000 in their respective margin accounts. Minimum margin is 30%. Interest on cash balances (positive or negative) is 0.5% effective monthly rate. Stock borrow fees are 0.1% effective monthly rate. Interest is calculated based on the balance at the start of each month and credited/charged at the end of each month. Alicia and Bashir both think that TFS will go up and III will go down. Alicia buys 100 shares of TFS and Bashir shorts 100 shares of III at time t = 0 (time measured in months). They are both correct about what happens with the two stocks: TFS in- creases in value by 1% each month and III decreases in value by 1% each month for the next 6 months. a) Neglecting interest rates (on both cash balances and stock loans) and commissions, guess who's account is worth more at the end of 6 months. Verify your guess by computing the net mark to market for each of them. Present your answers by filling out the spreadsheet A1Template! b) This time taking into account interest rates on both cash balances and stock loans (but still not commissions), guess who's account is worth more at the end of 6 months. Verify your guess by computing the net mark to market for each of them. c) This time Alicia uses as much leverage as possible by buying on margin. The minimum margin requirement is 30%. How many shares can she buy (to the nearest 100 shares)? How much is her margin loan? How much is her account worth at the end of 6 months (including interest but not commissions)? Month 123456 Interest rate on cash: Stock borrow rate: Monthly return on TFS: Monthly return on Ill: 0.00% (effective monthly rate). 0.00% (effective monthly rate) 0.00% 0.00% Share Value of Number of Shares TFS Price shares 100 $100.00 $10,000.00 Interest on Stock Loan Alicia Interest on Cash Cash $0.00 Total Loan (Cash + Stock) Margin Ratio Net mtm $0.00 1.000 $10.000.00 Month 0 1 2 3 4 5 6 Number of Shares III -100 Value of Share Price shares $100.00 $10,000.00 Interest on Stock Loan Bashir Interest on Cash Cash $20,000.00 Total Loan (Cash + Stock) Margin Ratio Net mtm -$10,000.00 1.00 $10,000.00

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a Neglecting interest rates and commissions Time Alicias TFS Shares Market Price of TFS Value of Alicias Position Bashirs III Shares Market Price of I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started